Tariffs! Winners, Losers and how I'm dealing with the issue

I hate macro and don't like to talk about it, but we have to at this point

I don't like talking about macro but let's talk about tariffs. Let's start with a short introduction about why tariffs might make sense and why not.

While I don't think tariffs are here to stay, as Americans will feel the pain, especially low income population, I feel that it will trigger second level effects. US citizens are already protesting and we’ll see if their voices will be heard.

I am nowhere near an expert on tariffs and I believe that we will see a lot of back and forth. Nothing we read right now can be taken with certainty and it’s all guessing, BUT we can think about potential consequences and how we could protect our portfolio or even set it up in a position of strength to benefit from tariffs. I’ve been talking about strengthening the quality of our portfolios for months, as we always should. Hope for the best, be prepared for the worst.

Countries, organizations and companies will now start to rethink their strategic reliance on the US. National security and resilience of supply chains could be impacted by arbitrariness of US policy makers. What used to be a reliable trade partner might be seen as a liability.

This can lead to the promotion of localized investment into alternative technologies and manufacturing. Even once these tariffs are gone things will already be in motion. I believe that now it's more important than ever to have companies with strong competitive advantages that aren't easily replaceable.

Tariffs, Macro, and the Long-Term Investment Implications

Why Tariffs? A Quick Primer

Tariffs are a classic political tool—governments use them to protect domestic industries, punish trade partners or gain leverage in negotiations. In theory, they can drive local job growth and reduce reliance on foreign supply chains. In practice, however, they tend to raise costs for businesses and consumers, disrupt global trade relationships and introduce unintended economic distortions.

The latest US tariff moves follow a broader trend of economic nationalism. While they might not be permanent, the impact they trigger could last much longer.

The Real Consequences: Second-Order Effects Matter More

Even if these tariffs don’t stay in place indefinitely, they send a clear message to companies, investors and policymakers worldwide: the rules of global trade are more uncertain than ever. Companies struggle to plan for the next 5-years, 1 year, 1 quarter or even day right now. Trump wants to bring manufacturing back to the US, he said America can build iPhones too…well they can, but it will cost $3,000+ for consumers. Large investments need certainty and right now nobody can plan and trust what the US administration says.

1. Rethinking Global Trade & Supply Chains

When the U.S. imposes tariffs unpredictably, countries and businesses have to prepare for future disruptions. The result?

Nations will push harder for self-sufficiency in key industries.

Companies may diversify supply chains, reducing reliance on the U.S.

Global investment will shift toward regional resilience over cost efficiency.

This could lead to a surge in localized manufacturing, new trade alliances and unexpected winners in global markets. In many industries like the semiconductor industry such a motion is already in place. Following the Covid disruption many countries offered incentives to bring chip plants to their region. Other industries will follow.

2. The Cost to Consumers & Businesses

Tariffs act as an invisible tax, increasing prices for companies and end consumers. In the US, this disproportionately hurts lower-income households, as they spend a larger share of their income on goods impacted by tariffs.

