Nu Holdings: LATAM fintech with untapped potential

An exclusive first look at a promising opportunity early in my research

Hey everyone,

This post is something new. Usually, I only share well-researched, high-conviction ideas, but today, I’m inviting you to peek behind the curtain and follow along in the early stages of my research.

Nu Holdings (NuBank) is a leading digital bank in Latin America. While it became a hot stock during the COVID growth stock boom, I’ve had it on my radar for a while—especially given my long-term investment in Mercado Libre since 2020. After a 20% post-earnings drop, the risk-reward ratio looks increasingly interesting, and I believe now is the right time to take a closer look.

💡 Why should you care? This is an opportunity to follow my research process in an earlier stage and see how I approach a potential investment before making a final call. Given the opportunity, I decided to try this format.

Similarities to Mercado Libre - LATAM’s Digital Revolution

Mercado Libre has been one of my oldest holdings in the portfolio since 2020. Let me quickly explain the secular tailwinds Mercado Libre benefits from:

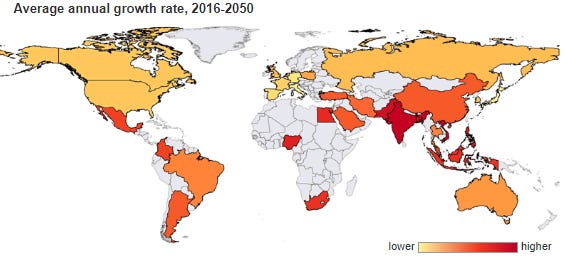

A booming middle class - LATAM should experience mid-to-high GDP growth rates over the long-term, according to pwc, as the region continues to develop and the middle class grows. This will accelerate spending throughout the economy.

Underpenetrated e-commerce and banking - Compared to the US, E-Commerce is underpenetrated in LATAM and has a long runway for growth. However, the region's widely differing cultures and unstable political climate present unique challenges, making it tough for international companies to enter.

Complex market dynamics - Operations, especially last-mile delivery, are even more complicated than in developed countries because of the unique challenges of the terrain, political & socioeconomic issues and crime in LATAM.

Financial inclusion - A large part of the population is unbanked and does not have easy access to credit, insurance and financial services. Furthermore, existing traditional banks are abusing their position with exorbitant fees. Digitizing the process can attract many untapped customers, and an ecosystem of services can make them sticky.

Much like Mercado Libre, Nubank isn’t just expanding into LATAM—it was built for LATAM. That homegrown advantage could be a key differentiator. While these are risks and opportunities for growth from my research and ownership of Mercado Libre, Nubank falls into the same category (at least partially). As a digital bank, they primarily benefit from the growing GDP, unbanked population and the war on cash that’s raging worldwide. E-commerce, while not a primary driver, has a second-level effect on Nu as well, as it accelerates the transition to cashless payments and especially seamless online payment experiences for customers.

What’s Next?

In the full analysis, I’ll break down:

✅ How Nubank makes money and where I see its biggest growth opportunities

✅ My open questions & concerns about the business model

✅ Potential risks that could derail the thesis

I’m still in the early innings of my research, and premium subscribers will get access to my deep dive and final conclusions.

Want the full investing experience? Consider subscribing to Heavy Moat Investments and take your investment research to the next level.

🔥 I recently made my deep dive into Ashtead Group free—so you can see exactly what to expect: Business model deep dive - Fundamentals and Valuation deep dive

As a premium subscriber, you’ll get:

✔ Detailed Research on high-quality global compounders and European champions, with deep fundamental & valuation analysis.

✔ Actionable Investment Pitches – Ideas with high upside potential and limited downside.

✔ Earnings Breakdowns on key reports and market reactions.

✔ Real-Time Trade Alerts on all my portfolio moves, plus access to the premium chat.

✔ Exclusive Investing Tools, including my Inverse DCF template and more.