IDEXX Laboratories: Quiet Compounder or Overlooked Opportunity?

A Deep Dive into Its Revenue Model, Margins and Long-Term Potential

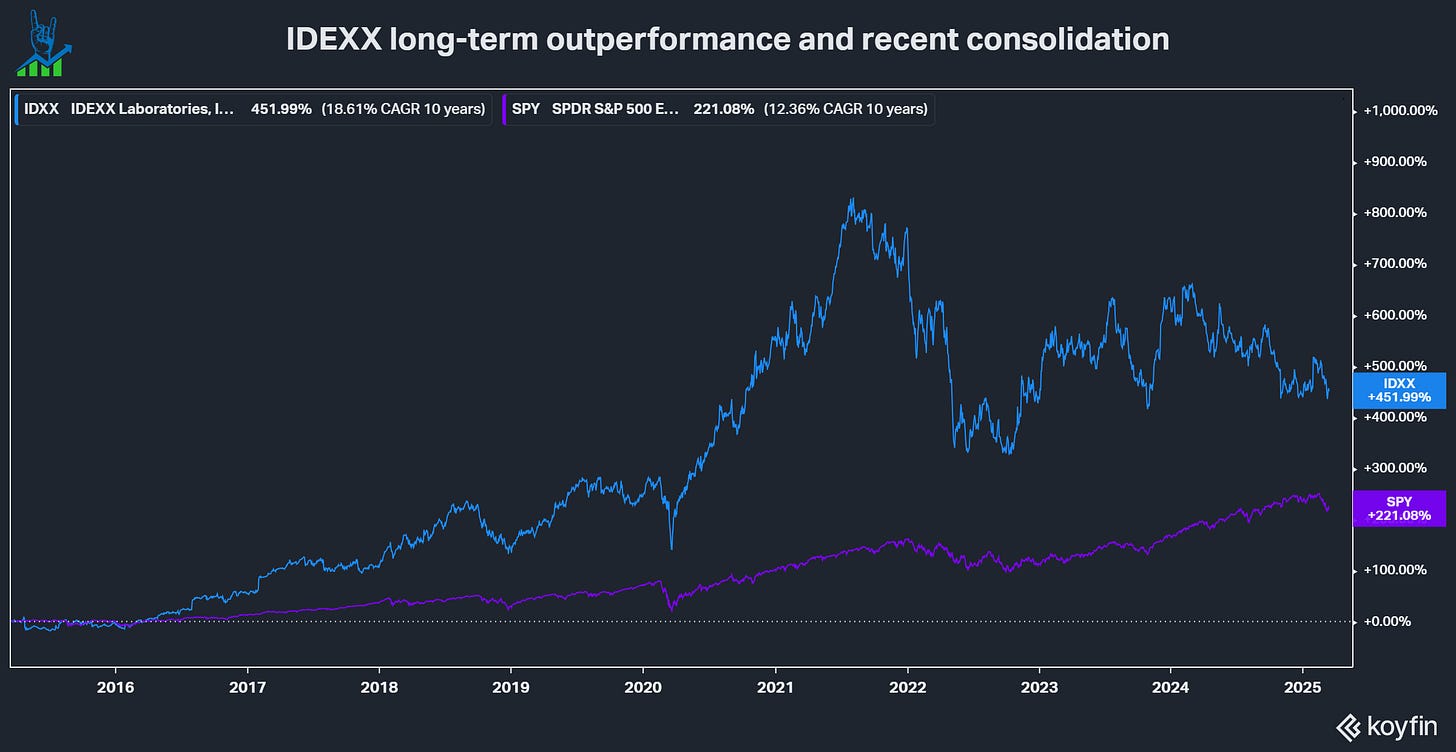

IDEXX Laboratories has been a long-term outperformer driven by a strong history of profitable growth and good capital allocation. IDEXX reached astronomical heights during the COVID bubble, trading as high as 84x forward earnings. Fast forward to today: The share price has been consolidating for four years, but the business fundamentals have continued to improve steadily. In fact, IDEXX is a better business today than when it peaked in 2021. Let’s break down what makes IDEXX a standout—and why it deserves a place on your watchlist.

You can find the first part here.

Reconstructing the success story

Last year I colaborated with my friends from

in a post discussing why margin expansion often leads to multiple expansion. IDEXX was one of the examples I used. Total shareholder returns can be deconstructed into five variables:Revenue growth (the most important one)

Margin development (increasing value capture from revenue)

Share count change (buybacks to increase ownership or dilution to fund growth)

Dividends (returning excess cash to shareholders)

Multiple expansion (out of management’s control)

In IDEXX’s case, the company has successfully pulled almost every lever—except dividends, as it focuses instead on reinvesting free cash flow into buybacks and growth initiatives.

