Time to sell? Breaking down my most expensive stocks

What should we do when our investment works out and stocks are now overvalued?

It’s the dream of every investor. You make a new investment and it just goes according to plan. Your thesis was right, the undervalued shares surge in price and your portfolio value climbs higher. But now a new question arises: Is the stock now overvalued?

Different approaches

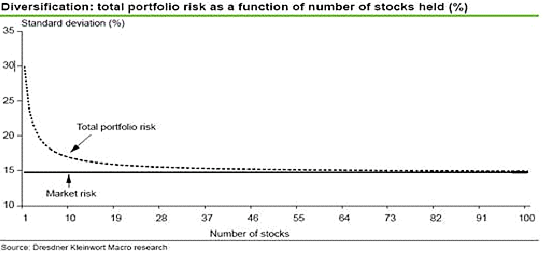

Portfolio construction is always something subjective. We know that adding more stocks increases our diversification, but only if these stocks are from different industries, countries and sizes. Otherwise, we benefit from the same industry trends and price movements. After 10 stocks, the added benefit from diversification starts to drop off fast and after 30 stocks you basically see very tiny incremental benefit.

I personally do not spend too much time on diversification. As a quality value investor you naturally end up with a diversified portfolio over time as different sectors become cheap and you’ll start positions. If you are now also country-agnostic (to an extent, I try to only invest in democracies with stability) then you get a good diversification without doing much extra work.

Then there are of course people looking to maximize risk by choosing a very concentrated portfolio of, say 5 stocks. That leaves you with a higher potential upside, but also a bigger risk of blowing up your account with just a handful of bad decisions. I prefer to focus on safety over higher returns.

When is something too expensive?

While long-term buy and hold is one of the most popular and promising strategies, I believe that buy, hold and check is a better strategy: We should periodically check the fundamentals and valuation of all our holdings and decide for ourselves:

Does the fundamental development match our expectations?

Are there (new) red flags?

How high is the IRR? Is it below our hurdle rate (12% for me)?

Did the quality of the business change (I use my quality score for this)?

IRR ranges and selling

Within my portfolio, I have an IRR range from 4.89% to 29.01% between my holdings. Of course, the question arises: Why not just focus on the 10 highest IRR ideas?

I generally tolerate IRRs falling below my hurdle rates as a result of companies outperforming and share prices rising, but even that has its limits. As IRRs fall below 7% I start to consider trimming. Too frequent trading is not good because of taxes, so if I trim a position, then I want to account for taxes. A new idea must be at least 25% better than an old idea to justify the tax hit, i.e., 6*1.25 = 7.5% IRR required for a new idea. I do aim for much higher however. Usually a new position must have at least an 12-15% IRR.

Before selling, I look at a few things:

Is the company known to outperform expectations?

Are my assumptions too conservative? Is that why the IRR is so low?

Could the company realistically grow much faster or increase margins a lot?

Is the position large enough to matter?

Unlock the rest and learn about my thought process

In the next part I’ll reveal:

The most expensive stocks of my portfolio

Go through their valuation and if I see further upside.

Decide if I want to trim or sell a position.

Talk about potential reinvestment opportunities I see right now

Through the month of May I’m running a free trial. I want to convince you of the value my service provides, so give it a try. Just click the button below or use this link. No strings attached and you can cancel within the 7 days if you don’t like it. I hope to see you around.