MSCI Quality Review: Is This Owner-Operator Worth Buying Now?

Breaking down MSCI’s moat, margins and management through my 13-point quality framework.

Hey everyone,

Welcome back to my Quality Score series, where I break down world-class businesses through my 13-point framework. Today, we’re diving into MSCI, a powerhouse behind many of the world's most popular indices—and a business with remarkable capital efficiency. Rarely does a company score as highly in my framework.

My Mercado Libre Quality Score post showcases how a full breakdown looks like.

Check out this post if you want more details about the quality score.

Let’s dive in!

What makes MSCI interesting?

MSCI is a financial services company spun out of Morgan Stanley in 2007. It is most well known for its Index products like the MSCI World. Furthermore, the company offers all kinds of analytics and risk management services for clients on all sides of the wealth management spectrum and diversifies further into different asset classes. MSCI is an excellent business because of…

✅ Critical infrastructure in global investing

✅ Scalable, asset-light, high-margin business model

✅ Owner-operator management

✅ Strong pricing power

✅ Beneficiary of secular trends like passive investing & ESG

Management Alignment (5/5)

MSCI is led by Henry Fernandez, who has led MSCI’s business since 1996, even before the spin-off in 2007. He owns 2.7% of the company (valued over a $billion) and other insiders own 0.6% of MSCI.

MSCI has a strong incentive plan covering:

Short-term cash incentive based on revenue, adjusted EPS, FCF, personal KPIs

Long-term 3-year vesting RSUs

Long-term Performance shares based on total shareholder return CAGR over 3 years

Performance stock options based on revenue and adjusted EPS growth over 3 years

Well-designed incentive plans and a long-tenured owner-operator make MSCI’s management highly aligned with shareholders. Non-executive employees also benefit from the company’s success, with over 6,000 receiving performance-related bonus payments.

Secular Trends (2/3)

MSCI is riding the wave of passive investing, with its indices underpinning thousands of ETFs and funds. As investors demand more ESG and customized analytics, MSCI’s role becomes even more entrenched. While these trends are well understood, there’s still room for high incremental margin growth.

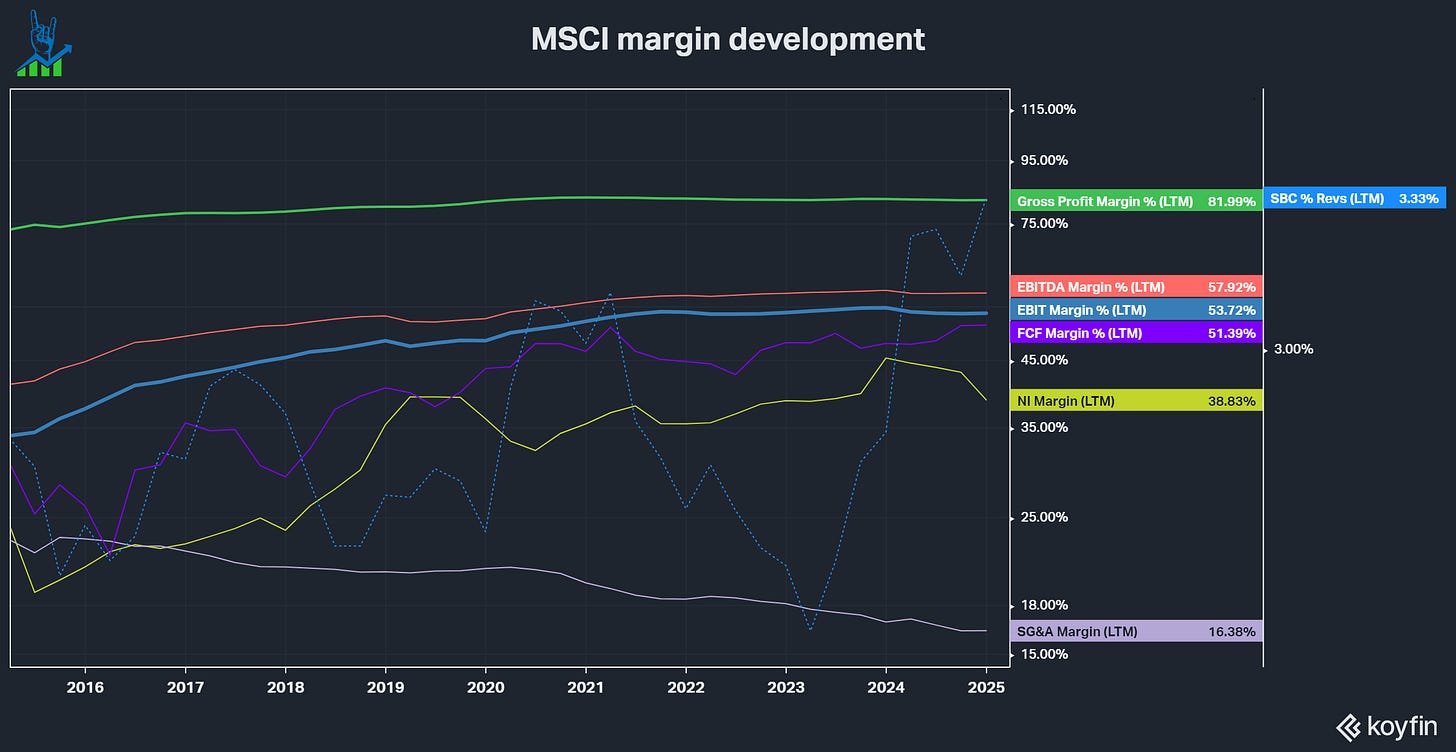

Margins (4/5)

Margins have developed wonderfully over the last decade, driven by the high-margin and asset-light business model. However, over the last few years, they have stalled, and I don’t see them as that high of a lever anymore. They can push EBITDA margins above 60%, but this won’t move the needle much. Incremental revenue has nearly 100% gross margins on fee-based products, making it highly lucrative.

Balance Sheet (1/3)

MSCI’s balance sheet is the only blemish. Leverage at 2.5x net debt/EBITDA is manageable but limits flexibility. In my premium analysis, I’ll explore how this might cap reinvestment opportunities and what it means for valuation.

Want the full breakdown into MSCI?

In the premium section, I dive into:

✅ MSCI’s moat and competitive advantage

✅ Its growth prospects and capital allocation strategy

✅ My IRR valuation model

✅ How MSCI’s predictability and cash generation make it a top-tier compounder

✅ What could go wrong—and if the company has a place in my portfolio

Upgrade now to get instant access to the full MSCI Quality Score, plus my entire library of deep dives, valuation models, and real-time trade alerts.

🔥 I recently made my deep dive into Ashtead Group free—so you can see exactly what to expect: Business model deep dive - Fundamentals and Valuation deep dive