Since Stemmer Imaging is getting acquired, I decided to drop the Paywall from all Stemmer Imaging articles. While the company won’t be tradable anymore, it still gives you an idea of the type of work I do for paid subscribers.

Stemmer Imaging reported its annual report last Thursday, and the stock hasn’t really moved. Yet I have some pain points with the report, which I want to address in this article.

Full-year

Stemmer has reported full-year results in line with its revised outlook of 144-151 million euros, down significantly from the initial FY 2023 guidance issued after FY 22 of 163-176 million euros in revenues. At the same time, EBITDA guidance of 26-32 million hasn’t changed and was achieved with 27 million. This shows Stemmer's outperformance on its margins, while a deteriorating market environment has hit revenue growth and turned FY 23 into a 5% revenue decline. Cash flows have been strong and Stemmer announced a 2.7 euro dividend. Stemmer ended the year with a healthy net cash position of 36 million, compared to around 200 million in market cap.

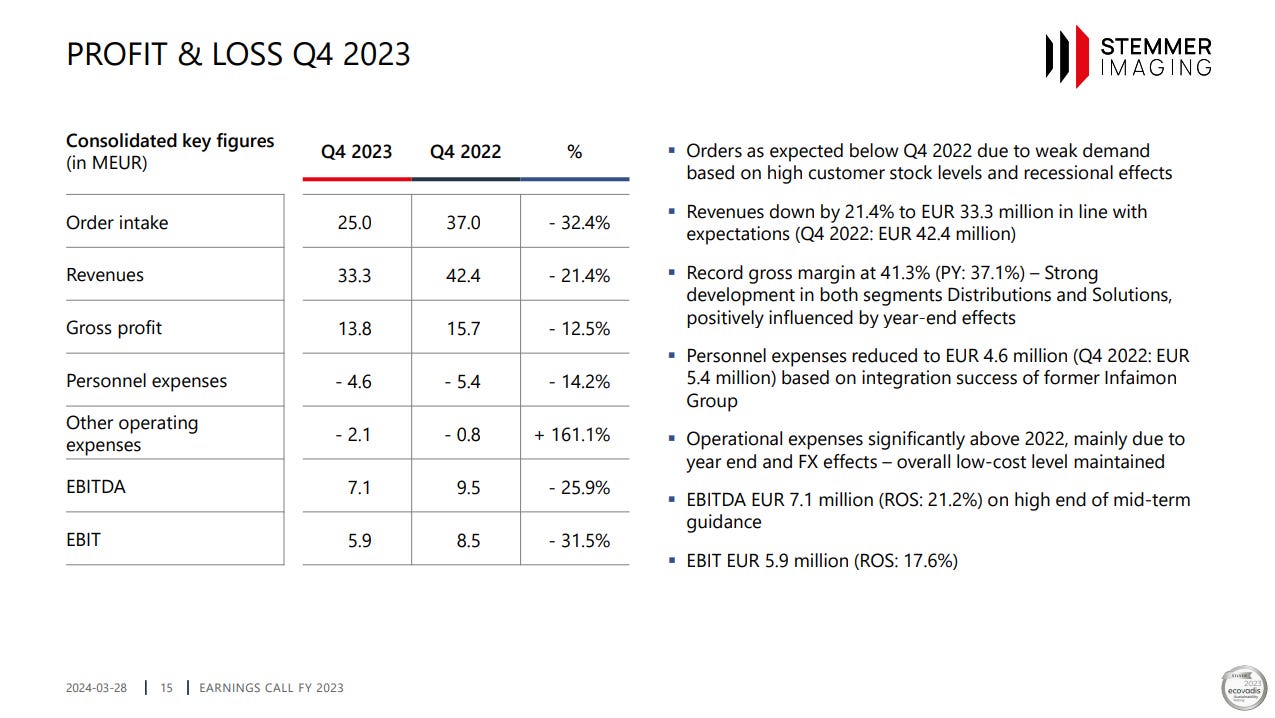

Q4 results

Q4 was weak, as expected, with a 21% revenue decline and a 32% order intake decline. Profits have held up nicely, but profitability was below last year's 21.2% EBITDA for the quarter. Gross margin, however, climbed to a record high of 41.3% due to positive year-end effects.

Stemmer also announced its entry into the North American market by acquiring Phase 1 Technologies, a 38-year-old machine vision specialty distributor with a high overlap of suppliers and a presence in industrial and innovative artificial vision end markets. The deal is expected to close in Q2, but until then, we won’t get details. Stemmer expects to expand its portfolio with new products and services, which it can also try in the European markets.

