ASML: Valuation and fundamentals

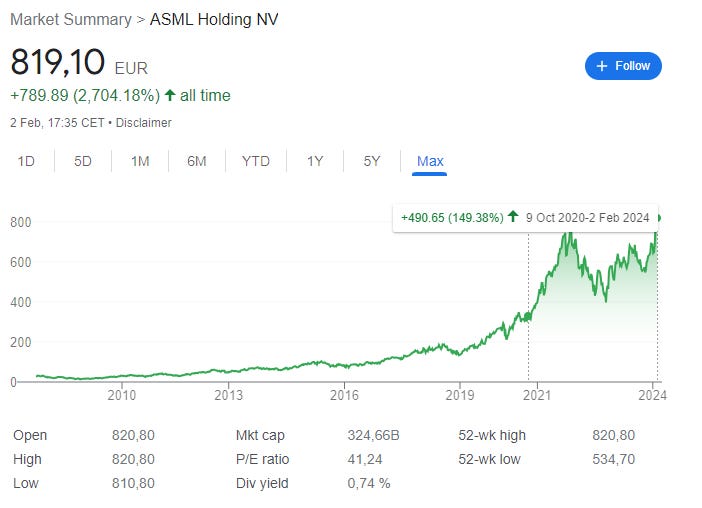

In my previous article, I covered the business model of ASML ASML 0.00%↑ and why I believe that it has one of, if not the deepest, moats in the world. I have owned the company since late 2020, and it has performed exceptionally well.

Over the last few years, ASML has seen tremendous hype from its fundamental development and getting more into the public eye. If we look at global Google trends for “asml”, we can see that the pandemic fueled interest in the company, coinciding with a sharp rise in share price. Let’s review the fundamentals in more detail.

Over the last ten years, ASML had a relatively stable valuation of around 20 times EV/EBITDA until 2020, and the chip industry fell into a shortage. ASML was seen as one of the largest beneficiaries of increased global tensions and the need for localized chip manufacturing and just chip capacity in general. The valuation shot up over the last five years, trading at 33 times forward EBITDA. 2022 saw a nice correction in the shares; the last time, I bought more as well.