Quality Investment Ideas to watch in August

High-Quality Investment ideas from my investable universe at attractive levels

I decided to use another name for the format; however, nothing changed: One free idea followed by two more (not in my current portfolio) for paid subscribers. Let’s get to it!

Free Idea of the Month: Amazon AMZN 0.00%↑

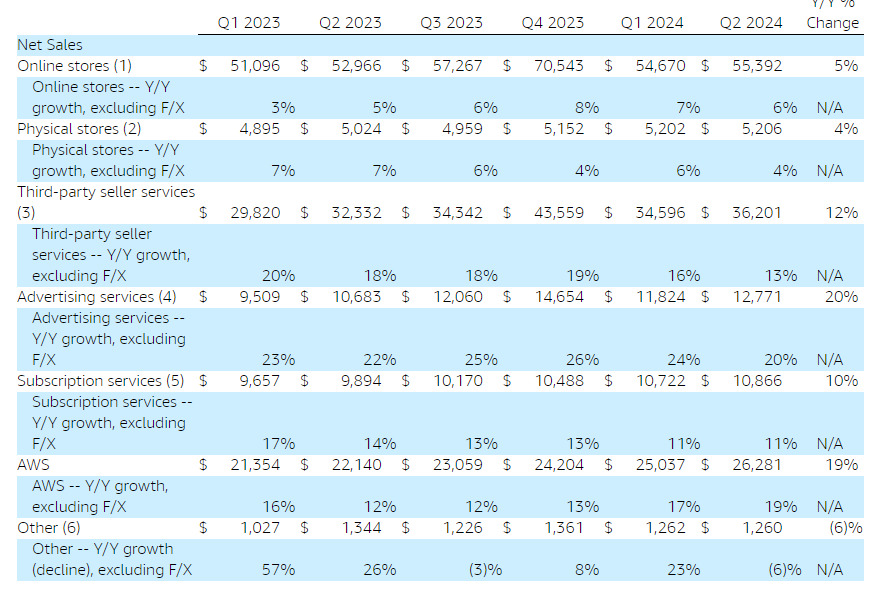

This may not be the most original idea, but after a little correction Amazon might be attractive again. In my opinion, it continues to be the most attractive big tech company. Amazon, hated just two years ago, has shown excellent operating leverage since then, growing EBITDA margins from a trough of 10% to 17%. EBIT margin was even more extreme, from 2.5% to 9%. Operating cash flow went from $35 to $108 billion while all segments are now contributing profits, an inflection point for the company. Especially the International expansion was often seen as an endless money pit. Besides growing into the large infrastructure footprint the company built, the company also continues to grow high-margin business lines at a much faster clip than low-margin retail (online stores and physical stores).

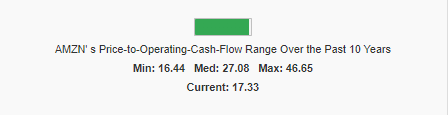

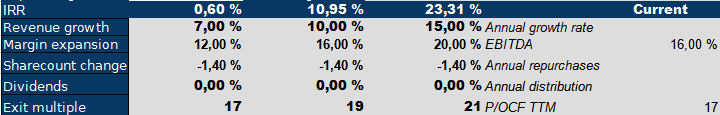

Amazon has a large growth runway left and seems more disciplined, resulting in massive cash flows. Estimates show that Amazon will generate $176 billion in operating cash flow three years out. Meanwhile, Amazon trades at its lowest Price to operating cash flow multiple of the last ten years, and the IRR model looks good even with conservative values. I don’t assume much margin expansion and no significant expansion of the multiple. Despite its size, Amazon looks like a great risk/reward and remains one of my largest positions.

Ready for More?

Unlock three more premium investment ideas by becoming a paying subscriber. Last month’s ideas are still exciting and can be found here. Don't miss out on the opportunity!