The beauty of compounding: The life cycle of an investor

How to approach retirement saving from an investment and income perspective

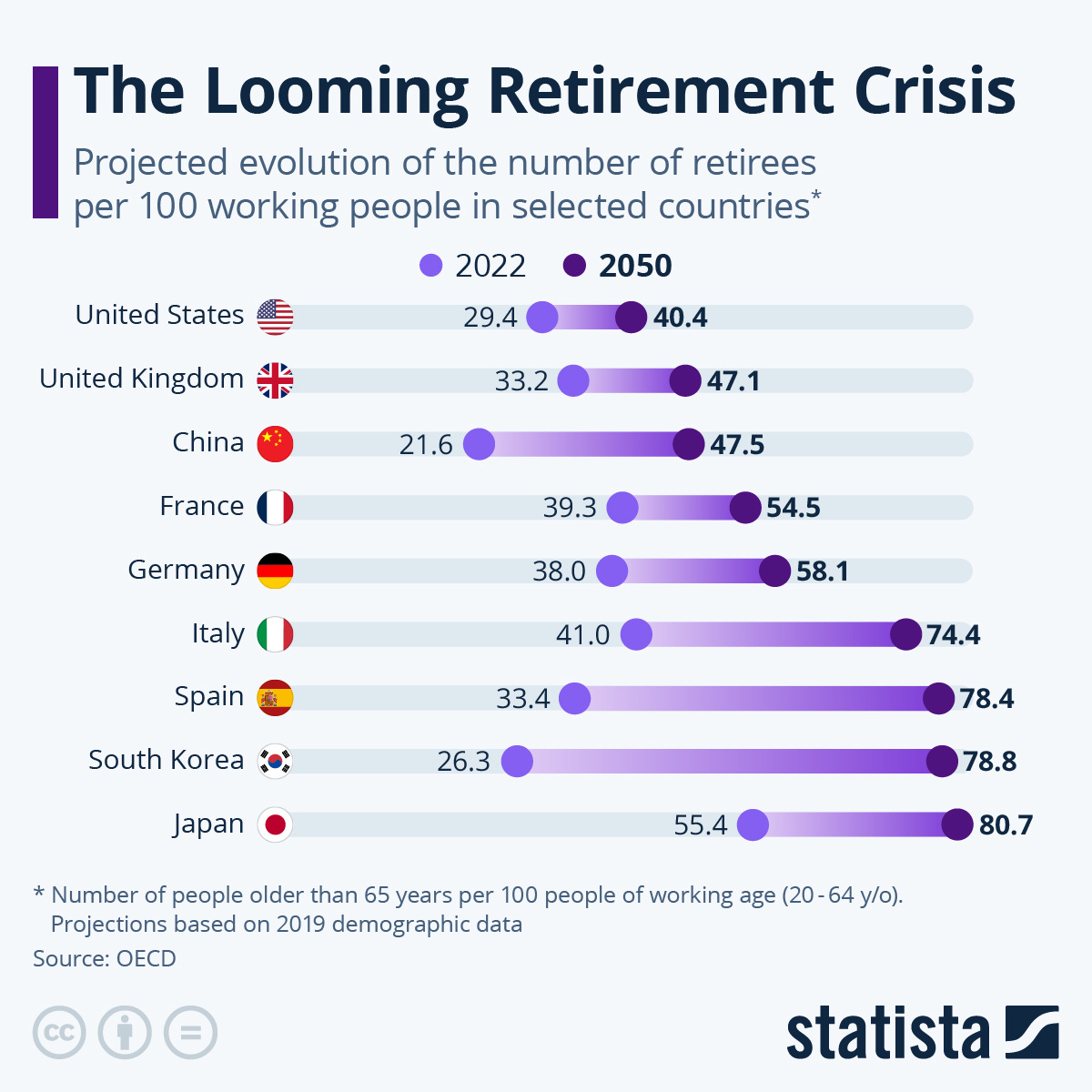

We are amidst a retirement crisis! I’m sure this is nothing new for you, as a reader of financial blogs and (most likely) private investor you are aware that we can’t rely on our pension (if we have any) to enable us to preserve our standard of living upon retirement. Below is a graphic from Statista with the projected percentage of people required to work after retirement. For me, particularly Germany is interesting as a German citizen, but we can see the same trend across countries. We must look out for ourselves and preferably start soon. The following concepts are not ground breaking and most of you will find them intuitive or familiar. However, it’s good to think about them from time to time.

