ASML: A quick update after the crash

My opinion on the 20% crash and ASML's future

ASML crashed around 20% after its earnings report leaked and has since recovered slightly. Shares have been down 18% over the last six months, but they have been flat year to date and up considerably over the long term. The ASML situation has been widely covered; after all, it’s one of my most “popular” holdings, and this crash represents its worst in decades. However, I still want to give a quick update and my opinion alongside a quick look at the valuation and what I’m doing.

What happened?

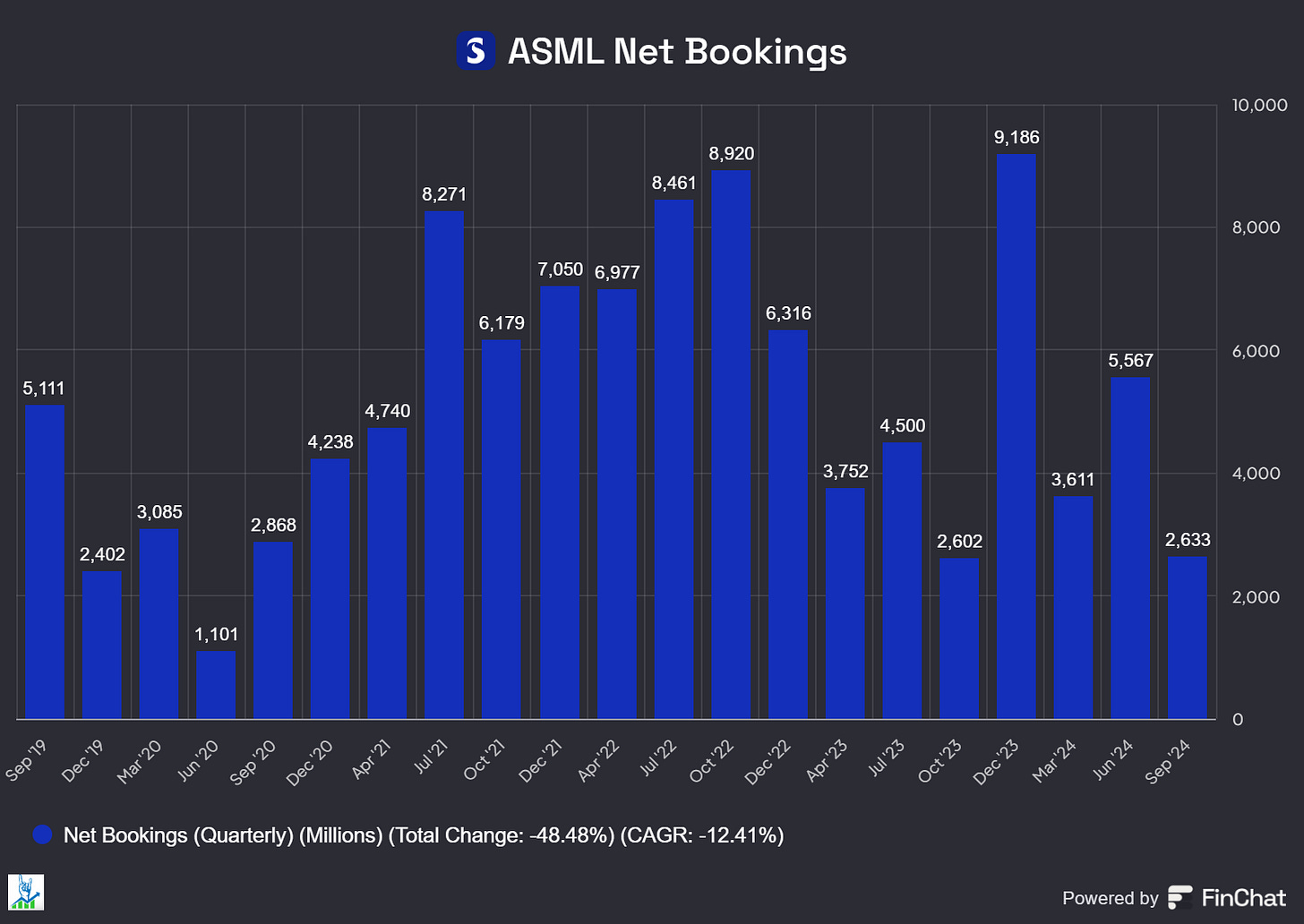

ASML leaked its Q3 2024 earnings report on Tuesday, while the release was scheduled for Wednesday morning. Following the results, shares plummeted. I do not believe that the leak itself was the issue, but it certainly added confusion to the market reaction and maybe amplified it. The company reported 2.6 billion euros in net bookings, compared to over 5 billion expected by analysts, but beat on EPS and revenue with a mid-single-digit surprise. Despite the low net bookings, we must remember that the backlog still stands at 36 billion. As can be seen below, ASML has very volatile bookings. This quarter, we saw orders pushed back as some large fabs saw delays in buildout from Samsung and Intel (as it is restructuring and trying not to go bankrupt). Overall, ASML sees continued strong AI momentum but with a slower recovery in other niches that will continue in 2025. The market also got spooked by the high revenue from China and the new export restrictions looming over the Chinese business. ASML’s CFO Roger Dassen said they expect China to have a more normalized revenue in 2025 (around 20%). Remember that ASML hasn’t been allowed to ship the new systems to China for years.

Furthermore, the company lowered/narrowed its guidance for 2025 from 30-40 billion to 30-35 billion in revenue with a lower gross margin of around 51-53%. This, of course, doesn’t sound great, and it makes sense that the market sells off the stock. However, we must remember that ASML is a highly cyclical company in the short term. ASML sells machines costing hundreds of millions that take months to build, test, ship and prepare for production. This makes revenue recognition very lumpy and just a few machines delayed or pulled forward can change the earnings picture completely. Over the long term, however, ASML is the only company able to serve the growing demand for lithography machines (well, Nikon and Canon hold around 20-30% of the DUV market, but their machines are of lower quality) and thus semi-conductors. These secular trends won’t stop, and ASML will find buyers for their machines. ASML, in my opinion, is a case of a company with weak short-term and strong long-term visibility. This makes shares very interesting for opportunistic investors who can use the high volatility associated with the volatile quarter-over-quarter performance of the company.

With that out of the way, let’s examine risks, profitability, valuation and my reaction.

Ready for More?

By becoming a paying subscriber, you can read the rest of this article and all of my writing on ASML, businesses, valuations and investing. Don't miss out on the opportunity!