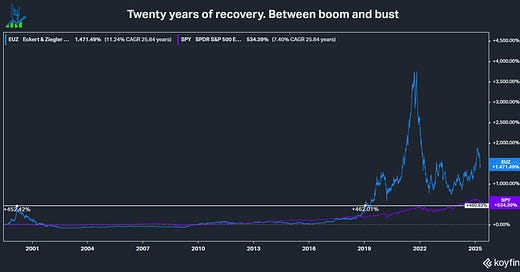

Eckert & Ziegler: Is the next boom around the corner?

A history of boom and bust, supported by secular growth trends

The last twenty-five years have been exciting and hard for Eckert & Ziegler shareholders. The company went through two booms and busts. It took the stock almost two decades to reclaim the dot com bubble top again. But the business is now stronger than ever. Let’s find out why I’m betting on faster new highs this time!

You can find the first part of the analysis here.

What led to twenty years of no returns?

During the dot com crash, E&Z was a much more infantile business, generating no net income and a bit of EBITDA. Over the coming decade the business developed well until in 2016 earnings started to get momentum and valuations expanded. With the intense euphoria in the market during Covid valuations ballooned again to 50 times trailing EBITDA with hopes of massive growth over the coming decade. As the bubble deflated E&Z now trades at just 11 times trailing EBITDA.

In this article we’ll understand how the numbers have developed recently and what we can expect going forward. How is management allocating capital and how efficiently are they doing it? Finally, we’ll look at the quality score and valuation of Eckert & Ziegler.