Today I have a rather big portfolio update with over 10% Portfolio turnover, so I decided to make a separate update post.

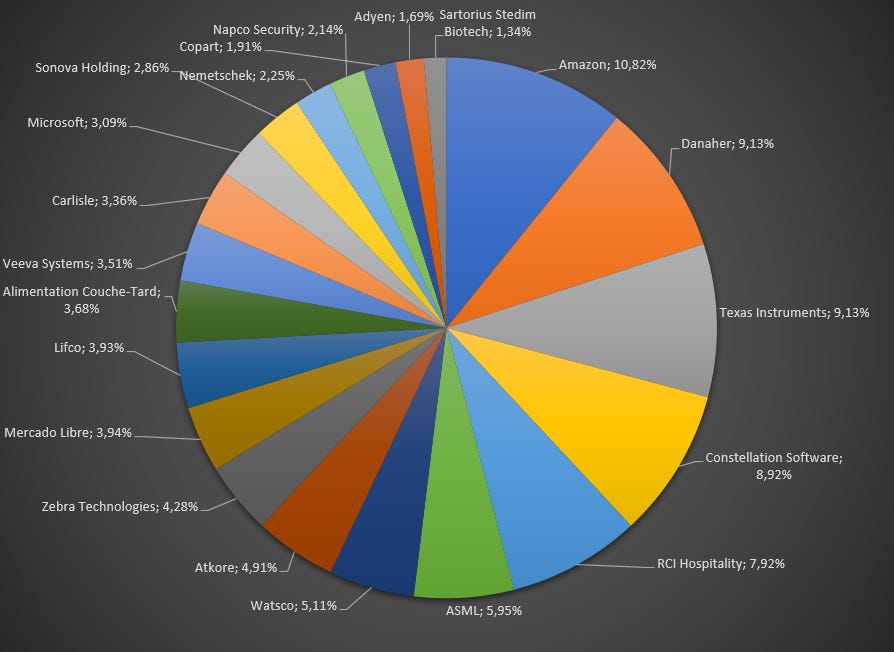

I have played with the thought of reducing my exposure to Big Tech for a while and I have finally decided to pull the trigger: I sold completely out of my Alphabet GOOG 0.00%↑ GOOGL 0.00%↑ position and sold 2/3 of my Microsoft MSFT 0.00%↑ (from 10% to 3% weighting), my Amazon AMZN 0.00%↑ position remains in the unchanged at 10%.

Before I get to my reasoning, I’d like to offer you a discount on Seeking Alpha Premium, a service I use and contribute to daily. If you want to check out the service, with my affiliate link you can save 50% for the first year!

The portfolio change has a few different reasons: Personal and fundamental. I noticed that I have a much harder time holding technology companies (a very broad term, but you get what I mean) in my portfolio. It’s much harder to anticipate the future with the number of players in the market and the possibility of disrupting technologies. This leads me to worry more about these companies and that’s something I want to avoid with my investments. My goal is to hold companies for a long period of time and I have an easier time doing that with hidden champions in the small and mid-cap space. Microsoft and Google are what I call consensus Long names that are in most portfolios and everybody is watching them. That makes it a lot harder to turn away from the noise associated with these companies. Hence I decided it is the right decision for me as an investor to focus on smaller companies. I remain invested in some large caps (Danaher DHR 0.00%↑, Amazon AMZN 0.00%↑, Texas Instruments TXN 0.00%↑ and ASML ASML 0.00%↑) though.

Now for the fundamental reasons: I struggle to see a good risk/reward with these two companies. Over the last months with the emergence of large public language models and other AI applications, we’ve seen how fast this space is moving and I do see a significant risk that this could dilute the business model of both companies: Google might not lose much market share, but the additional computing power required to run these services should impact margins. Google is all about search; now, for the first time, they have a strong competitor entering the market. Both companies are not cheap if you account for SBC and the fact that they already dominate their market. The risk-reward does not look appealing after I did my reverse DCF: Microsoft would need to compound FCF at 15% and Google at 9% for the next decade. I see margin pressures for both companies and buybacks do not achieve too much at least for Microsoft at this valuation. From a quality perspective, Microsoft is an outstanding business, so I decided to keep a small position. For Google, I decided to fully exit because the risk to the core business model is much higher and they don’t have anything outside of Ads really contributing to the bottom line. Even in the advertisement space, I prefer Amazon’s integrated ad business.

EDIT: After I made my decision this news came out. It had nothing to do with my decision, but it shows again that there is now real competition in the search market.

I redeployed the capital into five of my existing holdings that I find attractive right now: Texas Instruments, Danaher, Carlisle, Atkore and Watsco. I expect this change to be controversial and I’m looking forward to the feedback from all of you.

To conclude, I believe it is vital for an investor to find out what kind of companies they are comfortable holding on to. I noticed a pattern that I struggle a lot more with technology companies and thus it makes sense to focus on what I CAN hold over a long time period.

Congrats for take such a difficult decision! I think technology companies with new investments in IA has a lot to lose and not so much to win. IMO this sector is so complicated and I cannot see any big winner from now to 20 years in future.

Looking forward to hear more from you about smaller companies! 🙌🏻