Stemmer Imaging is getting acquired. I sold my shares.

Reviewing the MiddleGround Capital deal

Today, one of my portfolio holdings and my first published Deep Dive, Stemmer Imaging, announced that it accepted a voluntary public takeover offer from the American private equity fund MiddleGround Capital at 48 € per share. This represents a 52% premium to the last trading price. MiddleGround Capital already bought 69.4% of shares from the main shareholder, PRIMEPULSE, and secured 8.3% from insiders who will tender the offer once it goes through. The offer will go through due to the majority of shares already accepting the deal and is expected to be finalized in Q4 2024 after regulatory approvals.

This is the first time that one of my companies has been acquired. Following the announcement, shares traded up to the 48€ price and were even slightly higher (48.3€ as I write this). I could not find a Go-shop provision in the deal, so I don’t see why somebody would pay more than the bid. A Go-Shop provision is often part of a takeover and allows the acquired company to get offers from other companies to outbid the offer for a certain period.

I am unsure if I should be happy with this deal because Stemmer Imaging has a promising future. Ironically, Stemmer Imaging wanted to expand into the USA, which they did with a small acquisition last quarter and is now taken over by an American firm. Let’s rerun my models and see if Stemmer got a fair offer for its shareholders.

Valuing Stemmer Imaging

I first bought Stemmer Imaging in December 2023 and a few more times through February 2024. Together with its 8% dividend, I got a 63% total return and an IRR of 160%. While this is a spectacular return that I must be happy with, let’s do an inverse DCF and IRR valuation.

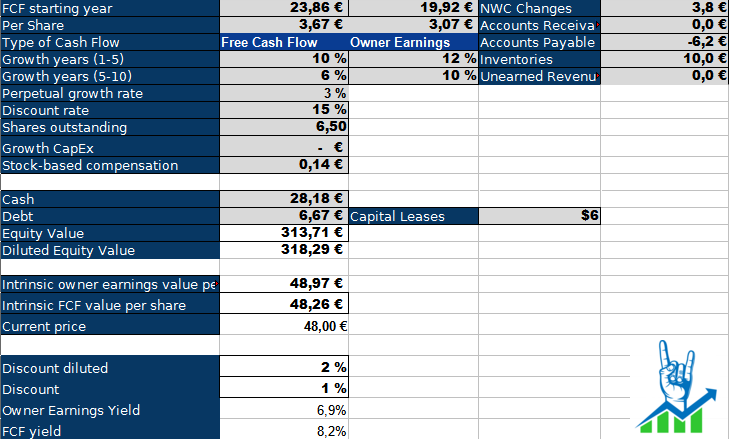

Owner Earnings are below FCF due to positive working capital effects, which I adjusted. I subtracted the dividend payment of 17.55 million euros from the cash position. We can see that Stemmer is priced to grow owner earnings by low double digits to achieve a 15% return. While this is no easy feat, I believe that the company could achieve this based on the expected demand recovery in H2 and beyond. The machine vision industry is expected to grow around 10%, so Stemmer could just go with the flow and achieve these targets. I don’t see much operating leverage in the short term because Stemmer has significantly increased margins over recent years. However, the long-term guidance of 21% EBITDA margins indicates another 20% operating leverage from the current 17%.

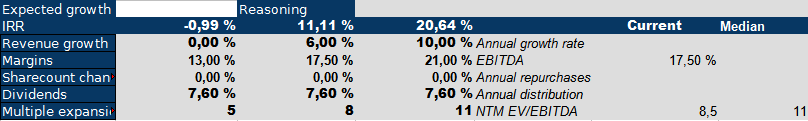

I used a five-year time horizon in my IRR model compared to ten years in my inverse DCF. In the bear case, I expect no revenue growth, a declining margin and multiple compression. Even despite these very bearish assumptions, Stemmer would roughly break even. In a normal scenario with 6% growth, steady margins and multiples, we’d achieve an 11% return. Suppose all goes well and Stemmer achieves its 10% growth rate, raises margins to the upper range of its long-term guidance, and the multiple rerates around its historical median multiple of 13 (I used 11 in the model). In that case, we get a 20% IRR from the takeover bid.

Conclusion

Ultimately, it doesn’t matter if I like the deal or not; it’s done, and I got cashed out of my holding. I believe Stemmer would continue to produce a nice IRR from the takeover price, but I am also happy with the 160% IRR I made since purchasing last December. It also is good to have some validation on my European buying spree. While many of my European buys haven’t kept up with the overall market rally in the US, this shows that there is tremendous value in European small caps waiting to be released. Over the coming days, I’ll reinvest the proceeds from Stemmer and update you on my next portfolio update.

Ready for More?

Unlock more investment ideas like Stemmer Imaging by becoming a paying subscriber. Don't miss out on the opportunity!

Subscribe now and get 15% off your first year using the code below:

Great call! Many small caps will follow... Also depends on the ownership structure and who's in charge: not all majority shareholders are willing to pay a huge premium, just look at Tessenderlo Group. It's been dead money for multiple years.

Well done!