Last week, I was on vacation at Wacken Open Air in northern Germany, and a lot happened while I was gone.

On Friday, waiting for the next band, I got some messages about the market crashing and decided to take a look. My portfolio was down 4% on Friday alone, and some companies were down significantly more. I brushed it aside and decided to continue enjoying the festival (partially aided by the terrible internet connection between 90,000 people). My portfolio dropped 8% in just two days from peak to trough and has since recovered again.

After returning home yesterday, I started to look for explanations for the market mayhem (which was much less fun than seeing the legendary, controversial band Mayhem live at Wacken). Here are some explanations that floated around online:

As always, US recession fears because of some economic data (nobody can predict a recession until we’re already in it)

Japan saw its largest crash in four decades after the central bank increased rates for the first time in a long time. Apparently, Japanese equities benefited a lot from the weak currency. I’m not interested in Japanese stocks and don’t own any, nor do I have exposure to large revenues in Japan. → It is not important for my portfolio.

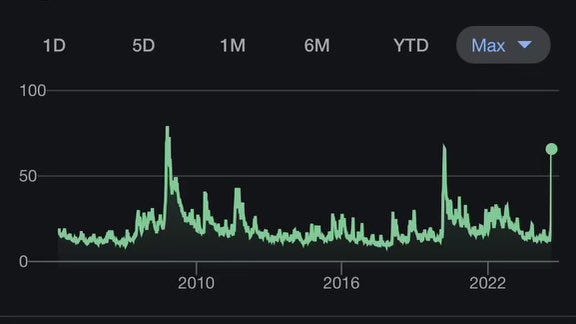

The VIX (volatility index) jumped to its highest values since the Covid crash and GFC. After months of very low volatility, this might have spooked some investors or traders with bad positioning and accelerated the declines. →not important long-term

Overall, I have not found any convincing issues that led to the declines. Some of my stocks declined over 10% intraday, and I made one small purchase yesterday. I updated my IRR valuation model for the whole portfolio, so let’s look at it and then talk about Atkore in particular.

Ready for More?

You can read all of my writing on businesses, valuations and investing by becoming a paying subscriber. Don't miss out on the opportunity!

Subscribe now and get 15% off your first year using the code below: