I’ve recently been thinking a lot about Discount rates as I try to develop my investment process and increase my expected future returns while decreasing risk via owning exclusively high-quality businesses with a heavy moat.

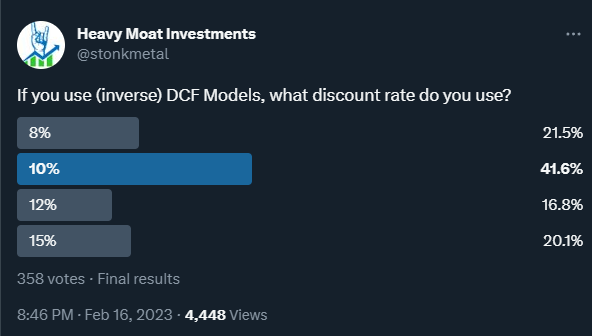

As a quick refresher: What is a discount rate? The most accurate way to (theoretically) value a stock is by doing a Discounted Cash Flow Analysis (DCF). This is done by assuming a future growth rate for the company's Free Cash Flows and then discounting it. There are models with widely varying levels of complexity, but they all have one thing in common: They use a discount rate, which is synonymous with the expected rate of return the investment should provide. I recently asked my Twitter audience which discount rate they use and the majority is using 10%. That is also what I use.

To give a bit more nuance, let’s look at my approach: Below you see an example of my Inverse DCF model I used in my recent article about Nemetschek NEM 0.00%↑, which I recently purchased. The difference between a normal and an inverse DCF is that an inverse DCF uses the current share price and calculates what growth rate the market assumes. I prefer this to traditional DCF models because it has fewer assumptions. It basically just views what the market expects.

I use a 10% discount and 3% perpetual growth rates. A what? A DCF goes on for a certain amount of years, in most cases (including mine) a 10-year timeframe. To model correctly, we need a growth rate “into eternity” at least in theory. Most people use something like the expected GDP of the country or something like this. I normally just use 3%. So discount and perpetual growth rates are really what we can change in our models.

The question arises if I should aim for higher than 10%, which should beat the market, but not by a large margin. Expecting higher returns should have a bigger margin of safety and a higher probability of a successful investment. The reason why I stick with 10% for now is that I try to mainly invest in high-quality businesses, often with predictable businesses, that I expect to compound for a long time. I hope that my 3% perpetual growth rate is conservative in many of these cases. The longer a company can maintain a higher growth rate, the more it can compound. The pictures from a post by my friend Leandro from Best Anchor Stocks illustrate this well.

The way I use my DCF models is to see if the assumed growth to achieve a 10% CAGR over a decade is reasonable. In the example of Nemetschek above, the 10-11% growth rate is in line with its projected industry growth rate. Because I expected Nemetschek to gain market share and do accretive M&A this looks like a good risk/reward to me. Base case I beat the market, bull case is much better.

To conclude this little ramble, I totally understand the arguments to use a 12 or 15% discount rate, but at least right now I am fine using 10% with reasonable assumptions. I plan to increase this discount rate as I develop as an investor and become more confident in my abilities. I hope this helped spark some thoughts for you and if it did please share how you use discount rates. Also share this post if you value in it.

But before you go, I’d like to offer you a discount on Seeking Alpha Premium, a service I use and contribute to daily. If you want to check out the service, with my affiliate link you can now save 58% for the first year!

nice take, thank you!