Every few months, the financial media goes crazy about 13F filings from the largest investment funds and companies like Warren Buffett’s Berkshire Hathaway. Let me tell you why I don’t care much.

What are 13F filings?

The SEC requires 13F filings for institutional investment managers with control over $100 million in assets. In the report, companies need to disclose quarterly their entire US equity long positions and any changes in the portfolio.

In my opinion, the best place to read 13Fs is Dataroma, a site aggregating reports for relevant super investors like Buffett.

Ready for More?

By becoming a paying subscriber, you can read all of my writing on businesses, valuations and investing. Don't miss out on the opportunity!

The problems with 13Fs

13Fs have several problems, the biggest one is that it’s backwards looking and only represents a point in time. 13Fs are filed within 45 days after a quarter is finished. This means we are getting outdated information. Within the quarter, companies can also trade around and some funds also do window dressing, meaning that they sell losers to have a better-looking portfolio by only displaying winning positions.

I frequently see people talk about Michael Burry’s portfolio. However, he is a very active, macro-driven trader who can go in and out of names within days. For this type of investment, the long time between portfolio filing and the information going public ruins most of the opportunity or the data can already look vastly different.

It’s different if one looks at long-only funds focusing on long-term investing. One example is TCI Fund Management, a concentrated quality investment fund and activist investor that rarely trades in and out of positions. Here it can make sense to look at positions. One must, however, keep in mind the limitations and properties of a 13F filing and not just copy trade (I’d recommend never copying without doing your own work and thinking).

Ulta Beauty as an example

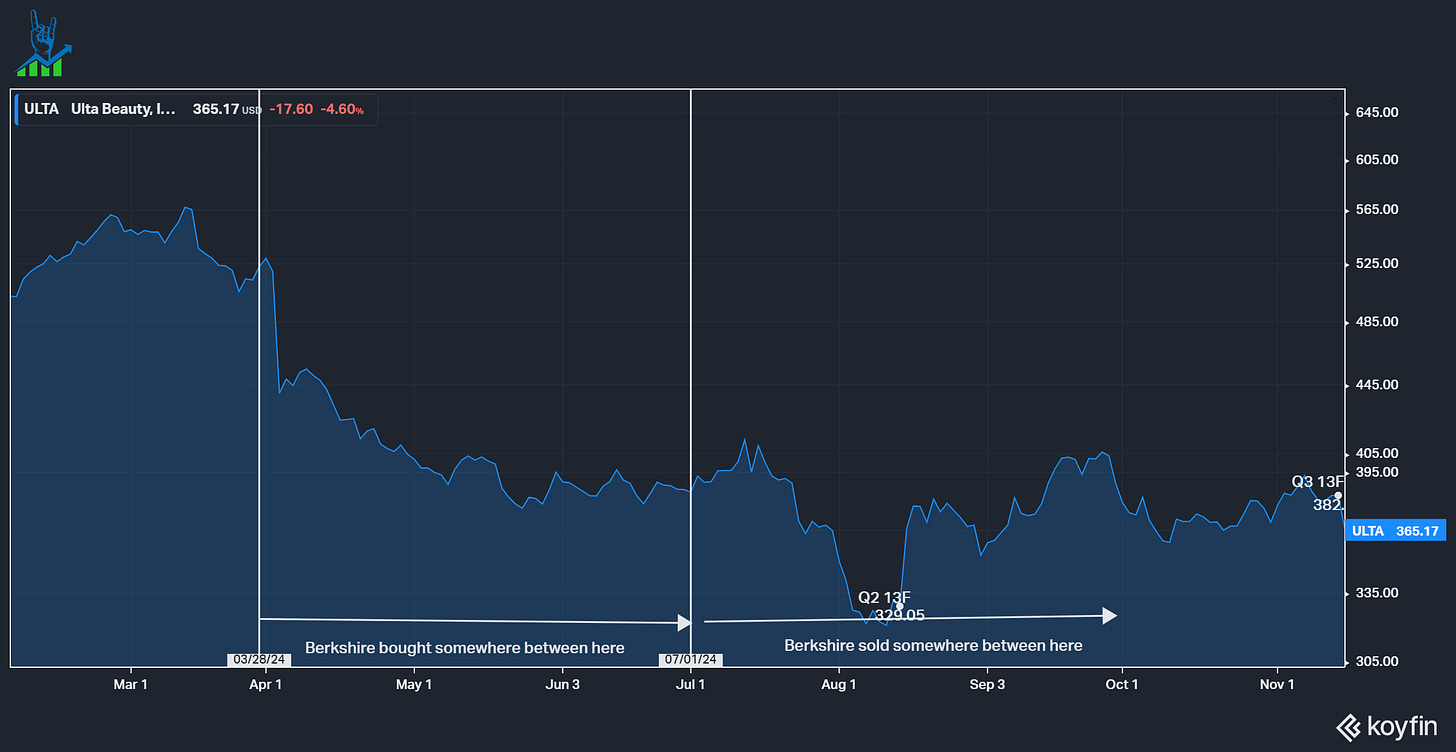

Value investors on Twitter and other media rejoiced after Berkshire filed its Q2 13F and showed a $266 million position in Ulta Beauty. It’s a good business, which I analyzed here, but I sold it at the start of the year when I felt it became a little expensive (a fortunate sale in hindsight). You can see that Ulta shares rose from its lows around 10% after the 13F came out. The great Warren Buffett bought shares, so it must be a great long-term buy-and-hold investment, right? However, just one quarter later, Berkshire sold 96% of its shares. Berkshire most likely sold its position at a loss and could have sold even before the Q2 13F was published! A similar picture was seen with Berkshire’s buy of TSMC (Q3 22) and subsequent sale (Q4 22, Q1 23). While people love to talk about Buffett’s long-term focus, only around 1/10 of his buys actually stay in the portfolio for a long time. A lot of the small positions are traded. Ulta Beauty was a 0.1% position for Berkshire upon purchase, so it really meant nothing. Following super investors into trades (without thinking for yourself) can be detrimental.

Conclusion

To conclude, I believe that it’s great that 13Fs are a thing and that large institutional investors have to make their investments public (at least their US investments). However, many people put way too much weight into this. Warren Buffett, especially, has a cult following, and meaningless moves (0.1% of portfolio investment) can drive a stock (Ulta rose >10% on the news) up.