Contribution ratio and the beauty of compounding

Thinking about this article my mind came across a concept I remember from a post by Rene Sellmann a while ago: (I think he called it) the contribution ratio, which describes the incrementally invested capital into the portfolio versus the capital gains within the portfolio. The concept is a good way to think about the different stages of a personal retirement strategy.

Below is a simple example of a financial long-term plan. Let’s assume we start with $0 in savings in year 0. We are fresh out of college, found a career that did not force us to take on student debts and now enter the workforce. We start off with strong income and are able to invest $15,000 every year and we increase our savings by $500 annually as we climb the corporate ladder or switch jobs. Further we assume 7% annual returns from our investments as an average. Money compounds and over 30 years of consistent contributions and average returns we arrive at an investment portfolio of over $1.5 million.

By the way, I’m running a free trial through all of May. Check out the button below to access all my premium content, no strings attached.

On year 11 we see that added money and capital gains cross. This is where compounding really takes effect. A similar story can be seen on the contribution ratio and the contribution yield (contribution/total capital): As our capital base grows investment returns start to become more important, despite a rising contribution!

What can we learn from this? In your first could of years as an investor, investing really shouldn’t be your priority. While we can learn investing and study the process in these first years, the capital gains won’t matter in the end. The difference between a 7% return on a $10,000 investment and a 15% return won’t change anything in 30 years.

Instead we should focus most of our time on learning a craft, finding a side hustle and generally live below our means in order to build that capital base to start the compounding process. Compounding is wonderful, but it requires capital to get going.

I don’t want to discourage you from investing and researching early, but it shouldn’t be the largest focus early on. By year 11 in our model, when added money and capital gains cross, the portfolio is at $250,000. Growth is exponential and I’d say the first $50,000 I wouldn’t focus much on generating returns, but rather on generating income. Consider buying an index instead of stocks (or put just small amounts of money into individual stocks to learn investing better).

The stages of an investment life

I’d very briefly categorize an investment life into three stages:

Income stage: build up a good income stream and save your first capital, ideally your first $100k.

Capital gains stage: focus more on returns on your capital. You want to retain the money in the portfolio and let compounding do its thing to grow the balance over time.

Capital return stage: As we approach retirement, we should put (even) more emphasis on reducing our risk and returning capital back to us to live off. We can either do this via dividend paying stocks or selling shares, it doesn’t matter at the end of the day in most cases and is up to personal preference.

My journey

I started investing in 2020, around 5 years ago. Since January 2022, I’m investing with my Heavy Moat Investments philosophy and have outperformed all of my benchmarks. As a result, I’m further ahead on my journey to a stress free retirement than initially anticipated.

We can see that I’m already 13% towards my 20 year goal. BUT a massive driver of this outperformance has been my high contributions, which were 3 times high than what I initially estimated. As time goes on these contributions start to matter less and we can focus more of our energy on generating higher returns (and lower risk) for our portfolio.

Most importantly

While investing is an important task we should all take seriously, we shouldn’t let it consume us. It is tempting to focus most of our time as young adults on earning more money, but we’re only young once and we should spend time AND money on enjoying ourselves and our loved ones. The right balance is important and that is a very subjective question we can only answer ourselves. Through the nature of compounding, discipline and endurance we can build a large net worth in order to sustain ourselves and others during old age, but we also should ask ourselves how much do we really need? This post is not a comprehensive guide of course and just some food for thought. A retirement plan should first map out how much we expect to need in old age, accounting for taxes, investment fees, inflation and what standard of living we want. I can recommend this post that describes some of these factors.