Atkore’s share price has yet again been hit after reporting Q4 24 and FY 24 results. However, the price recovered from -10% premarket to breakeven and climbed higher the next day. In my previous post, I already discussed a few yellow and red flags about the company. Shares have reached a new low, so let’s dive into it and its meaning for the investment.

Q4 earnings

Atkore once again saw its business decline, with sales down 9% in Q4 and FY 24. Profits declined disproportionally, with EPS down 42% in Q4 and 25% in FY 24. Adjusted EBITDA shrunk 40% in the quarter and 26% for the year. The reason was once again, pricing normalization with some positive impacts from solar credits, low single-digit volume growth and buybacks. Atkore missed analyst EPS of $2.43 by $0.04 and beat revenues by $39.98 million. The company also met its own Q4 guidance.

At the start of the year, Atkore guided for low double-digit volume growth across the board. We can see that this did not materialize, with the only double-digit growth being the 12% Mechanical Tube & Other segment. At least all segments saw volume growth in FY24.

The bigger picture

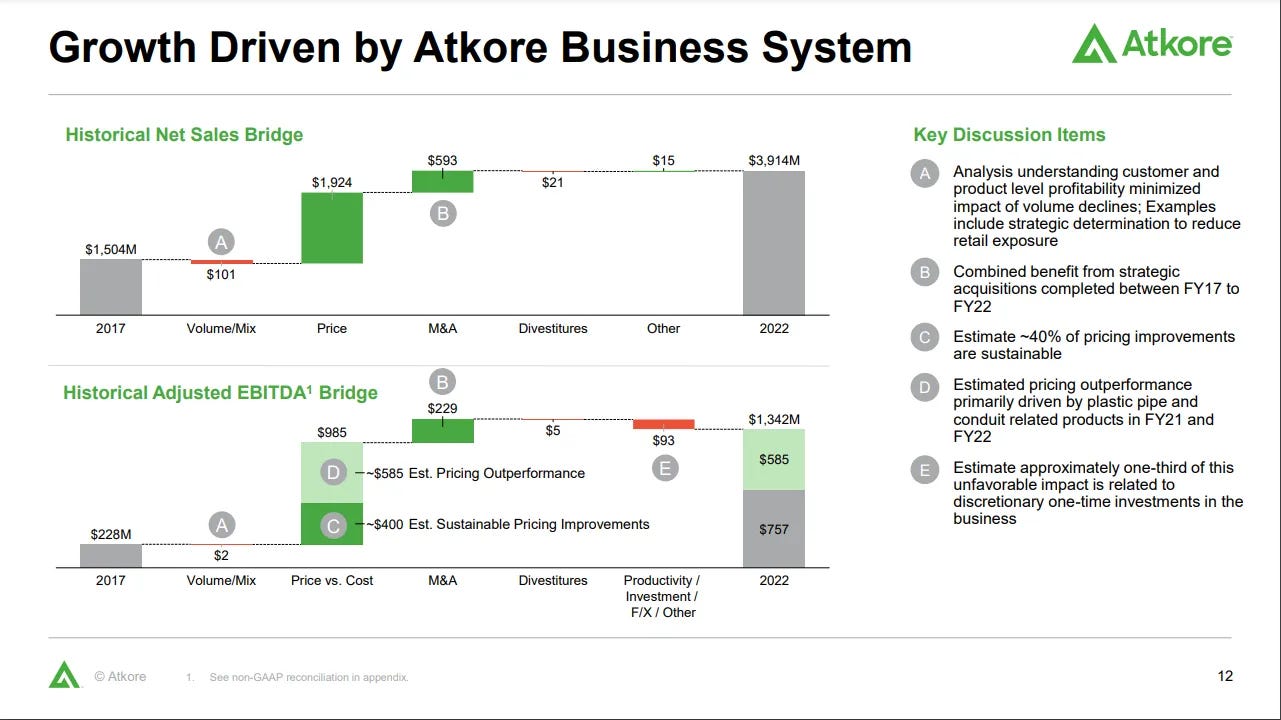

When Atkore released its FY22 earnings, the company presented the slide below to help guide investors through the pricing normalization. The company estimated that $400 of the $985 million in pricing outperformance would be sustainable and that it would see $585 million in pricing headwinds over the coming years. The end of normalization kept getting pushed out, and for FY25, Atkore again expects $245-275 million in headwinds (with a $285-305 million downside to Adjusted EBITDA) after $406 million in FY24 and $647 million in FY23, totaling $1313 million at the midpoint.

This is a much worse development than initially anticipated. Let’s dive deeper into this and the implications.

Black Friday deal: Biggest discount of the year!

By becoming a paying subscriber, you can read the rest of this article and all of my writing on businesses, valuations and investing. You can read more about the subscription benefits here. Don't miss out on the opportunity!

Subscribe now until 2nd December and get 30% off your first year annual subscription using the code below: