Hello and welcome to the Heavy Moat Investments newsletter on Substack. Join over 7,000 smart investors who already receive my in-depth analysis of high-quality businesses, timeless investment philosophy and actionable ideas straight to their inboxes. Click the button below to subscribe today and elevate your investment journey!

Watsco has significantly outperformed the S&P 500 and other indices by a good margin over the last 3, 5, 10, 20 and 30 years. Especially after the pandemic, supply chain disruption started to fade. Watsco started to pull further ahead. Let’s dive into the fundamentals and see if the current 15% drawdown makes shares attractively valued.

Here’s the first part of the deep dive.

Growth

Watsco has been a growth machine ever since it pivoted from manufacturing to distributing HVAC equipment. Revenues compounded at 15% over the last 35 years, a track record not many companies can show. As the company scaled, EBIT grew by 18% through margin expansion. The key question now is what kind of growth rates we can expect from a much more mature company. Market share scaled from <1% to 15-18%. In a highly fragmented market that still leaves a lot of targets to consolidate, but it also shows that the lever is partially used up and it won’t be easy to double revenues just by doubling the market share. Let’s look at the industry and what kind of other drivers we can expect.

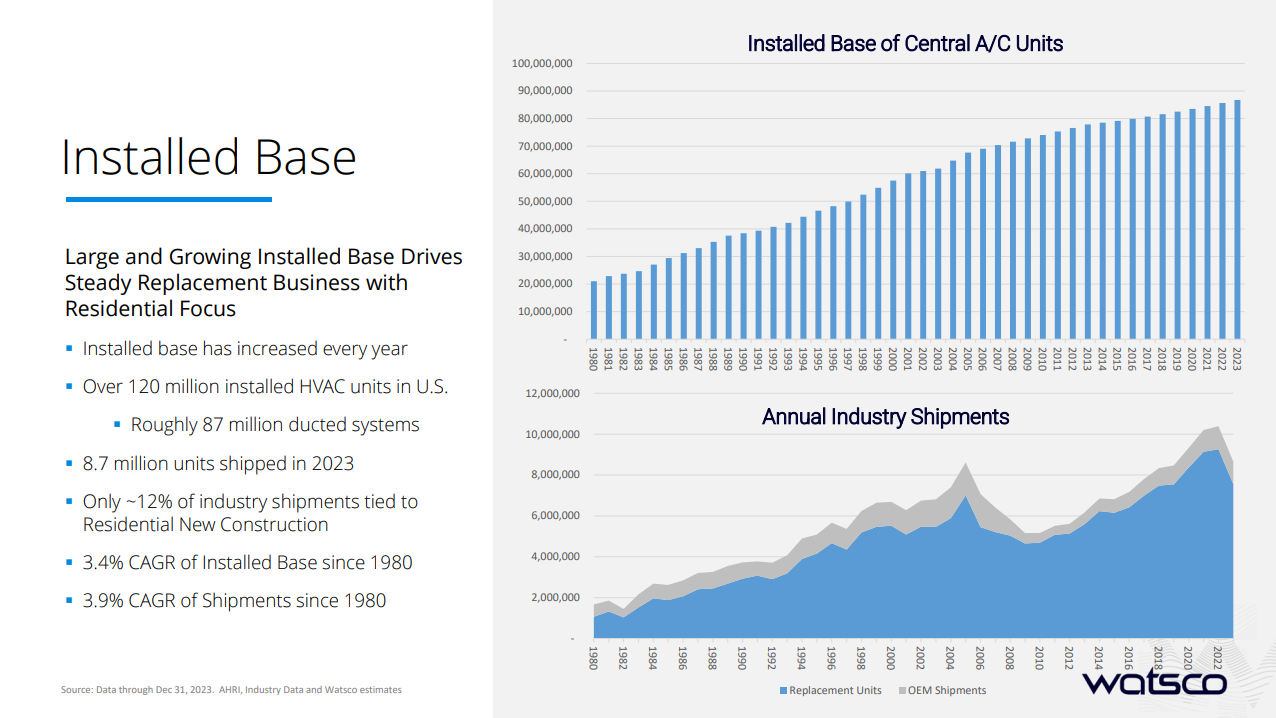

The US installed base has grown steadily at a 3.4% CAGR, and annual shipments at a 3.9% CAGR, but the latter is much more volatile and reliant on the housing cycle. We can also see that most shipments are maintenance-related, providing better predictability.

The US HVAC market is expected to grow by 5.6% through 2032 according to Fortune Business Insights and by 7.4% through 2030 according to Grand View Research due to global warming and extreme weather. This provides a strong tailwind for the sector as it grows units and pricing. Let’s examine why Watsco might manage to outgrow its industry.

Unlock the full analysis and much more

As a paying subscriber, you'll gain exclusive access to the rest of this article, where I dive deep into Carlisle’s reinvestment and valuation, plus all my premium insights on businesses, valuations, and investing strategies. Take advantage of this opportunity to elevate your investing game today!