Napco Security Technologies is a fast-growing high-quality small cap that nobody talks about.

They are in essential markets and are growing a recurring revenue stream. Let me show you why I bought NSSC 0.00%↑ after it’s already up 1500% in the last decade.

Business model and Industry

Napco operates in three markets:

Alarms & Connectivity (Smoke detectors, Fire Alarm, Sensors, Surveillance cameras and other Intrusion alerts, etc)

Locking (Keyless and Wireless locks)

Access Control (Card readers, smartphone-enabled access control, security management platform)

The company focuses on the commercial segment, which accounts for around 80% of revenues. Napco offers a full suite of products for building security and safety needs, which enable recurring revenue streams. This allows customers to have low upfront costs and pay a recurring fee for the service.

The primary end markets are commercial buildings, schools, medical facilities, detention centers, airports and residential. Napco is aided by several tailwinds, most importantly:

The growing obsolescence of Copper phone lines in the USA drives a massive upgrade cycle through millions of buildings that need to update their security infrastructure from Copper to wireless.

School safety is a big problem in the USA with 47 school shootings just in 2022! Doors in US schools are designed to open outwards and are locked most of the time outside. This can be fatal in a shooting. Napco offers solutions that enable teachers to lock the doors inside the classroom via a physical switch or remote.

Another important factor is regulatory mandates that require businesses to upgrade fire alarms regularly, no matter if the building is occupied or not. This means even during lockdowns companies had to upgrade these systems.

Switch to recurring revenues

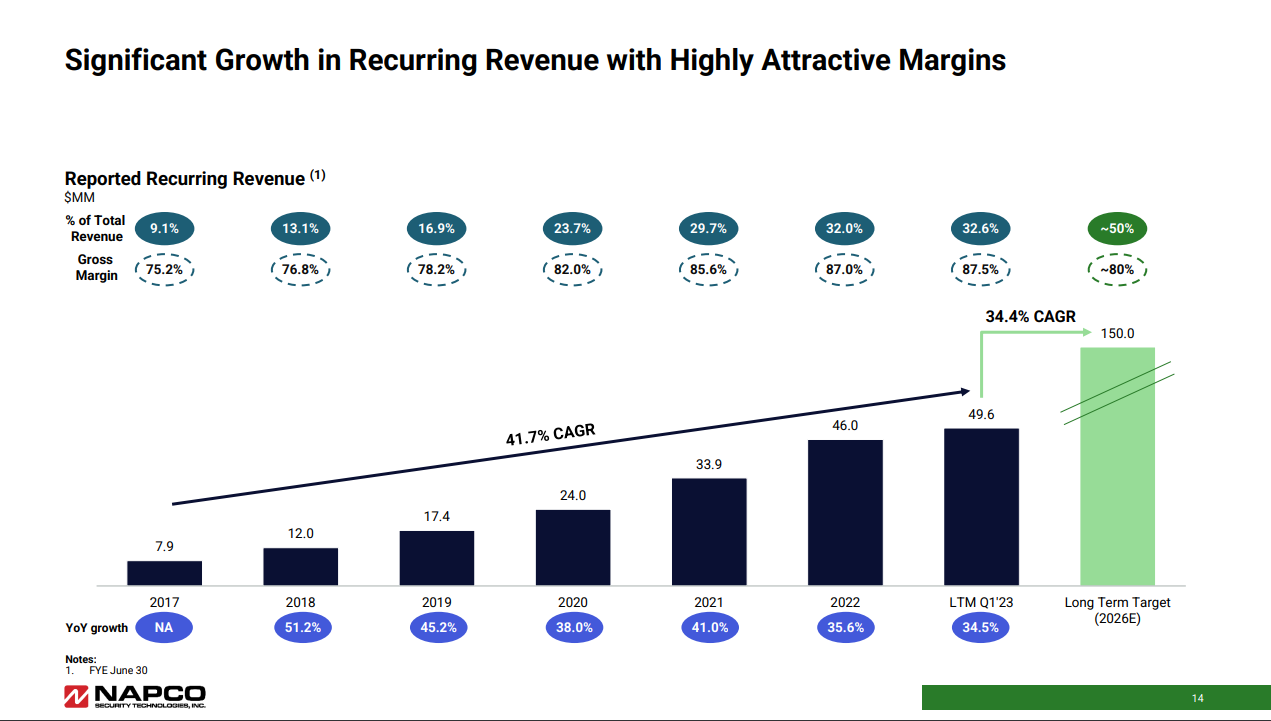

Over the last few years, the company focused on transforming its product offering to include recurring revenues through IoT solutions. The current portfolio includes recurring revenue products in every product category. Since 2017 recurring revenues grew from 9% of revenues to over 32% and the goal is to have half of the revenues as recurring revenue by 2026. Over the last 3 years, product sales grew by a 13.3% CAGR, while recurring revenue grew by 37.9%. This resulted in adjusted EBITDA growing at a 40.8% CAGR in the same time period.

Current headwinds and why they won’t last

The company is currently facing heavy headwinds in its manufacturing from missing parts. The semiconductor shortage is still ongoing, especially in specialized parts. The company decided to buy these essential parts at any price to keep manufacturing these products. Even if they currently have low gross margins on these products (20% versus 37% pre covid), they generate recurring revenues at >80% gross margin and the competition can’t and won’t produce. This has led and is leading to Napco gaining market share from competitors and introducing them to new distributors. Some of these parts currently cost up to 10 times as much as pre covid. As a result, inventories are up around $30 million y/y, decimating Free cash flows. I applaud this decision to focus on the long run and sacrifice short-term profitability. Let’s see why they can certainly afford to do this.

A fortress balance sheet

Napco has built up a fortress balance sheet. Currently, the company has 1.6 times EBITDA net cash and no debt (just $6 million in leases). FCF has suffered, but they are still positive even after spending $30 million in a year on increased inventory. Management knows what they are doing and they have skin in the game: The founder is still the CEO with 19% of the equity and the remaining management team owns another 2%. The company also generated a 14% ROIC/WACC spread this year according to gurufocus.

Risks

The company does not come without risks. Let’s go through some of them briefly:

The company primarily manufactures in a company-owned facility in the Dominican Republic. This facility supports up to $300 million in hardware revenue, so a lot of capacity left. The company also has land to expand in the future. Even though it is beneficial due to lower labor costs and lower shipment times compared to China, it is a risk to have most of the manufacturing located in one space.

It’s a small cap and even though it’s well-led, there is risk associated with the small size. The CEO also is 75 and might retire eventually. He also has been selling shares occasionally in large quantities.

Valuation isn’t cheap at 20 EV/EBITDA and 32 PE. FCF yield is useless right now due to the large change in inventory rendering FCF void this year.

Conclusion

Napco is a high-quality smallcap in a large addressable market with differentiated products and is founder-led. Once the semi-shortage headwinds abide, I can also see a drastic improvement in margins, elevating profitability. I purchased a 2.5% position for my portfolio. I also covered the stock last month on Seeking Alpha, if you want to read that next.

I love these dives into old economy! Great job Heavy Moat :D

Great take, interesting, thank you! Keep moat-ing :)