Readers of my Substack will know that I’ve been buying a lot of European stocks, most of them small or mid-caps, for the last year or so. My portfolio now comprises 46% Europe, 49% North America and 4% LATAM.

That’s why a recent letter from the fund Verus Capital Partners, which I found thanks to my friend Mavix from Under-Followed-Stocks, piqued my interest. The following graphics are all from Verus.

Small Caps

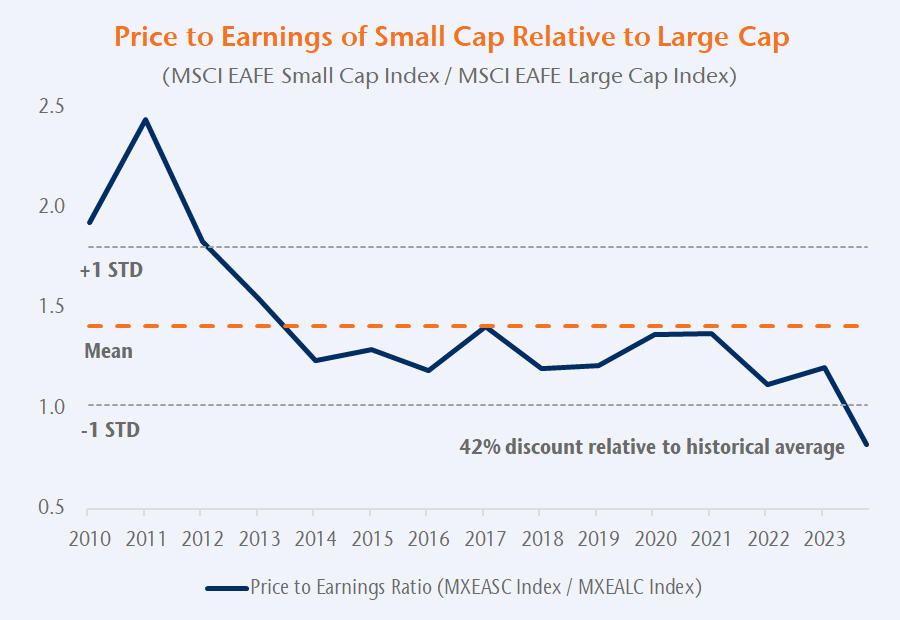

The first chart compares the long-term PE of small caps relative to large caps (I don’t like the PE ratio, but it works on an equal comparison base). We can see an increasing discrepancy in valuations with a 42% current discount to historical averages.