Revenue Growth – The Power of IDEXX’s Growth Algorithm

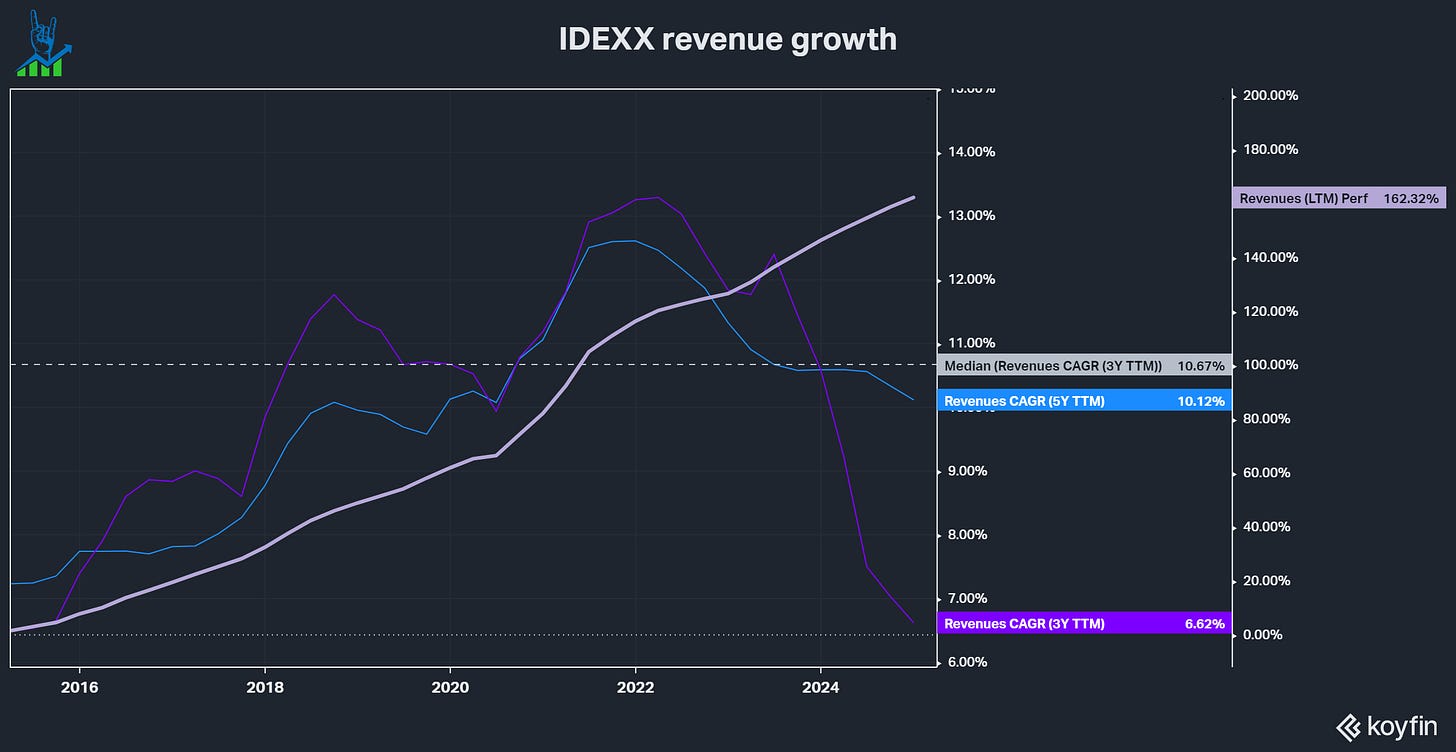

Over the past decade, IDEXX grew revenue at an impressive 10.6% CAGR, resulting in a 162% total increase in sales.

The IDEXX Growth Algorithm is what makes this company a standout. In the premium section, we break it down—how it works, why it’s so powerful and what it means for long-term investors.

During the pandemic, IDEXX experienced an acceleration in growth driven by an unprecedented rise in pet ownership. But post-COVID, the industry has faced headwinds:

Veterinary labor shortages are causing bottlenecks in clinics

Consumers are deferring non-critical care due to economic pressures

Even so, IDEXX continues to outgrow the underlying market thanks to its entrenched competitive advantages.

Margin Development – Efficiency at Scale

IDEXX has an immaculate margin development and perfectly shows how a well-operated scalable recurring revenue business can develop:

Gross margins rose from 55% to 61%

SG&A margin declined from 30% to 25%

R&D margin declined slightly from 6.6% to 5.6%

EBIT margins rose from 18% to 30%

In the future, this lever will become more challenging to pull. At 30% EBIT margins, IDEXX is already highly profitable and incremental margins have less of a leverage effect on earnings.

