Capital allocation is the CEO's most important job. William Throndike, Author "The Outsiders"

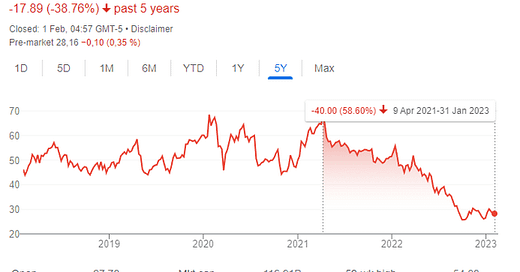

Intel, a piece of American History, has fallen over 58% since its All-Time-High in 2021, shortly after Pat Gelsinger was announced as the new CEO. In this article, I want to focus on the company's Capital Allocation and why my trust in the management team is gone. This article was originally intended for SA, but it was too much of a rant for there, so I’ll post it here. Please consider sharing the article.

Capital Allocation 101

I am a big fan of William Throndikes Book "The Outsiders", a book discussing eight case studies of unconventional CEOs that massively outperformed peers and the market by doing things differently. The book's primary focus is how good capital allocation can make a material difference over the long term.

Capital Allocation is what a company does with its excess cash flows. There are two components to it: Raising money and deploying money.

There are three ways for a company to raise money:

Selling shares/Equity in the company

Taking on debt

Funding it with cash from operations.

All of the ways have advantages and disadvantages and should be viewed as the toolkit of a Capital Allocator. There are five/six ways for a company to deploy money:

Invest back into the business (CapEx, R&D, S&M)

Mergers and Acquisitions (inorganic growth)

Stock buybacks

Dividend payments

Debt payments

Sitting on the cash (this isn't a decision, but rather a delay in allocating the capital)

Intel's Capital Allocation

Let's look at how Intel has historically allocated its capital. The picture below shows that Intel has constantly repurchased shares up until June 2021; outstanding shares have been rising since then. Intel has also been paying a growing dividend. Historically the company has made some acquisitions, often followed by taking on larger debt positions and then paying them off. Capital Expenditures have also been on a steady rise.

Financial Engineering in the numbers

Let's take a look at the most recent quarter. Intel saw a significant deceleration in its revenues, down 32% and all other metrics. Earnings and cash flows collapsed. Let's look closer at cash flows in particular. Cash from Operations for the full year halved from $30 to $15 billion, while CapEx increased from $15 to $25 billion. This means that Free cash flow was a negative $8 billion (Intel displays a $4 billion cash outflow because they adjusted it for a $4.56 billion "Sale of equity Investment". I do not see how this could be considered cash from Operations instead of Cash from Investing activities. A red flag in my books).

More Financial Engineering

Adding a sale of equity investment back to Operating cash flow is not the only financial engineering at Intel. In the earnings call, CFO David Zinsner talked about an accounting change:

Effective January 2023, we increased the estimated useful life of certain production machinery and equipment from five years to eight years.

I find this change in accounting highly questionable. This change is expected to decrease depreciation by $4.2 billion in 2023. LTM depreciation stands at $11 billion, so these significant changes will drive Net income up significantly without providing any value to the company.

Management incentives

Let's talk about incentives. If we look into the Intel Proxy Statement, we find this Sentence about the Long-term Compensation structure:

Our long range plan is bold and ambitious, but it will take time and requires us to be dynamic and nimble along the way. Stock price and market cap are the clearest measures of our success across a long-time horizon

Page 76, Intel Proxy

In a recent article about Watsco (WSO), I talked intensively about management incentives and what they can tell us. Most of the compensation for the executive team is tied to the share price and market cap. This implies a few things:

Management doesn't have a high incentive to repurchase shares because Marketcap is a big part of the compensation; in fact, Pat Gelsinger's compensation is only measured on Market Cap.

The fundamental results of the company don't matter; just the market cap does.

Management is not aligned for the long-term because it is focused on keeping the stock up over the short term to vest shares.

Additionally, the short-term goals are based on Revenue and Net income (both non-GAAP). If we look back at the Financial Engineering section of this article, we can see the outcome: By using Non-Gaap net income instead of cash flows, the management is incentivized to increase net income, no matter how. Stock-based compensation and changes to depreciation schedules are ways to drive up net income for the short term.

Lastly, according to the proxy statement (page 58), insiders own 936,613 shares in the company. Based on a count of 4,137,000,000 outstanding shares, I'll not even calculate the percentage management holds. It's neglectable.

By the way, I’d like to offer you a discount on Seeking Alpha Premium, a service I use and contribute to daily. If you want to check out the service, with my affiliate link you can save 50% for the first year!

Cutting wages instead of the Dividend

On Wednesday, news broke that Intel is cutting wages from 5-25% for mid-level workers all the way up to the CEO. Additionally, the 401k match will be dropped from 5% to 2.5%. Intel has 131,900 Employees, so these savings will probably be up to a few billion. If we look at the chart below, we see Intel's Dividend and how it is financed. We can see that Intel currently pays out $6 billion in dividends and has committed to raising the Dividend even in these times so that we can expect at least $6 billion each coming year. We can also see that FCF has been deteriorating and that net debt has been rising. As a reminder: Free cash flow (FCF) is the cash a company earned in a period that can then be allocated. The Dividend should always be lower than the FCF; otherwise, you're paying it with debt or by selling assets (both are happening at Intel right now). Is it worth saving a few billion by cutting wages and potentially demoralizing your employees while trying to catch up to Nvidia (NVDA) and AMD (AMD)? I believe that the much better way to save money and finance the foundry build-out would be to suspend the Dividend. Intel is bleeding cash, the outlook is even worse (40% sales decline on top of the 2022 decline and negative non-GAAP EPS) and the US Chips act subsidies are not going to be paid for at least another year. The problem is that Intel's management can't take the bullet and shoot the stock down further by suspending the Dividend because their compensation depends on it heavily. Incentives are not aligned, so Intel must keep bleeding cash, a real dilemma. Prudent capital allocation says to buy back stock while it is under intrinsic value and sell stock while it is over intrinsic value. Intel has been buying back tens of billions during the good times and now, during the bad times, they are diluting shareholders and paying a high dividend. The right decision would be to cut the Dividend and potentially buy back some stock (but really, they should get the FCF back into the positive again without adjusting it for equity sales).

Conclusion

Putting a rating on Intel is tough. On the one hand, management lost all credibility to me due to their misalignment, bad capital allocation decisions and missing their forecasts by a mile. Still, on the other hand, the stock could be cheap if they can turn the ship around. I do not see a high likelihood of that materializing, so that I will put a sell rating on Intel. It really is a turnaround story with strongly deteriorating fundamentals.

What do you think about Intel? Do you believe in the turnaround? Let's continue the discussion in the comments below.

I've just written a valuation for Intel myself, highlighting a few of the factors you mention here like free cash flow and financial engineering, but I'm actually reasonably bullish on them - I think they are a risky play but are reasonably priced for the risk they pose to investors. I'd be interested in your thoughts on my article, if you can find the time to read through? Thank you!