Early in my journey as a content creator on Twitter and Substack, I learned that collaboration is the key to growth for creators and audiences. That’s why I love to help promising newcomers who do good analysis. For this reason, I want to establish the Emerging Talents Spotlight as a new format on my Substack. The first installation of the series will be a quick summary of Compound & Fire’s Analysis of Rightmove, plus my quick interpretation of the valuation. I did not know Rightmove, but after reading the article, I found it to be a potentially compelling opportunity that I might investigate further. Arnold has over 30 years of experience in the market, recently launched his publication and his number one rule is the Buffet classic: Don’t lose money. Over time, I have come to appreciate this rule more, and that’s also why downside protection is an essential part of buying a new stock for my portfolio.

Rightmove PLC

Rightmove is the UK’s unrivaled online digital property advertising and information portal. The company reports on the Agency, New homes and others segments. Rightmove holds a strong market share between 80-90% in the UK.

The core business of Rightmove is having property professionals such as estate agents, letting agents ad new home builders pay a subscription fee to advertise their properties on Rightmove. This includes digital advertising products and tools to increase the agents profiles, differentiate themselves from their competition and access Rightmove’s market profiles data. Extensive property market data is sold to a range of customers, among others agents, landlords, surveyors and insurers. Through Rightmove’s partners they provide mortgage in principle and broker services to consumers who want to gauge affordability, which generates commissions when the mortgage completes. Finally they also sell advertise banners to a range of businesses.

Source: Rightmove Annual Report 2023

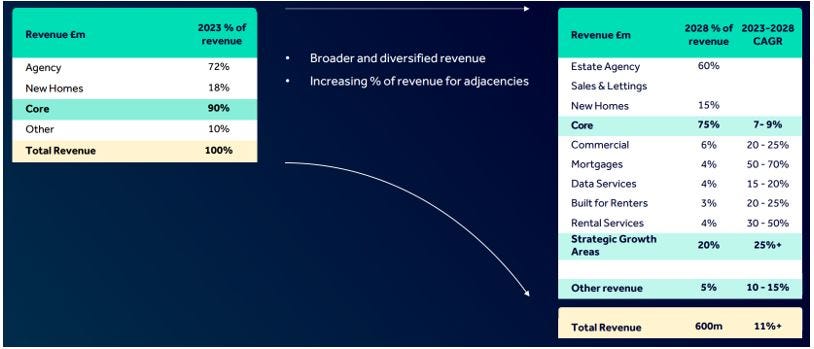

Rightmove aims to continually monetize more of its expanding services offering, as stated at its recent Investor Day in November 2023. While most monetization opportunities are within the Find segment, the other focus areas can potentially add the equivalent value if we combine them.

The management team expects strategic growth areas to grow rapidly at 25%+ CAGR over the next five years, decreasing the reliance on the core business of agency and new homes from 90% to 75%. Total revenue CAGR is guided at 11% to 600 million in 2028. This overview also gives investors guidance to follow management and see progress on the target.

Rightmove is an incredibly profitable and asset-light business generating EBIT margins of 70% and over 200% ROIC (they just need 70 million pounds of invested capital to generate 200 million in NOPAT). EPS grew at 10% CAGR for the last decade. The issue is that the company can’t effectively reinvest in the business. They do occasional bolt-on acquisitions, but only a few million. Fortunately, the company returns almost all its cash to shareholders, with 71 million in dividends and 130 million in buybacks over the last twelve months. It’s good to see that management doesn’t seem to indulge in pet projects or other wasteful ways to spend the capital but instead returns it.

Valuation

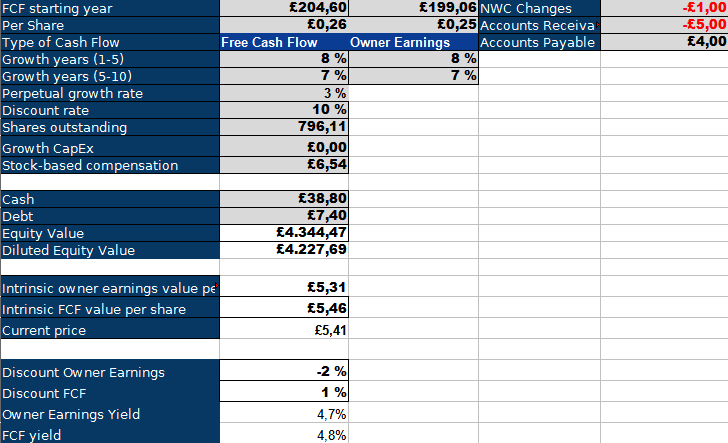

I’ll use my inverse DCF model to roughly value Rightmove. Keep in mind that I haven’t done extensive research on Rightmove yet. I’ll use a 10% discount rate due to the monopolistic and asset-light nature of the business. The company has eight percent growth priced into the next five years, followed by seven percent in the next five. This is below the targeted 11% total revenue CAGR through 2028. I wouldn’t expect operating leverage to have a big effect because there really isn’t much room to improve on a 70% EBIT margin business. The more significant worry would be that new business segments could be at lower margins and pull down margins. The company trades around 5% owner earnings yield and distributes all of it back to shareholders.

One risk to consider is that it’s purely a UK-based business and thus relies on a single regulatory framework, which is especially dangerous as a monopoly. Also, a prolonged recession would hit the housing market harder than the economy and, in turn, Rightmove. Asset-light high-margin businesses are also dangerous because the low entry barriers don’t deter competitors from launching. As the undisputed market leader, all agents have to use Rightmove, but they might also start to do secondary listings on other marketplaces. Over time, this can shift away volume and deteriorate the market position. Rightmove thus needs to be ever vigilant and continue to improve its platform. This isn’t a free-lunch type of monopoly.

Conclusion

I like Rightmove as a business, but I don’t think I’ll add it to my portfolio due to limited diversification (especially in an industry that regulators might target) and a lack of reinvesting ability. If the stock would trade down closer to an 8% owner earnings yield, I’d consider it, though. I don’t expect it to trade down this much, however due to the market position it has.

Thank you to Compound & Fire for the analysis. Please make sure to check out the publication. Please let me know your thoughts about this format and vote on the poll below.

Thanks for sharing, I feel really honoured!