Hello and welcome to the Heavy Moat Investments newsletter on Substack. Join over 7,400 smart investors who already receive my in-depth analysis of high-quality businesses, timeless investment philosophy and actionable ideas straight to their inboxes. Click the button below to subscribe today and elevate your investment journey!

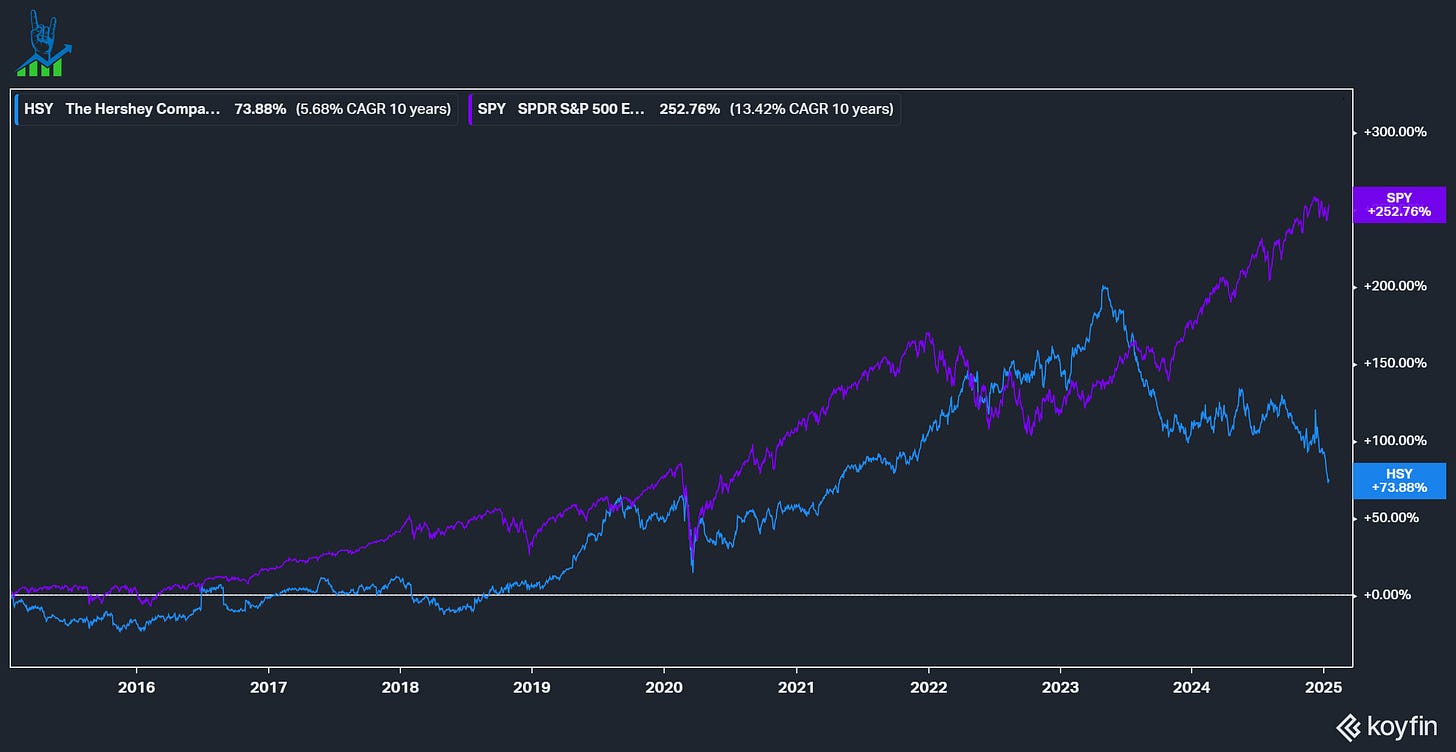

Hershey is a popular dividend growth stock that has fallen from grace in the last year. Its shares peaked almost two years ago at a 14% 10-year CAGR, but they are now down to a 5.7% 10-year total return CAGR. Let’s quickly examine the business and see if it’s a sweet (pun intended) deal now.

Hershey

I probably don’t have to introduce Hershey’s to my US readers, but it’s not as well known internationally. Hershey’s is a leader in the snack business with a diversified portfolio of brands, focused on its North American Confectionery (Chocolate, gum and Sweets) business, contributing over 80% of sales. They own 31% of the US CMG (candy, mint, and gum) market and 45% of the Chocolate market and continue to gain market share. The company also has a small NA Salty Snacks and International business.

On paper, Hershey hits all the right spots for a well-led business:

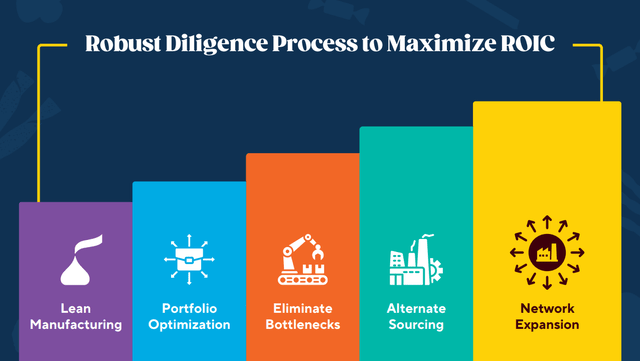

ROIC focus (22% current, 24% 10-year median, 19% trough, 30% peak)

Lean manufacturing and automation

Driving margin improvements

Rational capital allocation policy (Reinvestment+M&A → dividend at 50% payout → opportunistic share buybacks → maintain 1.5-2 x leverage ratio)

The problems

While Hershey’s expected in its last Investor day in 2023 that 2024 would see 3-4% sales and 7-8% adjusted EPS growth, reality turned out very differently. FY 24 guidance has repeatedly been lowered throughout the year and now comes in at flat revenue and down mid-single digits for adjusted EPS.

Unlock the full analysis and much more

As a paying subscriber, you'll gain exclusive access to the rest of this article, where I talk about the problems and potential rewards for Hershey’s stock, plus all my premium insights on businesses, valuations, and investing strategies. Take advantage of this opportunity to elevate your investing game today!