February 2025 Portfolio Update plus new valuation matrix

Great performance in February up 4.9%; 13.1% YTD

Hello and welcome to the Heavy Moat Investments newsletter! February was another eventful month—both in the markets and here at HMI. I’ve been working hard to improve the service and provide even more value to you. Your feedback from the recent survey was incredibly helpful, and I appreciate everyone who took the time to share their thoughts.

What’s New?

I detailed what’s changing in this post. Many free readers weren’t aware of the full scope of the premium subscription, so I made my deep dive into Ashtead Group free—giving you a first-hand look at the level of analysis I provide. You can check it out here: Business model deep dive - Fundamentals and Valuation deep dive. The new welcome page will direct you, no matter if you’re a free or paid subscriber, through my offering and answer questions you might have had. I want to take this service to the next level and I can only do that with your help.

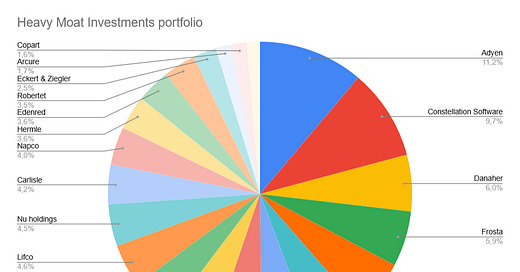

The monthly portfolio update is evolving as well! Starting today, I’m including my valuation matrix, offering deeper and actionable insights into which companies I find most attractive at the moment and which are the highest quality.

HMI continues to grow—this month, we welcomed 570 new subscribers and over 1,400 new followers. I’m excited to keep building this community with you. Yesterday I also published a podcast with

about Robertet for paid subscribers, but the episode will be available to all free subscribers in a few weeks.New Content in February

Here’s what I covered this month:

Deep Dive: Sonova AG

Earnings update: Napco’s sharp decline

Annual update: Frosta AG’s strong FY results

Portfolio Overview: Quick investment cases for all my holdings

New Investment Pitches: A Scandinavian small cap with a 15% forward IRR & Nu Holdings

New Format: Quality Score introduction (free example with Mercado Libre)

Podcast: A deep dive into Robertet (now available for premium members, coming soon for free subscribers)

Portfolio Update

In February I sold my entire position in Amazon. I described my reasons in this post, but to summarize:

Fundamentals are fine but its getting more capital intensive (not much of an issue and could be positive). This isn’t the reason for my sale.

I noticed a large decline in product quality: Search is terrible because of ads, logistics are very unreliable and the AI support is lackluster at best. I fear that Amazon is cutting too many corners in order to drive margins higher.

The morals of Amazon bothered me for a long time. The huge environmental impact of destroying billions of returned packages each year gets multiple by copying Temu with Amazon Haul. Lastly it also kills small businesses with its marketplace.

Overall I continue to see Amazon as a profitable investment, but I’d prefer to invest in small companies and ones that I can be proud to be an owner of. I sold Amazon at a 150% gain.

I also realized a 100% gain by selling 1/5th of my Lifco position. Nothing wrong with the company, but the valuation ran up too much and I don’t think Lifco can surprise too much on the upside with its business model. It remains a top position in my portfolio.

All the raised cash was reinvested into the portfolio. I started a new position in Nu Holdings, a founder-led LATAM fintech platform with first mover advantage, excellent customer focus, high profitability and long-term focus. It is a great addition to Mercado Libre and Pluxee/Edenred to play the LATAM region.

I bought more of EVS, growing this new position to a 4% weight and I finally was able to size up Carlisle, a business I’ve long been looking to increase my position in. Lastly I bought a bit more of Danaher and Robertet.

After an underperformance in 2024, January started great and February continued the positive trend: The portfolio gained 4.9% (0.04% if we ignore the realized gains within the month from Amazon and Lifco sales, but they should be part of total return) compared to -0,57% for the S&P 500 and -1.94% for the Nasdaq 100. YTD the portfolio is up 13.1%, compared to +1.57% (S&P500) and -0.4% (Nasdaq 100). Since inception in January 2022, the HMI portfolio continues to outperform the US indizes. Europe continued to perform well in 2025 and offset losses from US stocks, particularly Napco, which fell around 30% after earnings. I continue to monitor Napco and at this time do not want to buy more shares. There are too many issues frequently and the stock is too volatile with many equally attractive opportunities around. Here are my top contributors and detractors in the month:

📈 Top Contributors:

Hermle +20%, didn’t see any news, but was oversold

EVS Broadcast +14.5%, great earnings

Adyen +11.3%, great earnings

Frosta AG +9.3%, great FY results

📉 Top Detractors:

Napco -33.56%, disappointing earnings

Sartorius Stedim -11%, bad sector sentiment

Carlisle -8%, ran up a lot and came back down

Edenred -7.7%, market didn’t like earnings

What’s Next?

For paid subscribers, I’ll be sharing my updated valuation matrix with this report—helping you see which stocks I currently find most compelling within my portfolio.

If you’re serious about identifying high-quality investments early, consider upgrading to premium and unlocking the full experience. Right now, you can subscribe with a 15% discount.