That said, let’s dive into my worries from this report.

My first reaction to reading the full-year results was pretty adverse, but the more I reflected on them and listened to the earnings call, the more I started to like them. My concerns were regarding the slowing order book and the capital allocation.

Order book

The full-year order book came in at 130 million euros, which is 20% below 162.4 for FY 22. We’ve seen a strong decline in the second half of 2023. While H1 already saw the order book decline by 14.2%, it got progressively worse, with Q4 now declining 32.4% to 25 million. Management, however, indicated this already last quarter and is expecting a turnaround in the demand in H2 24. Q1 is already seeing a more optimistic order intake. Especially big customers seem to have better momentum, while small buyers delay purchases more. As a result of the sluggish order book, Stemmer widened the range of outcomes for the 2024 guidance. Last quarter, they expected upper single digit % revenue growth but have now added a range from -4% to +7.5% due to the low visibility. A strong reacceleration over the summer could happen, but it is uncertain. I like the cautious approach from management much more than many companies' overly optimistic approach. Underpromise and overdeliver.

The mid-term guidance of 240 million in revenue in 2026 remains intact if 2024 is the optimistic side of the guidance range. Profitability should stay at these high levels, however. Further inorganic expansion will be a key contributor to this goal.

Capital Allocation

Stemmer announced two things regarding its capital allocation:

an increase of the regular dividend from 1 euro to 2.7 euros (last year, they paid a 2 euro special dividend on top to arrive at 3 euros)

the acquisition of Phase 1 Technologies

I am not a big fan of dividends, so I wasn’t excited to see such a large dividend payment. However, I knew Stemmer likes high dividends, partially influenced by its large majority shareholders, Pulseprime (69% ownership). The dividend policy pays out 70% of net income + whatever sum they don’t need for operations. The balance sheet shows they have a 36 million net cash position. At 2.7 euros per share and 6.5 million shares, they will pay out 17.55 million euros. The acquisition will cost mid-high single-digit millions, so after subtracting both, we still have around 12 million of net cash on the balance sheet and didn’t account for free cash flows coming in. However, I dislike seeing dividends larger than the owner earnings of 16 million for the last year.

The acquisition of Phase 1 Technologies sounds well thought out, unsurprisingly, after the company reiterated its M&A process over the last calls and that they are waiting for the right pitch at the right price. Stemmer has long wanted to expand into the USA based on a few reasons:

higher expected growth rate due to the reshoring (Build America, Buy America Act) and general incentives to improve local manufacturing

generally poor existing quality in the marketplace

existing European customers requesting local support for the NA operations

This makes the US an attractive and low-risk market in which to enter. By leveraging its existing customer base, it won’t be stuck without contracts in the US. Furthermore, they can leverage their proven and improving system to gain market share. Generally, Stemmer aims to achieve 20 million euros in sales in each of its regions over time. With just around 7 million in sales from Phase 1 and the tremendous opportunity, Stemmer will use the company as a buy & build platform and is optimistic to get more M&A deals soon while everybody is pessimistic.

However, given their strategy of continuing to invest in a new market, I don’t understand why they pay such a large dividend. With the 2024 guidance, it seems unlikely that owner earnings will far surpass the 16 million generated in 2023, thus not covering the dividend. Still, they won’t have to deplete cash reserves by much if they decide to keep the dividend at this level. With around 27 million in EBITDA, the company could very comfortably lever up if they find an outstanding bigger deal. Given the low-risk business model with strong profitability, I’d be okay with seeing them leverage up to 1.5 times. This would allow for around 50 million additional funding besides the ~35 million in cash on the balance sheet—enough firepower for several deals in their target range. I’d, however, hate to see a deal with share dilution, at least at these cheap levels.

Valuation

To value Stemmer, I updated my inverse DCF model. We can see that Stemmer has positive NWC effects right now, so owner earnings are below FCF. The stock is priced for high-single-digit growth to arrive at a 15% return. Stemmer is cheap, but they need to show that they can deliver growth again. The market should turn, and once that happens, growth must return. The expansion into the US makes a lot of sense and doesn’t look to be too risky due to the reasons discussed above. A few years out, I’d love to see them pay out dividends with their owner earnings again. If they start to hinder operations by large dividend payments then I’d consider selling. The risk is there with a large majority shareholder, however, I do not see it as a high likelihood. I continue to look at Stemmer favorably as a good risk and reward investment.