About Heavy Moat Investments

Heavy Moat Investments is an independent investment newsletter focused on uncovering high-quality businesses with strong fundamentals, operating in attractive markets, and led by capable management teams with smart capital allocation.

I’m Niklas, a 26-year-old former software developer and private investor with a deep passion for researching great businesses. As a self-taught investor, I document my journey in identifying durable, high-performing companies while ensuring we don’t overpay for quality.

What You Can Expect

✔ Deep research into high-quality, global businesses, often in overlooked growth markets.

✔ Management & capital allocation analysis—understanding how leaders create long-term value.

✔ Concise, to-the-point writing—no unnecessary 5,000-word reports, just clear insights.

✔ A rational, cash flow-driven investing approach with a long-term focus.

✔ Ethical, high-quality investing—no hype, just strong fundamentals.

What You Won’t Find Here

❌ Short-term trades, speculative moonshots, or unprofitable turnaround bets.

❌ Price targets or investment advice—just research-driven insights on a 5-10-year investment horizon.

❌ Emotional reactions to short-term market noise.

Free sample post

I recently made my deep dive into Ashtead Group free—so you can see exactly what to expect: Business model deep dive - Fundamentals and Valuation deep dive

Why Listen to Me?

I don’t claim to be the best investor out there, but I’ve spent years publicly sharing my investment research on Twitter, Seeking Alpha, and Substack. Along the way, I’ve made mistakes (as all investors do), but more importantly, I’ve learned from them.

Since tracking my portfolio from January 4, 2022, it has delivered a +41.66% return, outperforming the S&P 500 (+33.36%) and Nasdaq 100 (+36.7%) as of February 16, 2025.

While past performance isn’t everything, it’s a strong sign that my strategy works. My deep research process and focus on rational investing have helped me deliver results, and I aim to continue this track record.

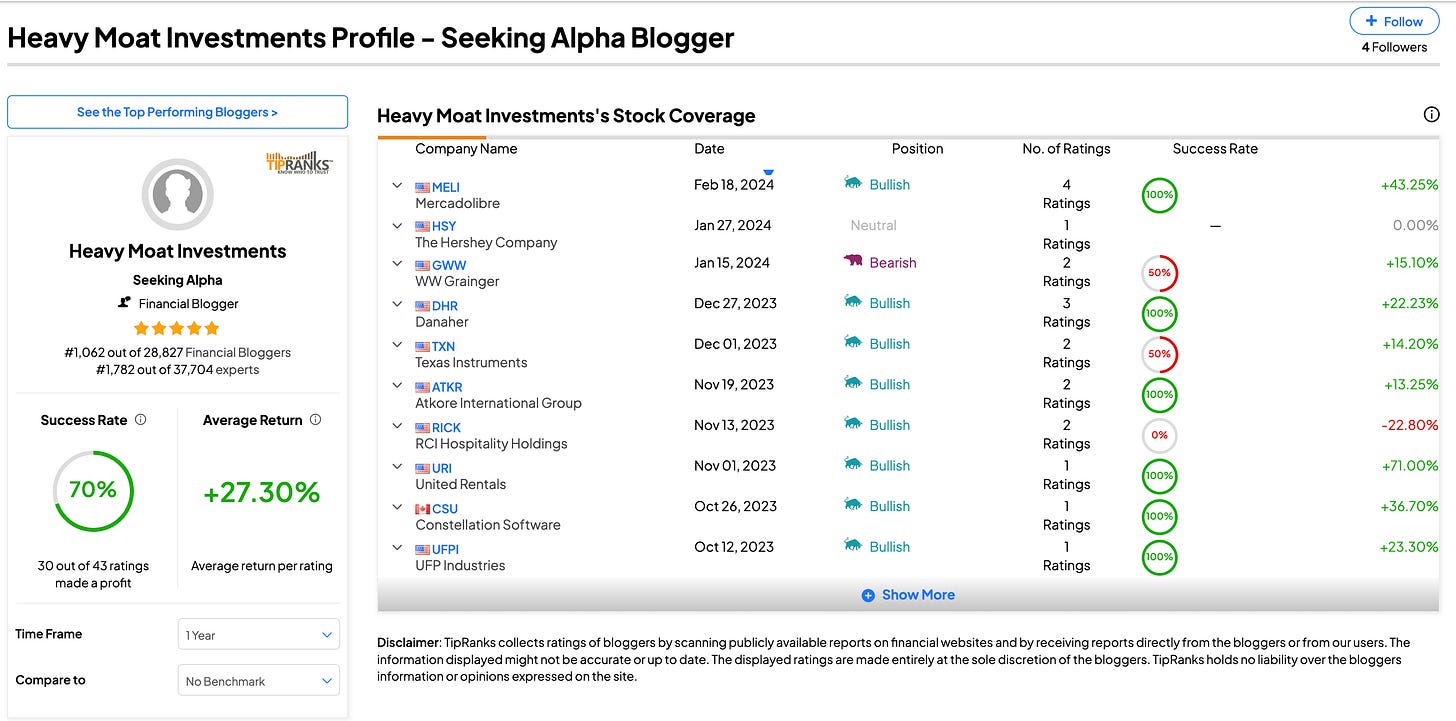

When I was actively writing for Seeking Alpha, TipRanks ranked me as a 5-star blogger, placing me #1,062 out of 28,827 financial bloggers (as of May 22, 2024).

If you value high-quality research and rational long-term investing, you’re in the right place. Welcome to Heavy Moat Investments!

Premium Offering

As a premium subscriber, you’ll get:

✔ Detailed Research on high-quality global compounders and European champions, with deep fundamental & valuation analysis.

✔ Actionable Investment Pitches – Ideas with high upside potential and limited downside.

✔ Earnings Breakdowns on key reports and market reactions.

✔ Real-Time Trade Alerts on all my portfolio moves, plus access to the premium chat.

✔ Exclusive Investing Tools, including my Inverse DCF template and more.

As a free subscriber, you get:

✔ Monthly portfolio updates.

✔ Occasional free posts about investment principals or individual stocks.

The subscription is affordable at $25 a month or $150 a year. I produce timeless content (most business models won’t be too different five years from now), and as the library grows, I expect to raise prices as the value of the offering increases (existing subscribers are grandfathered in their pricing).

Feedback from subscribers

Disclaimer: The content on this website is for informational and educational purposes only and should not be considered financial, investment, tax, or legal advice. I am not a certified financial advisor, and nothing presented here constitutes a recommendation to buy, sell, or hold any securities.

Any financial decisions you make are your own responsibility. You should conduct your own research and due diligence before making any investment decisions. I do not guarantee the accuracy, completeness, or reliability of any information presented, as financial data is sourced from third parties such as company reports, Koyfin, or Seeking Alpha, which may contain errors or updates.

I am not liable for any financial losses, damages, or actions taken based on the information provided on this website. By accessing and using this content, you acknowledge and agree to these terms.