If you are familiar with my content, you’ll know that I have always been a fan of Koyfin and have predominantly used them for my fundamental analysis. Heavy Moat Investments is now a Koyfin affiliate partner. You can use my link to get a 20% discount on a subscription. I encourage you to try Koyfin in the free version and see if you like the interface and the data. It can be a powerful tool if used correctly, and the free version already offers substantial value. With this partnership, I aim to enhance the quality of my content and provide you with cheaper access to high-quality data visualizations. Let’s look at some examples of how to use Koyfin.

With Koyfin, you get a complete platform to customize charting fundamental data, as shown in the chart below. Here, I looked at historical quarterly share repurchases to see how they correlate with the share price (we want more buybacks when the share price is down). I also cumulated FCF, buybacks, and SBC over the last few years to see how much of the FCF is used for buybacks. Lastly, I checked how this ultimately affected the share count.

Koyfin offers a lot more than charting data. You can create screeners, watchlists and portfolios using all the data Koyfin has available and a convenient interface. The picture below shows my portfolio and some KPIs.

You can also read conference call transcripts and search through years of conference calls for keywords. This can be very helpful for spotting patterns in management and determining whether they stick to what they say. In this example, I searched the last 20 years of Texas Instruments transcripts for mentions of Free cash flow per share.

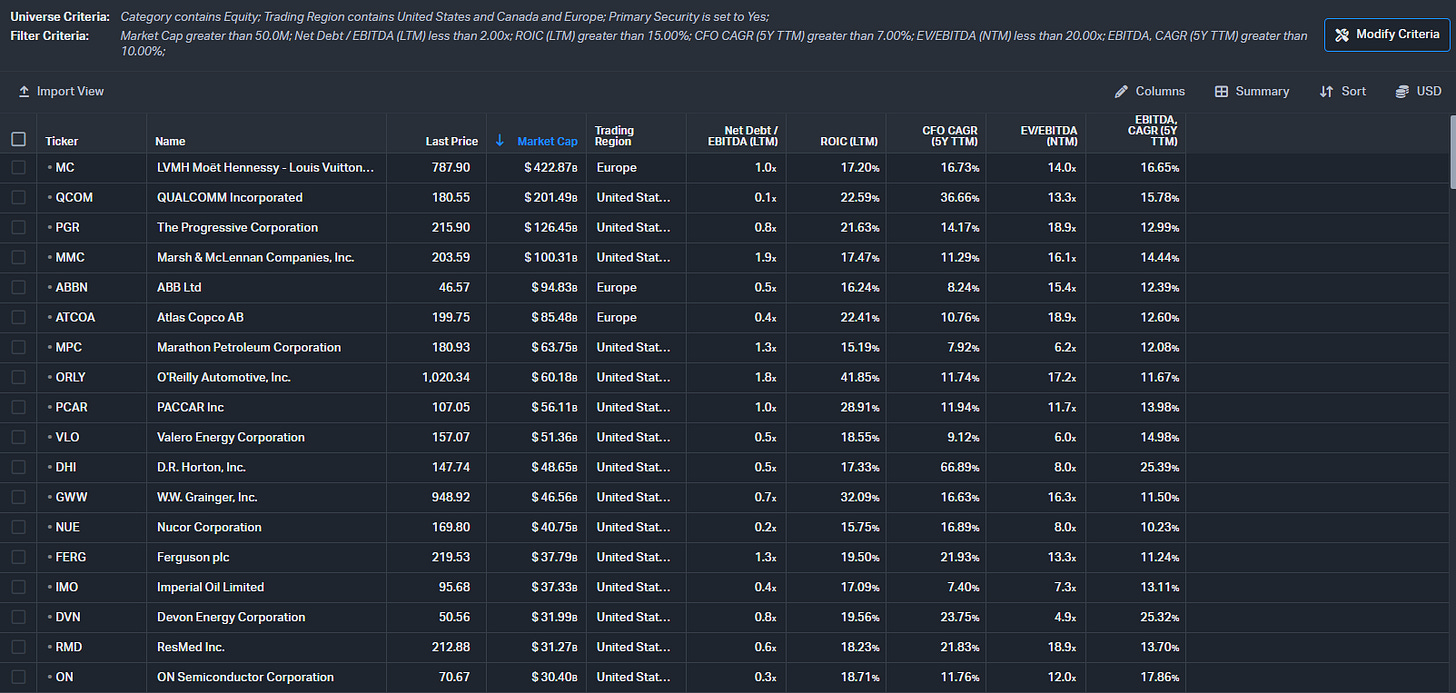

Here’s an example of a simple screener. This one filters all NA and EU companies by net debt <2x EBITDA, ROIC >15%, operating cash flow 5-year CAGR >8%, EV/EBITDA <20x and EBITDA 5-year CAGR >10%. While I don’t use screeners too often, they can help to generate ideas.

I hope this provides some examples of how to use Koyfin. While reading my content, you’ll find many examples of Koyfin being used. So once again, if you’re interested, check out Koyfin over this link.