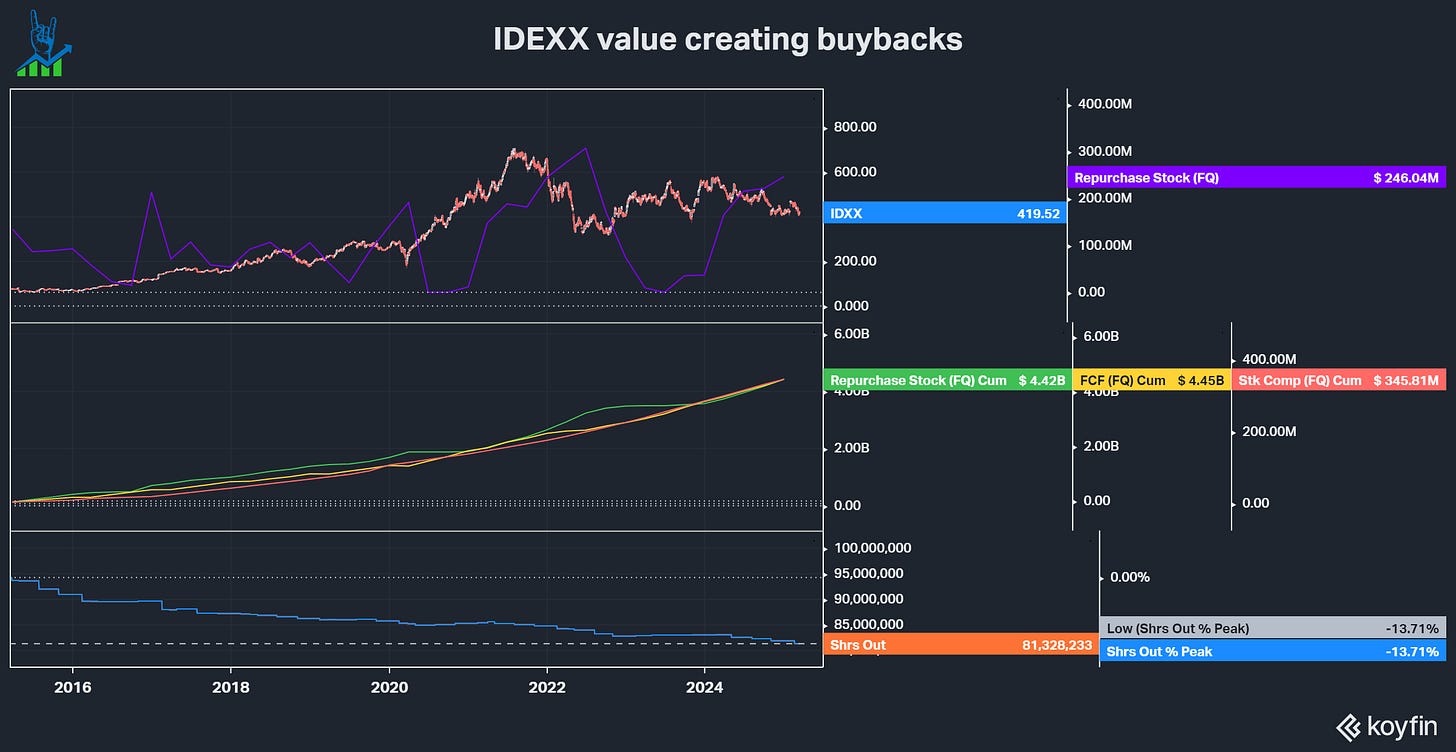

Buybacks – Thoughtful Capital Allocation in Action

IDEXX reduced shares outstanding by 13.7% over the last decade, reinvesting its entire Free Cash Flow. Based on the current market cap of $34.1 billion, the 12,924 million repurchased shares have a value of $5.43 billion versus $4.42 billion spent on buybacks. Well done!

Valuation Multiple – From Headwind to Tailwind?

Until 2021, multiple expansion was a major driver of returns. IDEXX traded at astronomical valuation levels at its peak, but much of that excess has now unwound.

Today, IDEXX trades at a much more reasonable multiple, especially when factoring in its:

Recurring revenue model

Capital efficiency

Long-term reinvestment runway

For patient investors, the next phase could offer a compelling entry point.

🚀 Want to Dive Deeper?

In the premium section, I break down the IDEXX Growth Algorithm, including:

✅ How it systematically drives recurring revenue

✅ The capital efficiency that sets it apart from other diagnostics businesses

✅ A valuation deep dive—is it a buy at today’s prices?

✅ My personal investment case, including risk factors and return expectations

Join hundreds of other investors already getting exclusive deep dives, high-conviction ideas, and real-time portfolio updates.

🔥 New to my research? Check out my free deep dive on Ashtead Group to see the level of insight you’ll get as a premium subscriber. Business model deep dive - Fundamentals and Valuation deep dive