Adyen ($ADYEY): Innovating and Dominating Global Payment Services

Rapid founder-led growth at a fair price

The story of Adyen started with Arnout Schuijff and Pieter van der Does at Bibit Global Payment Services in 1997. Two years later, in 2004, the Royal Bank of Scotland acquired the company, and the two Dutch entrepreneurs founded Adyen, which means to start again in Sranan Tongo. Adyen is a payment processing company that has developed a broad network of services and solutions for its customers on one holistic platform.

Acquirer business model

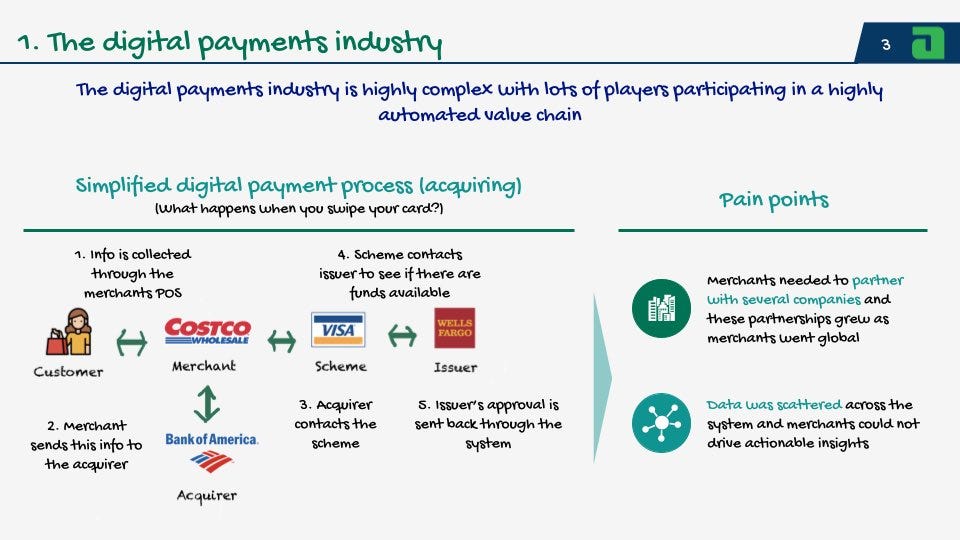

I’ll use a great graphic my friend Leandro from Best Anchor Stocks (highly recommended) to illustrate the general business model. Acquirers are crucial in the digital payments value chain to connect merchants with payment schemes and issuers. Acquirers do not have any risk here of owning customer funds but merely pass on the information and take a tiny fraction of the transaction costs (Adyen takes under 0.2% of the total payment). The card issuers, which handle the customer funds, take most of the risk and the highest part of the fees. Merchants need a reliable partner that works seamlessly, fast and has a large partner network to allow multiple payment methods.

This is Adyen's primary business model. Over the years, Adyen has added other services to its portfolio, such as point-of-sale devices, issuing and risk management. The last one is especially important because failing transactions are a major pain point for digital payments. Differentiating between fraudulent payments and real ones is crucial, and falsely flagging real payments as fraudulent and declining them has a substantial impact on merchant revenues. Adyen claims to have the best at these so-called authorization rates.

Offering PoS devices was a fantastic addition, too, because large international customers usually move from brick-and-mortar to online and not the other way around. Adyen can offer a full omnichannel solution, where it owns all the data and can enhance the payment experience for its customers.

Adyen operates in three segments:

Digital focuses on just online payments to provide performance and cost savings at scale for global customers with complex payment needs.

Unified commerce helps customers transform their retail operations into omnichannel offers using one unified platform and reducing complexity.

Platform offers an end-to-end payment solution for peer-to-peer marketplaces, on-demand services, crowdfunding platforms or any other platform business model.

Premium Offering

Consider subscribing to Heavy Moat Investments to get the full experience and improve your investment journey. As a premium subscriber, you get:

Investment research into global high-quality/compounder companies, primarily in the Small/Mid-cap range ($100 million to 20 billion), split into business model and fundamental & valuation analysis.

Earnings analysis on interested earnings reports (often after a strong reaction in the stock price or unexpected fundamental developments).

Notified about all my transactions on the same or next day and a premium chat.

My Inverse DCF template and other resources.