Frosta AG: Fundamentals and Valuation

Frosta AG has outperformed the S&P 500 over the last decade, with a 16.8% CAGR versus 12% for the index. In this timeframe, the company grew revenue by a 5% CAGR, operating cash flow by 15%, and net income by 11%. Let’s review how the company created such strong operating leverage and whether it is still attractive after a multiple expansion.

Frosta has pulled two out of three pillars a company can pull to enhance returns over the last decades:

Share count reductionMargin expansion

Market multiple expansion (not in their control)

In this post, I recently discussed this topic with my friends over at the StockOpine substack.

Share count reduction

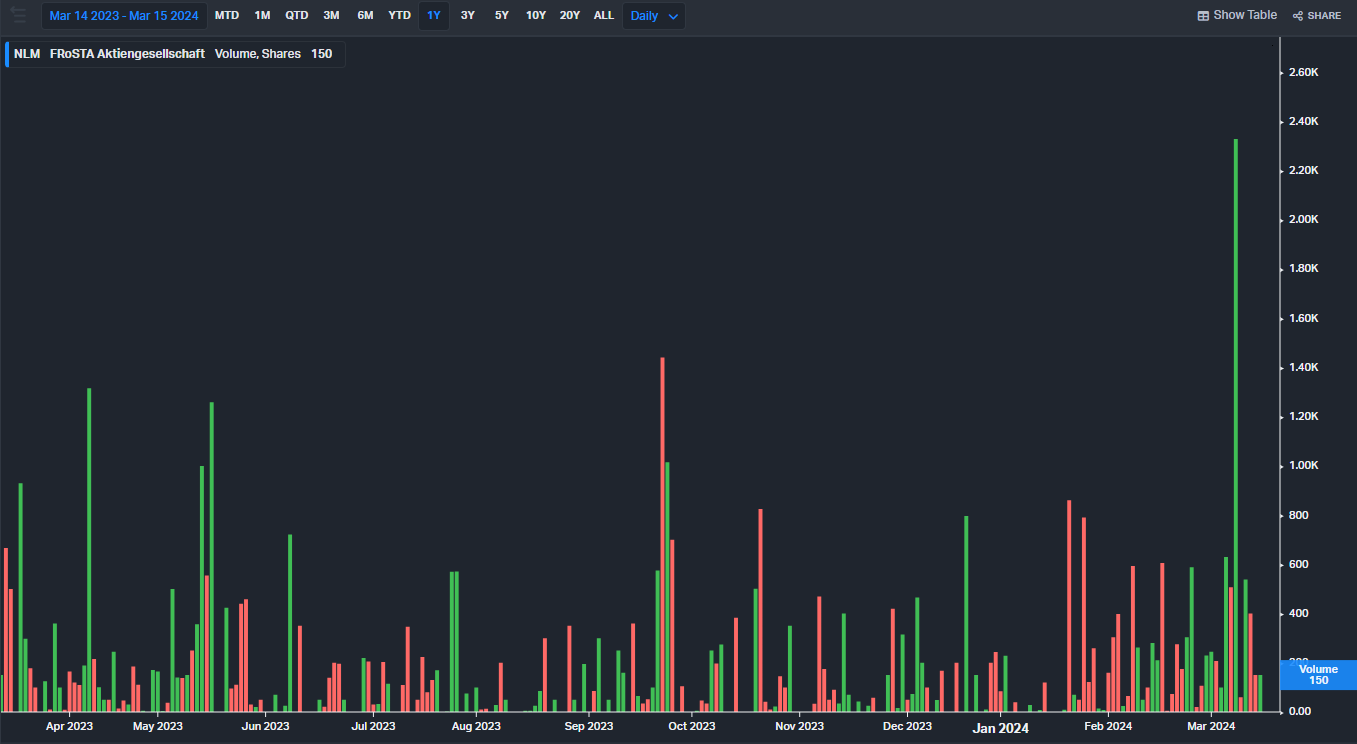

Frosta, like most European family businesses, doesn’t reduce the share count. The family collectively owns over 50% of the shares, so there isn’t a very large free float of shares out there. Additionally, Frosta shares have a very low trading volume. The day with the biggest trading volume of the last year had just around 160k euros in turnover, compared to a 470 million euro market cap. Frosta instead returns cash to shareholders via its annual dividend, which was recently increased to 2 euros.