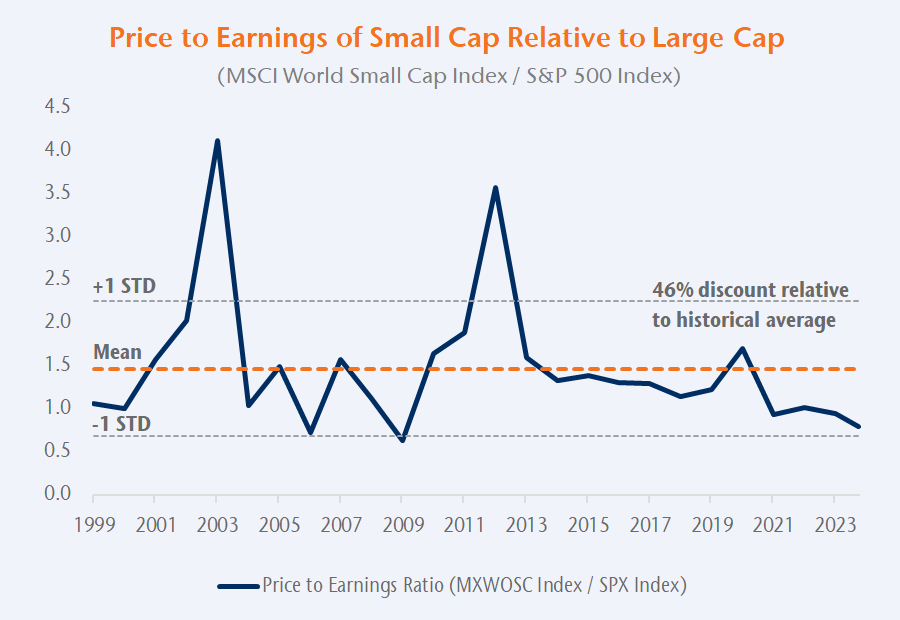

A similar picture can be observed between the MSCI World Small Cap and S&P 500 Index. Here, the discount is even 46% and we can view a longer time frame. We are getting close to the long-term trough discount and it’s important to note that there have been historical periods where small caps are rewarded a much higher multiple than large caps.

Ready for More?

By becoming a paying subscriber, you can read all of my writing on businesses, valuations and investing. You can read more about the subscription benefits here. Don't miss out on the opportunity!

Here’s an even longer time frame from Hardford funds. Over the very long term small caps outperform by 2.85% on average. Why is that? Small caps often have a much larger runway of growth and to penetrate an industry. This, of course, often comes with higher risks. In recent years, a more significant percentage of small caps are unprofitable, according to Goldman Sachs (I don’t have the source, sadly), with around 33% versus 5% just two decades ago. Small caps sometimes get a bad reputation because of this, even though many highly cash generative small caps don’t need to dilute and take on debt to grow.

Smaller sizes often lead to higher growth, which we can see in projections for the next two years. Over the last years, indices, especially in the US, have become more weighted towards their largest stocks, often dominant tech stocks, taking large parts of the S&P 500 allocation, for example. ETF and fund flows into these (admittedly) great businesses have ballooned valuations, while small companies without many eyes on them have seen funds flow away. I believe that this is a very favorable risk-reward scenario. However, we must be very selective. Small caps often have higher risks and haven’t always proven themselves already, but there are long-term owner-operated small caps that can now be bought at cheap valuations with a great future.

Europe

Let’s talk about Europe. I don’t need to show a performance chart of European equities compared to US equities. We all know that Europe has massively underperformed. One explanation is the lacking innovation and more industrial-heavy European economy. Many old economy businesses, such as automotive, chemicals and industrial manufacturers, are heavyweights in European indices. This demands lower valuation multiples than the more asset-light and innovative American economy. Also, we have a higher bureaucratic burden and overregulation in Europe. There certainly is a reason why they trade at a discount!

Below is a chart of the median 20-year valuation discounts and the current discount based on sectors. We can see that all sectors (excluding telecoms) have a massively higher discount than the median. While there undoubtedly is a worse business climate in Europe and it’s not improving, the discount is immense. I’d argue that it is not justified.

This chart from Caia.org also illustrates it well.

How can we use this information?

I do not believe there is a huge advantage to buying European indices over US indices. While they are cheaper, I do not like the general direction of Europe. This does not have to concern us as investors in individual companies, though! Europe has many high-quality, globally diversified businesses that continue to thrive and which trade at massive discounts to their US peers. It is definitely a case-by-case problem to solve and we can’t just say, “Buy Europe because it’s cheap.” Instead, I’d say that we should fish in the pond of cheap European stocks that meet our (hopefully high) qualitative and fundamental standards and trade at fair or cheap prices.

I’ve been contemplating cutting my US exposure further to take advantage of this valuation discrepancy. However this again is a case-by-case situation. Some of my US stocks are still cheap, while others are at a massive gain and trading at lofty multiples. Selling your winners often isn’t a great idea; I generally like my portfolio right now. We’ll see if I trim some run-up winners to take up another opportunity. It’s vital to know what you own and to have done the due diligence on whatever company you might want to own.

Let’s take a quick look at a selection of European high-quality stocks that fit this criteria and might be good candidates for a watchlist:

Want to read the rest and much more?

By becoming a paying subscriber, you can read the rest of this article and all of my writing on businesses, valuations and investing. You can read more about the subscription benefits here. Don't miss out on the opportunity!