There Are No Points For Creativity! The Power of Shameless Cloning

How I Use Shameless Cloning to Find Great Investments—And an Idea I'm Researching Now

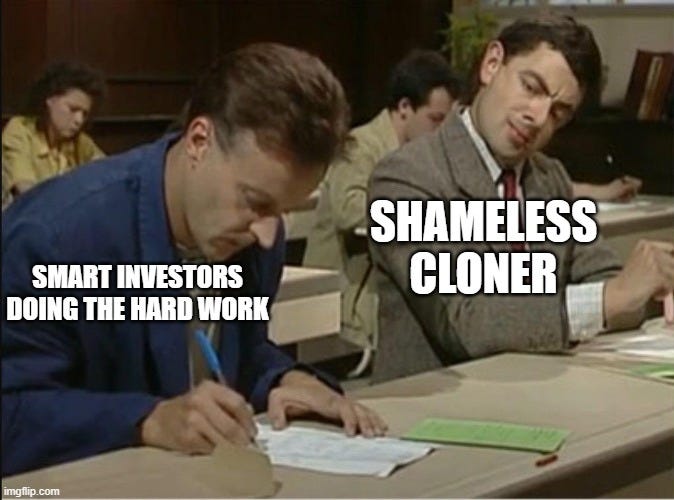

Investing is often portrayed as a game of genius where the best investors uncover hidden gems before anyone else. But the truth? Many of the world’s smartest investors don’t start from scratch—they find inspiration in the work of others.

This is the philosophy of shameless cloning, a term popularized by legendary investor Mohnish Pabrai. It’s the idea that instead of reinventing the wheel, we should study the portfolios, writings and insights of the best investors—and use that as a starting point for our own research.

Why Cloning Works

The stock market is full of noise, and filtering through thousands of companies is overwhelming. Cloning helps us focus on high-probability opportunities—because the best investors have already done the heavy lifting with hundreds of research hours. By following them, we can shortcut the idea-generation process and focus on what really matters—evaluating whether the idea fits our portfolio and risk profile.

Here’s why shameless cloning is an edge, not a shortcut:

1. Great Investors Are Already Filtering for Quality - If a high-quality investor is making a concentrated bet on a company, it’s worth paying attention without blindly following them. It’s important to understand the investment style of those we follow to see if it aligns with our own philosophy.

2. It Saves Time & Expands Your Circle of Competence - Instead of screening from scratch, we can start with ideas backed by conviction. This allows us to explore industries and businesses we might not have considered otherwise. In investing, we can be selective when we swing on an opportunity. I disregard 95% of stocks I hear about, but those remaining 5% tick my boxes and will get further researched.

3. Cloning Is Just the First Step: Do your own work – Once we find a compelling idea, we analyze the business deeply, ensuring we understand its moat, financials and risks before making a move. I like to rank a business with my quality score to understand it better. We need our own conviction if we are to own the company—in whatever way we’re comfortable with.

How to Clone the Right Way

✔ Follow high-quality investors – Not just anyone, but investors with long-term track records, deep research and a clear investment philosophy aligning with our own. However, be open-minded. You can find great leads in all sorts of places and people.

✔ Read their work, interviews, posts and letters – Understanding their thinking is often more valuable than just knowing what they own. How do they approach investing, which metrics and characteristics are important?

✔ Analyze the businesses – Even great investors make mistakes. We need to develop our own convictions before investing. As long-term investors, we must know what we own and when to act.

✔ Check if it ticks your boxes - I listen for things like recurring revenue, rational capital allocation, strong moats, secular trends and reinvestment runways. If an investment ticks my boxes, I dig deeper. Just a cheap price is not enough for me!

Want to See Which Idea I’m Cloning Right Now? 🔒

For premium subscribers, I’ll reveal an idea I’m currently researching, where I found it, why it caught my attention and why I believe that it could generate >30% IRR over the next five years, BUT with an elevated risk profile compared to my usual ideas.

You’ll get:

✔ How I found it, the investor I cloned it from and a link to their thesis

✔ My quick thoughts on the company’s fundamentals, risks and valuation

✔ An IRR model