Why are Chinese Stocks so cheap? Aren't they compelling at some point?

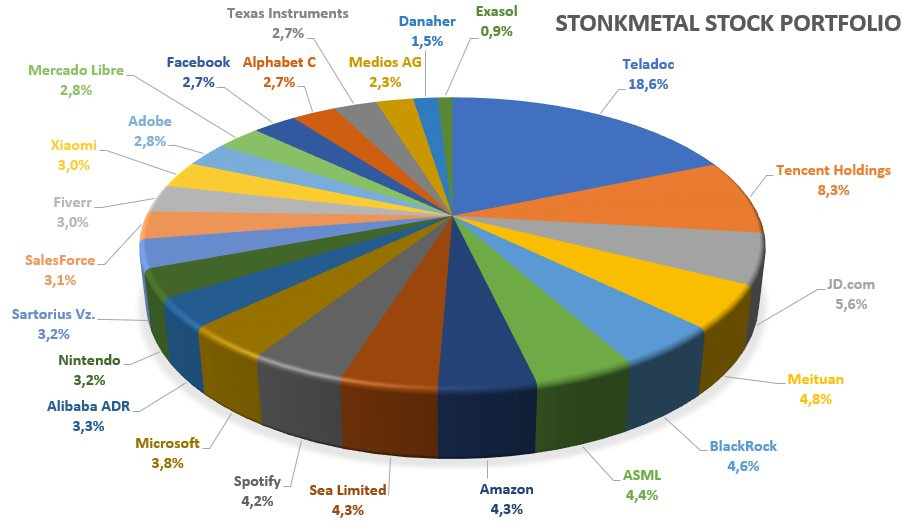

In recent weeks, I’ve seen people mention Chinese stocks repeatedly, as they do all the time, but something made me look twice again. I used to have a large part of my portfolio invested in China before I found my current investment strategy. Below is a picture of my portfolio at the end of 2021. Some names I still own, but the majority were not up to my quality standards, and I sold most of these. Back then, I held Tencent, JD.com, Meituan, Alibaba, and Xiaomi; let’s look at JD.com a bit closer.

We can see valuations have been on a secular decline over the last decade but have become very cheap over the previous years. JD now trades at a 27% FCF yield, a crazy valuation for a company expected to grow its earnings by over 10% for the next two years and to grow sales by single digits for a while.

The issue is the political situation. People don’t want to invest their money in a political system that could seize their assets anytime. I experienced this myself in 2021, a key reason I sold all my Chinese holdings: In September 2021, Tencent and Alibaba each committed 100 billion yuan ($15.5 billion) to Xi’s vision of common prosperity over the next years. This is a prime example why political systems matter in investing and why certain countries have different valuations.

By the way, I recently enhanced my paid subscription to this publication. I’ll now share exclusive European Small and Mid Caps content besides the existing content. For a limited time, you can get 20% off the first year if you’re interested.

But is there a point where Chinese equities could be a compelling and rational investment even under these circumstances?

While I personally do not want to invest in China again, from a value investing perspective, it would make sense under one condition: Dividends. The main reason we don’t want to invest in uncertain regions is whether we’ll ever see the cash flow (after all a stock’s price is the future value of cash flows and the distribution of those). Many Chinese companies sit on huge cash piles and started paying dividends, but prices kept crashing. JD and Alibaba pay a small dividend, which doesn’t change much. Taking the example of JD, this would change a lot if they’d commit to paying out more of their cash flow as a dividend. At this valuation, they could comfortably pay out a 20% dividend. This would undoubtedly elevate the stock meaningfully, as investors could now expect to get their initial invested capital paid out over a few years, a trade-off many would take. Without large dividends, I don’t see a reason to invest in China, as I personally see the risks as too high.

I hope you liked this hypothetical scenario, where an investment in China could make sense from a risk/reward perspective. Of course, the question remains if they COULD even do something like that or if the government would pressure them to stop. Anyway, it is a nice thought experiment.