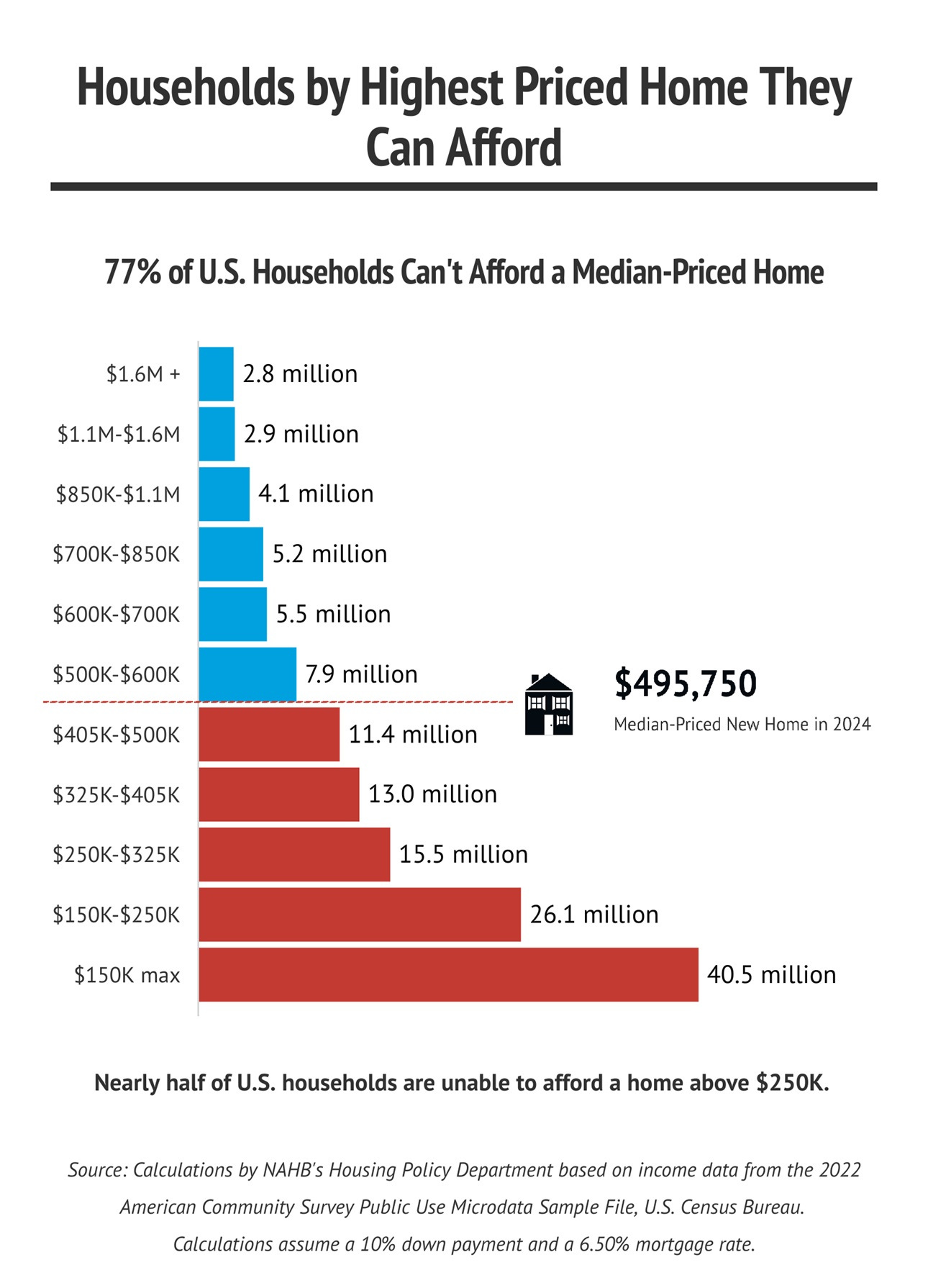

The US is already in a full blown cost of living crisis for the lower-income households. Housing affordability is a particular issue and the dream of owning a home is becoming distant for over half of Americans. This issue will intensify, because most basic materials needed for housing construction are imports and will increase sharply. Housing will get even less affordable under tariffs.

For businesses, higher costs may lead to:

Margin compression for companies unable to pass costs to consumers.

More aggressive automation and cost-cutting efforts.

Potential shifts in capital allocation toward tariff-proof industries (M&A brokers/banks might benefit).

What This Means for Investors

Here’s the key question: Which businesses can weather this kind of uncertainty?

Some industries will be hit hard—especially those with global supply chains or commodity-driven cost structures. But others, particularly companies with deep moats and non-replicable competitive advantages, will be more resilient.

I believe that my portfolio is well protected against the worst of it with resilient companies, enjoying recurring or reocurring revenue models and with large moats.

🚀 Want to Go Deeper? The Paid Section Covers:

What Types of Competitive Advantages Are Most Protected? – A breakdown of the business models that can withstand tariff-induced uncertainty.

Which Industries Stand to Benefit? – How localized investment trends could create new winners, amplify strong moats and crush weak companies.

How I’m Positioning My Portfolio – Rating the disruption potential for all my companies and where I see the best opportunities.

I recently made my deep dive into Ashtead Group free—so you can see exactly what to expect: Business model deep dive - Fundamentals and Valuation deep dive

Join Heavy Moat Investments today to access the full deep dive.