Texas Instruments TXN 0.00%↑ has been a success story over the last two decades, compounding at 13%, outperforming the S&P 500 but below the semiconductor index. We can see that TI has shown remarkable resilience in the past five years. Through Covid and the bear market in 2022, Texas Instruments had a trough decline of around 25% compared to 45% for the SOXX. The stock has been relatively flat for the last few years as the sector entered a downturn. In the last weeks, TI has finally moved to new highs as investors are more optimistic about the bottom of the semi-cycle. Let’s discuss the big picture for Texas Instruments and look at the valuation.

You can read the first part of the analysis here.

The semi cycle

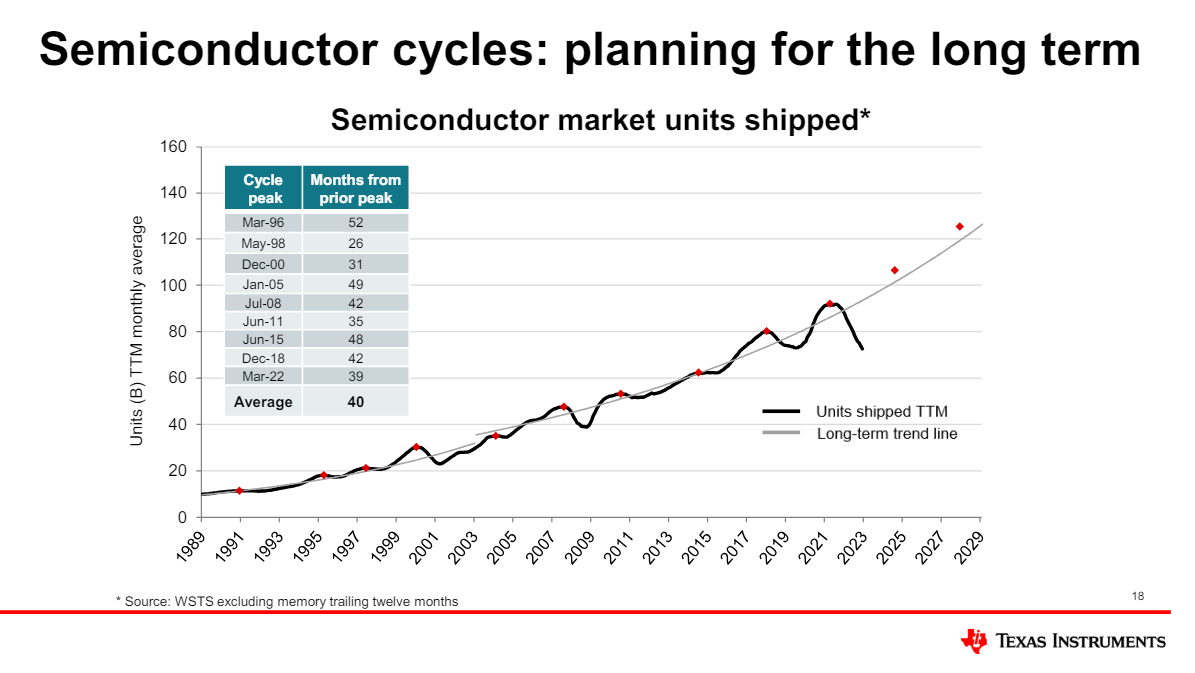

Let’s briefly talk about the semi-cycle. As you hopefully know, the semiconductor industry is quite cyclical, meaning its demand fluctuates with the economy. We can see that while it is short term very volatile, over the past 40 years it has a long-term secular trend for increased chip shipments and that each new cylical peak is higher than the last one. The expectation is for 2024 to see a 13% growth in the market again, with single-digit growth rates for analog semis. In cyclical markets like this, the most important thing is to survive and deploy capital effectively.