April flew by and here we are again with another portfolio update. In the month, I published analysis on Atkore and Texas Instruments alongside commentary on the steller Pluxee H1 results, Stemmer Imaging’s annual report and Adyen’s unjustified selloff. I didn’t publish a lot of free content last month. However, I encourage you to check out my post talking about corrections and how long-term investors should view them (the post didn’t get the attention it deserves, in my opinion). I’m also looking forward to collaborating more to bring more value to my subscribers and share other high-quality publications. Lastly, I also noticed that the chat function isn’t working as I intended, with some paid subscribers reaching out with the concern. You can find the chat here, and I’ll also make sure to start new threads instead of just posting inside an existing thread (that way, Substack sends push notifications).

The publication continued to see strong momentum, adding over 500 subscribers and 1,000 followers. I’m proud to share that Heavy Moat Investments now is a Substack Bestseller, reaching 100 paying subscribers and has over 3,620 total subscribers and 4,820 total followers.

Thank you all for your support. Unlock exclusive access to a wealth of valuable resources and insights by upgrading to my premium tier today. As a premium subscriber, you'll enjoy:

Investment research into global high-quality/compounder companies, primarily in the Small/Mid-cap range ($100 million to 20 billion), split into business model and fundamental & valuation analysis.

Earnings analysis on interested earnings reports (often after a strong reaction in the stock price or unexpected fundamental developments).

Notified about all my transactions on the same or next day.

My Inverse DCF template and other resources.

Click the button below to secure your premium subscription now and enjoy a 15% discount for the first year! Don't miss out on this limited-time offer to become a better investor.

Portfolio Update

I purchased a new company in April, which I’ll disclose next month (still building the position). It’s a German industrial high-quality small cap. Paid subscribers can read the summary here. I will also publish a more detailed summary and a full analysis in the coming weeks.

After owning the company for over a year, I also sold out of RCI Hospitality (RICK). This decision was predominantly a moral one: I dove deeper into the morals behind the business and confronted myself with it. I never was really on board the casino idea; I'm very anti-gambling. That's why I will also not cover Evolution gaming, by the way. I should have sold after the casino was announced, but it took me this long, sadly. Following your moral compass is important, in my opinion, to be able to hold businesses for the long term. Fundamentally, RCI is also struggling with hefty same-store sales declines and Bombshells collapsing in profitability. I believe, however, that this is temporary and the industry will get an upswing again. On Bombshells: They should divest it, it’s a lot lower quality then the nightclub business. Casino is a big question mark, too, which so far has used up a lot of capital and needs to prove that it will be profitable growth in the future. I put most of the proceeds into Alimentation Couche-Tard, Robertet and Frosta. I also bought more Pluxee later in the month.

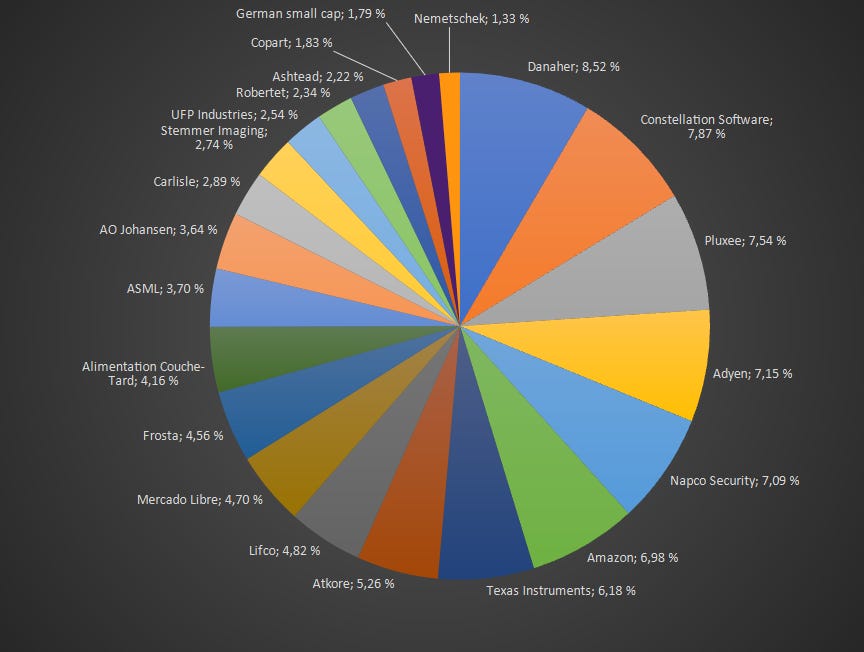

April finally saw negative returns for the portfolio and the overall market again after a prolonged rally. As long-term investors, we should celebrate more attractive prices to buy more shares in high-quality businesses. The portfolio lost almost 4% in April, a little more than the overall market. The top contributors were Robertet(+10%), Pluxee (+7%) and Ashtead (+5%), while Nemetschek (-8%), Lifco(-8%) and especially Adyen (-28%) detracted the most. I covered Adyen in more detail, but given the large position size, it pulled the portfolio down a lot.

Over time, my portfolio has widened, with the top 5 positions accounting for only around 35% of it. Ideally, I want to be concentrated, but I also see the benefit of diversification, especially because I continue to invest in smaller companies. I will think about this topic in the coming weeks.

I also saw a lot of people complaining about falling stocks, considering how little the market declined. Declining prices are normal, but a lot of people still get emotional about them. Try to turn off the noise and focus on your companies’ fundamentals.