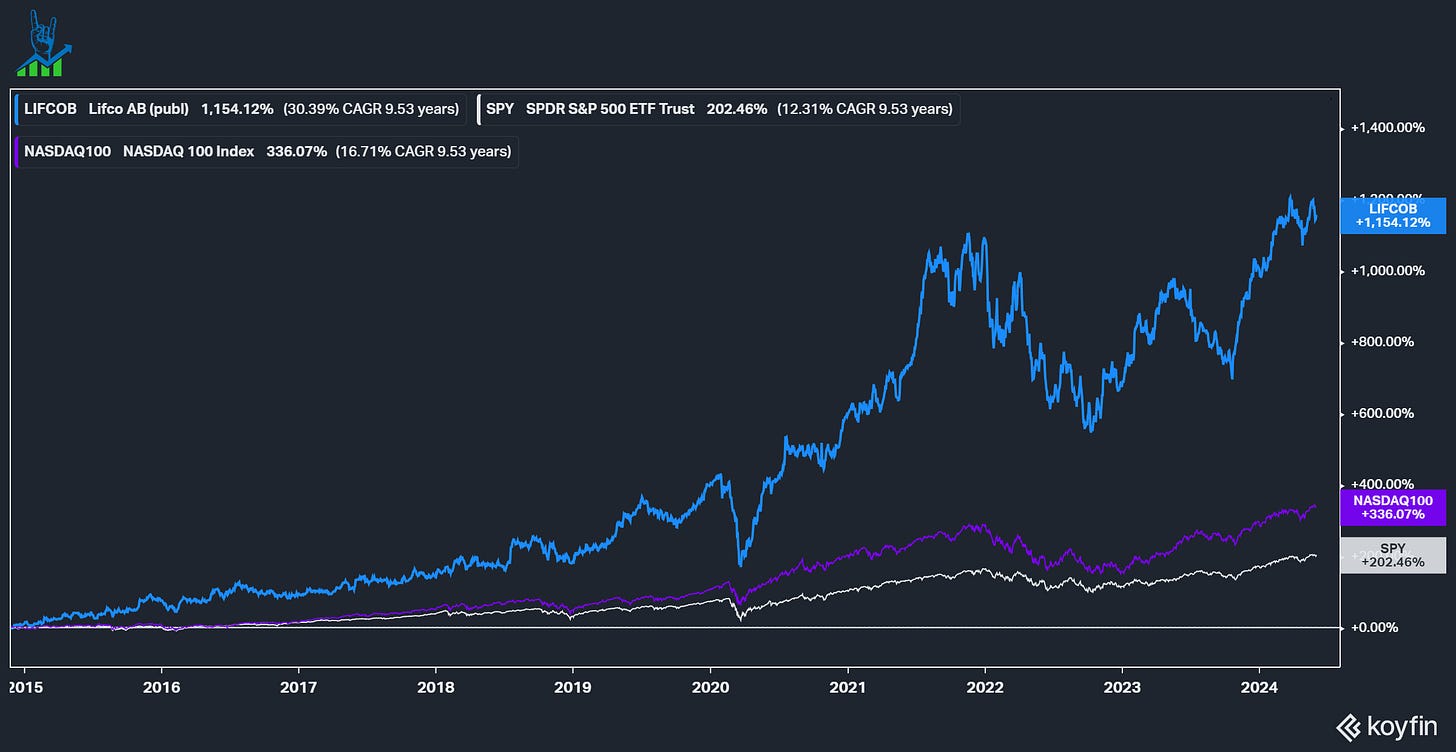

Since its IPO 10 years ago, Lifco has delivered an outstanding performance for shareholders, increasing 11-fold or at a 30% CAGR. The stock has delivered this performance with remarkable stability for the most part. The COVID crash saw a 46% drawdown, and the 2022 bear market saw shares decline up to 45%. Let’s examine how they delivered this performance, how the fundamentals and reinvestment opportunities look and finally, how the valuation looks. Read the first part about the business model here.

The four drivers of performance

Let’s examine the four drivers of stock performance: earnings/cash flow growth, dividends, change in share count and change in valuation multiple. The change in share count is uninteresting for Lifco because the company hasn’t issued new shares and has been at 454 million since the IPO.

Growth

Lifco is one of those companies that openly talks about long-term performance and thinking. This is evidenced in the nine-year CAGRs that they proudly share in their presentations. Lifco typically talks about EBITA, adjusted for impairment of intangible assets from acquisitions, as a proxy for profits. The company has averaged a 22% EBITA growth rate over the timespan. As discussed in the first part, Lifco is a serial acquirer focusing on organic growth. Organic growth almost kept up with inorganic growth with an 8% CAGR versus a 12% CAGR. Foreign exchange tailwinds benefited Lifco by another 2% annually. Organic growth is more cyclical due to the industrial nature of most business segments. However, Lifco hasn’t seen a negative organic growth year in the timespan, even during COVID-19. Beginning in the last Q2, Lifco started to see negative organic growth (-0.9%), which then accelerated to -5.1% in Q4 and to -7.8% in the last quarter. Notably, the demolition & tools business has been hit and represents the downturn in European industrials. Lifco has offset these declines by capital deployment through M&A. Lifco’s organic growth is also impacted by delivery timings; for example, in Q4 23, they saw an extraordinary positive impact from strong deliveries of nonconstruction machinery. This can skew Q/Q results, making looking at the long-term trends mandatory. Lifco generally has rather long order books, making revenues somewhat predictable (cancellations can occur, of course). On the other hand, this makes it harder to raise prices fast, which was a tailwind in the high inflation environment over the last few years.

Similarly, acquisition growth is lumpy. Lifco actively searches and closes deals, but they vary in size and timing. Lifco doesn’t want to force growth by rushing deals to meet a guidance.