Hermle: Fundamentals and Valuation

An efficient business trading at historically low multiples

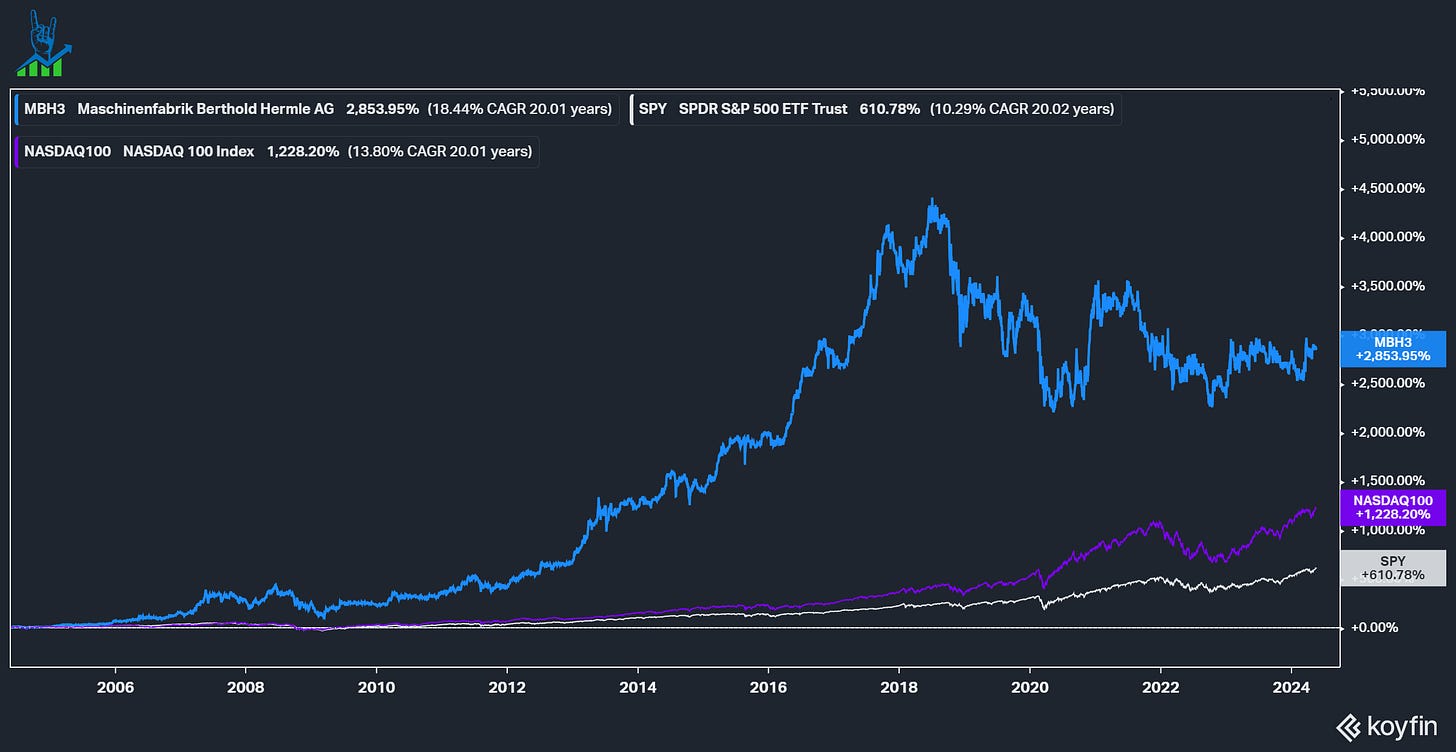

Over the last twenty years, Hermle has been a major success story in Germany, returning an 18% CAGR. Since 2018, however, the stock has lagged behind, delivering a negative total return. Let’s review Hermle's fundamentals and valuation to find out if the growth story is broken. You can find the first part of my analysis, discussing the business model and moat, here.

The economic Cycle

Hermle sells CNC milling machines to industrial customers, which is vulnerable to the economic Cycle. The great financial crisis hit Hermle hard, cutting revenues more than in half. Covid was another large hit, with a 35% revenue decline. We can also see that the company stayed profitable throughout the last 20 years, with trough EBIT margins of 6% in 2009 and 17% in 2020. Usually, the EBIT margin comes in at 21% with similar operating cash flows, which is slightly lower. The recovery after 09 was swift, and just three years later, Hermle hit a new record revenue.

Similarly, Hermle recovered within two years from the Covid crash and saw a new revenue record in 2022. Koyfin does not appear to have the FY 23 results in their database yet, but Y/Y revenues grew 12%, with EBIT increasing 16%. Let’s discuss the numbers in more detail: We’ll look at reinvestment opportunities, capital structure and efficiencies and, of course, the valuation.