In this little post, I’ll quickly introduce three Compounders from my current watchlist. These are companies that I already researched a decent bit and would love to either own or would research further (do the last 20%) if they dropped a good bit. Compounders are companies that can generate high capital returns for a long time and generally have a high-quality business and deep moats. Most of my portfolio is invested in compounders and I go into more detail about it in this article.

Ametek AME 0.00%↑

Ametek is a diversified industrial company in the Aerospace parts, Process and Analytics instruments & Automation and Engineered soluations industry.

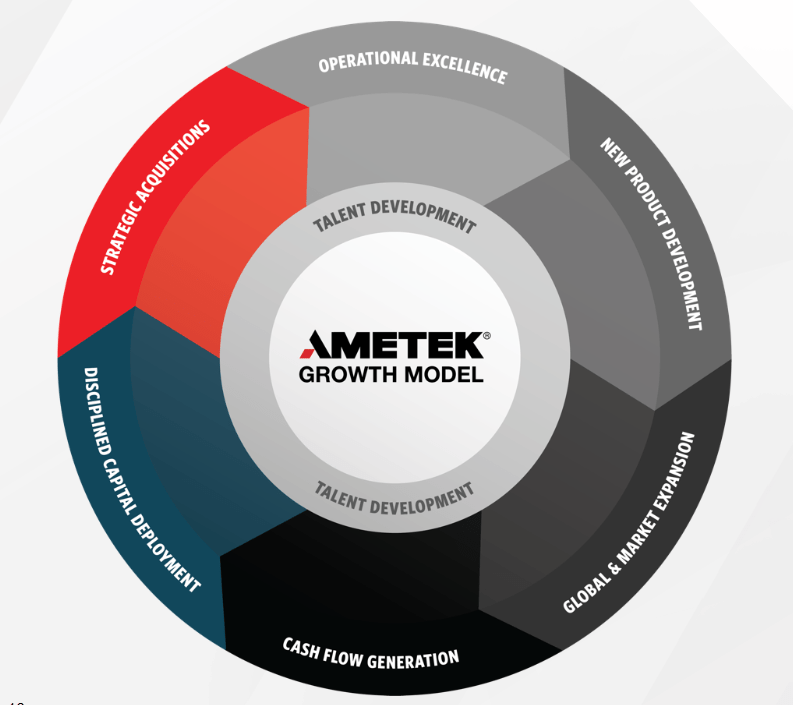

Below you can see the company’s strategy, which relies a lot on serial acquisition. The company is very disciplined and has a good framework for them, acquisition targets must have:

Technically differentiated products and solutions

Operational Synergies with Ametek

Year 3 ROIC of 10%+, IRR 15%, Year 1 EPS accretive

Attractive end market dynamics

Strong management team and solid culture fit

By adhering to these hurdle rates, the company acquired tons of companies over the years and spent $7.4 billion on acquisitions since 2012. Ametek is a great company, but I have three issues that have kept me from buying yet:

ROIC is not great with only 10%, while also having a 10% Cost of capital. This is primarily because the company has a very high Goodwill at $5.2 billion out of its $9.66 billion total capital. This is not a great indicator and could tell us that they might overpay for acquisitions at least occasionally.

Ametek lacks insider ownership, maybe this is also a factor that leads to more reckless acquisitions, visible in the high Goodwill.

The valuation is too high for me. In September I did a reverse DCF in my article on SA and got to an implied necessary FCF growth rate of 11-13% over the next decade. I’d love to buy Ametek with high single-digit FCF growth rate expectations, but since I wrote this article, the stock price went up 18%. Too much for me to pay, there are better serial acquirers at this price IMO.

Atlas Copco

Atlas Copco is, like Ametek, a diversified industrial company and serial acquirer. The company is the leader in Vacuum and compression with around 30% in each industry, both highly fragmented and prime targets for acquisitions. AC has had high insider ownership for the last 150 years and a highly decentralized culture, a prerequisite for successful serial Acquisition strategies. The company rarely sells its acquired companies, comparable to those I own, like Lifco and Constellation Software. Growing maintenance and repair businesses also bring more stability in this proven compounded over time.

To conclude, I really like Atlas Copco, but I’d love to get it around a 4-5% FCF yield.

Copart CPRT 0.00%↑

Copart is an excellent Business straight after Peter Lynch’s books: A boring and dirty business. I wrote more about it recently in this article. The company owns and operates the leading online auction platform for used cars and the scrapyard where the wrecks are stored. These yards, similar to RICK 0.00%↑ clubs and WM 0.00%↑ yards, have a moat unlike most other realestate you can own. They all don't really get new licenses, so you have a large fragmented industry ready for consolidation. Copart is the only strong company, especially after rival IAA 0.00%↑ is being acquired by Ritchie Bros RBA 0.00%↑, a move which will in my opinion hinder them to operate more than it will help.

Copart benefits from several secular tailwinds:

A growing and aging car fleet

Incerasing Vehicle complexity

Increasing demand from third world countries.

Copart has excellent management and large amounts of insider ownership. I have no doubt that the company will prosper in the next decades, but the valuation is rich! At a 27x forward PE and 2.55% FCF yield, I’d at best tip my toes in. I might start to DCA into this high-quality business, but I’m just waiting right now.

I hope you found some value in this small piece, let me know if you like these kinds of posts. I have a couple more companies in my close watch list that I could send out like this.

thank you, keep it rocking!