Sartorius Stedim was part of my portfolio from early 2022 to mid-2023. Since I sold out of the position, the shares have fallen considerably; over 50% since my purchase and 70% since its ATH. The company holds a market-leading position throughout the bioprocessing life cycle, a market with great growth prospects. Peers like Danaher and Thermo Fisher are down less than 20% from their ATH in 2021 and have performed considerably better. Let’s examine why Sartorius fell this significantly, if it’s a long-term or temporary issue and if the company now could be a compelling investment after the fall.

Shareholding structure

First, let's look at the ownership structure of Sartorius: There are two publicly traded companies. Sartorius AG holds 100% of the Service and Infrastructure companies and 100% of the Lab holdings, including the Laboratory subgroup. The second company is Sartorius Stedim Biotech, which is the pure play option with just the biotech subgroup. Sartorius AG holds 74% of that company. I concluded that Stedim is the more attractive company because the biotech group is the most attractive part of the company, and Sartorius AG only adds more debt and two inferior businesses (lower growth, lower margins, lower ROIC).

After the passing of the prior CEO and family member, Horst Sartorius, in 1998, he noted in his will that the majority of ordinary shares would be given to an executor. They are locked until mid-2028, 20 years after Horst Sartorius's passing. The publicly traded company Bio-Rad Laboratories owns 38% of the ordinary and 28% of the preferred shares outstanding of Sartorius AG. As far as I know, they don’t own a stake in the remaining 26% of free-float Sartorius Stedim shares.

M&A strategy

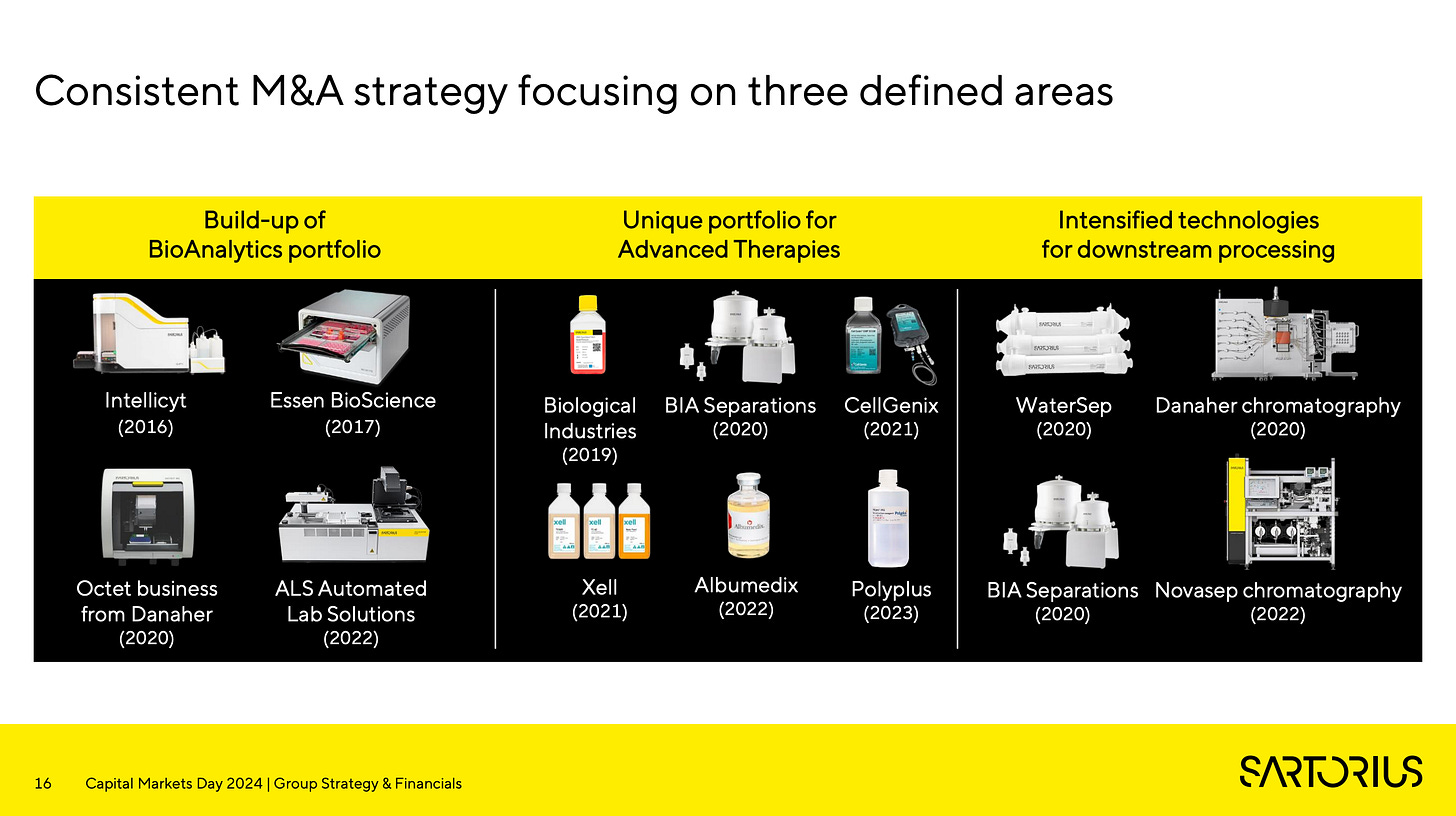

Sartorius has been an avid acquirer and has continually improved its product portfolio this way. The company generally buys companies to integrate into its portfolio to upsell its large customer base. Like DHR 0.00%↑ , the goal is to become a one-stop shop in its niche to cover the whole value chain and continue to gain share of wallet from its customers. The company spent over 4 billion euros on M&A in the last decade, however the last deal (Polyplus) looked pretty expensive at first sight. The thing with biotech M&A is that synergies play a huge role. While I usually don’t like it when acquisitions depend on synergies, Sartorius, Danaher, Thermo Fisher, and other peers have shown that the strategy works in this industry. The value Sartorius can add with its customer and distribution network is immense and can bring massive growth potential and OPEX reductions. Growth rates for Polyplus are expected to be 20-30% just from a market growth perspective, and the company is already operating at healthy margins exceeding the Sartorius group level. Generally, Sartorius targets companies with complementary products or technologies with a cultural fit, capable management, and either a top 3 player in its niche or with a USP. Companies should reach group-level profitability within 2-3 years, and the price should make sense.

On Capital Markets Day, Sartorius showed they are ready to issue up to 30 million new shares for deals. While I find it alarming that they shared this new slide during a downcycle where the stock price is in the bin, they also noted that this is just a possibility for highly lucrative deals and only if market conditions make sense. Debt financing will be the primary lever. Deleveraging from the Polyplus acquisition will be the focus, so I don’t expect large deals right now.