Verra Mobility has gone through many hands over the last 20 years. In 2017, as American Traffic Solutions, the company was acquired by Platinum Equity, a private equity company. Verra Mobility was taken public via SPAC by combining with Gores Holdings shortly after. Many readers will now see a red flag already. SPACs have a terrible reputation after the billions of dollars burned over the last few years, with unprofitable moonshot bets taken public via the SPAC model. However, I guarantee you that Verra Mobility is a high-quality business, so stay tuned. Since then, Verra has acquired several companies to broaden its portfolio of mobility solutions. The company also fully paid out all earnout shares and exercised all warrants from the SPAC IPO.

The business model

Verra aims to shape the future of mobility by assisting the ongoing transformation of rental car and fleet operators, government solutions, parking solutions and international expansion. Verra currently generates 91% of its revenue in North America, 5% in APAC and 4% in Europe. There is a lot of runway for international expansion, and NA represents the current business.

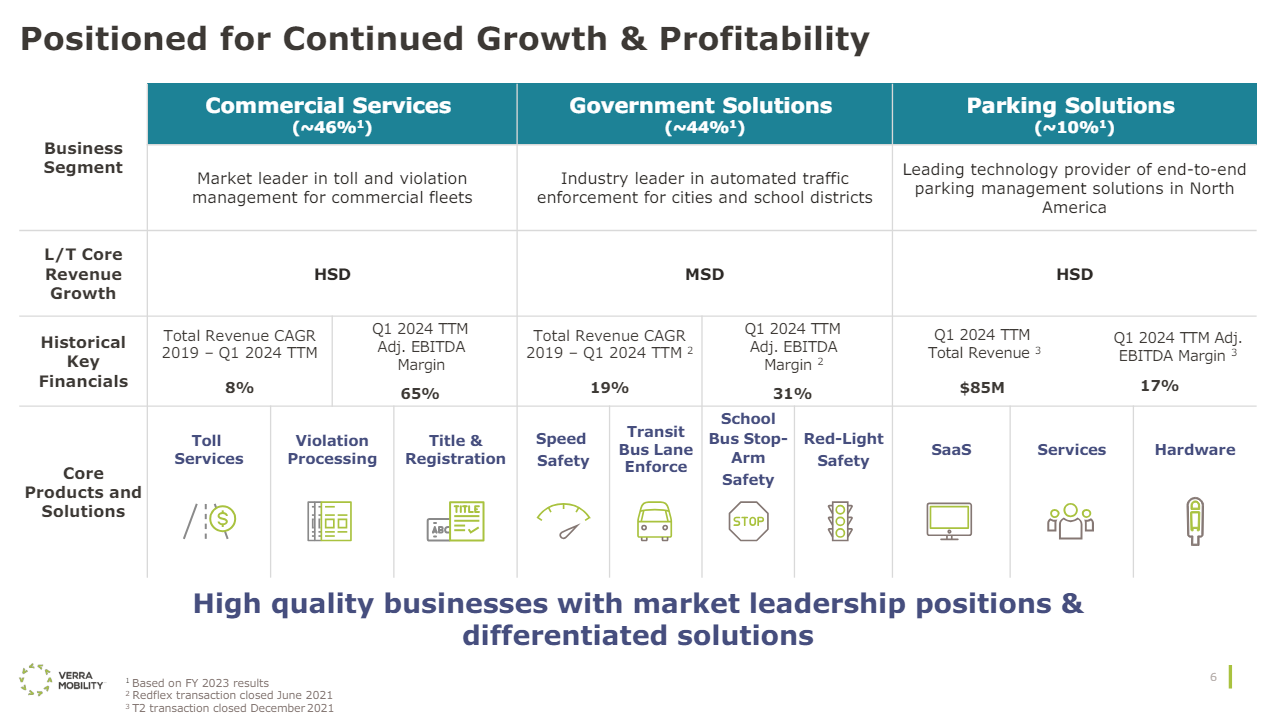

Verra has three business segments. Commercial services are value-added services for commercial fleets like rental car companies. Verra has software solutions that automatically handle toll payments, traffic violations and registration of new vehicles. These services are no-brainers for rental companies as they free up hundreds of hours of organizational tasks that don’t add any value to the organization. Commercial services account for 46% of revenue and generate the highest margin by far at 65% adjusted EBITDA.

Government solutions include different software and hardware solutions to enforce traffic rules. An example is red-light cameras that automatically report violations to the local authorities. This business accounts for 44% of revenues at a 36% AEBITDA margin.

The newest segment is parking solutions, where Verra provides software as a service and hardware solutions for parking in cities and universities. It’s the smallest segment, with 10% of sales and just a 17% AEBITDA margin.

These solutions are mission-critical and provide Verra with a large competitive advantage. Let’s discuss the moat in more detail.