Robertet: Fundamentals and Valuation

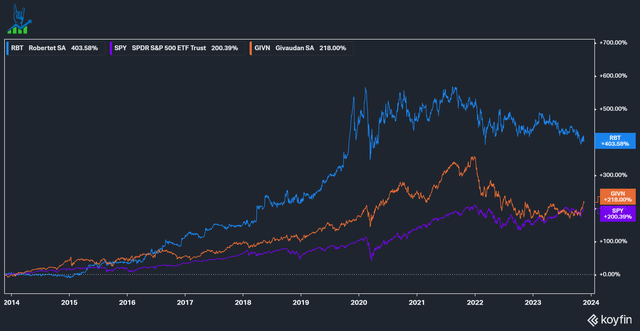

Robtertet, a leading fragrance and flavor industry player, has been a long-term outperformer compared to the S&P 500 and rival Givaudan. After the pandemic hit, Robertet and Givaudan traded sideways (although Givaudan had higher volatility).

I'll only look at Robertet in this article, but Givaudan is benefiting from similar tailwinds.

Margins

Robertet has had a good margin development over the last decade. While Gross margins have declined, EBITDA and EBIT margins improved by 400 bps each. Scale economics and the continued build-up of their vertically integrated network should further help increase margins slightly over time.

Reinvestment opportunities

Robertet has several reinvestment opportunities for growth, a few of which have already been addressed in the previous article on the business model.