Valuing a company is a very important step of every due diligence process (or at least it should be). Like everything in investing, it is not a science but an art. Many different ways can work for different people.

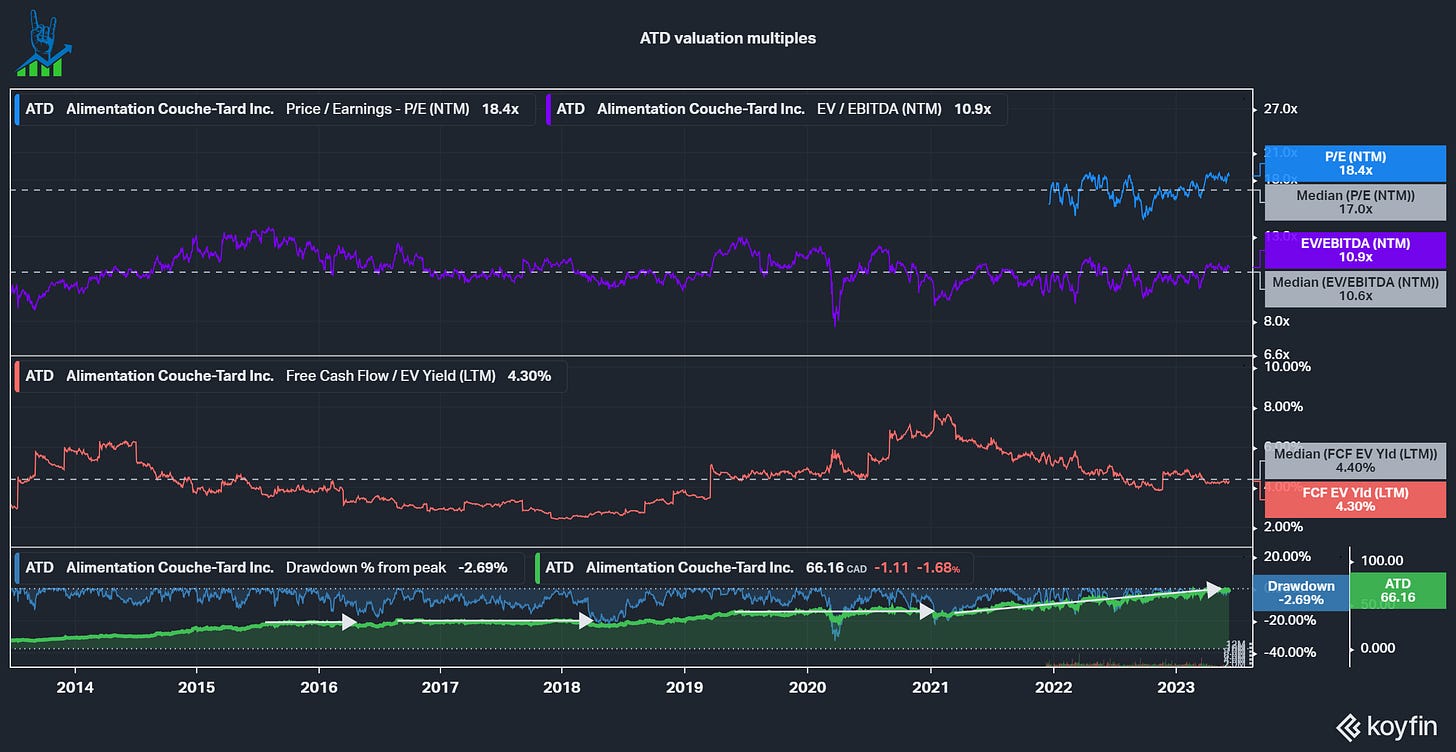

One of the most popular ways is using valuation multiples. I do not want to spend too much time here because I assume most people are aware of this practice. By taking the market cap or enterprise value (market cap +/- net debt) and dividing it by earnings, EBITDA, sales or another metric one can get a grasp of the valuation. Ideally one should compare it to historical levels to judge if the company is fairly valued. These multiples don’t take into account things like a change in a business model though, i.e. Adobe ADBE 0.00%↑ in the early 2010s switching from licenses to subscriptions.

A more accurate method: DCF

The most accurate way to value a company is by using a discounted Cashflow model or DCF. In a DCF one assumes a growth rate for a timeframe (most often 10 years), a discount rate and a terminal growth rate and plugs them into the model. Then the current cash flows are grown and discounted into the future to arrive at a fair value for the company. DCF models can get a lot more complex by using more assumptions for things like taxes, debt, share repurchases or other variables. While in theory DCF models are the best way to value a company, it has one major drawback: You have to assume the future performance. This makes DCF models hard to do and incredibly sensitive to the assumptions of the analyst. If you want you can justify ANY stock price with the right DCF assumptions. That is why I prefer to use an inverse DCF model.

Before I get to the next company, I’d like to offer you a discount on Seeking Alpha Premium, a service I use and contribute to daily. If you want to check out the service with my affiliate link, you can get a 14-day free trial!

Inverse DCF Models

An inverse DCF model removes the hard part of a DCF: The assumptions. The goal is to use the current Free Cash Flow, discount rate and perpetual growth rate to arrive at the growth rates of the market prices into the current stock price. I personally always use a 10% discount rate as my required rate of return and a 3% perpetual growth rate around the long-term GDP growth rate. The example below is using Ametek AME 0.00%↑ numbers. We can see that with the current free cash flows the company is required to grow by 13% for the next 5 years, followed by 5 years of 11% growth. Investors now can judge for themselves if they believe this to be a reasonable assumption.

Is an inverse DCF model perfect?

Of course this model isn’t perfect, but it is a good approximation in my opinion. A major drawback is that this model uses Free Cash Flow, which has a few downsides. I will address these downsides in an upcoming article about Owner Earnings and why I prefer to use them. Subscribe if you haven’t yet and stay tuned for that.

Hello! The inverse DCF which you show is made by you? I am interested in have it if it's possible. Thanks in advance.