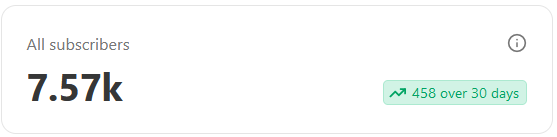

Hello and welcome to the Heavy Moat Investments newsletter on Substack. Join over 7,500 smart investors who already receive my in-depth analysis of high-quality businesses, timeless investment philosophy and actionable ideas straight to their inboxes. Click the button below to subscribe today and elevate your investment journey!

2025 started with turbulent times for the market as new tariffs from the US and sudden fears about Chinese LLM DeepSeek hit the market. Europe on the other hand has seen some great performances, which reflected into a great month for my portfolio.

Heavy Moat Investments gained over 460 subscribers and almost 1,500 followers in January. I’m happy with this growth and am looking to continue publishing high quality content. Next month I have planned to do a podcast with

about one of my holdings. I’ll upload the podcast onto Substack as well, if that works smoothly.In January, I pubished fundamental deep dives into Carlisle and Watsco. I posted about the problems at Hershey’s and went over my semiconductor earnings reports. I pitched a new company and a European company I didn’t buy. I published my three part portfolio 2024 review, but I was honestly disappointed with the lack of response to the post. In the future, I’ll keep such posts shorter if my readers aren’t very interested in it. Finally, I updated my portfolio quality ranking.

Improve your learnings today!

As a paying subscriber, you'll gain exclusive access to all my premium insights on businesses, valuations, and investing strategies. advantage of this opportunity to elevate your investing game today!

As a premium subscriber, you get:

Investment research into global high-quality/compounder companies, primarily in the Small/Mid-cap range ($100 million to 20 billion), split into business model and fundamental & valuation analysis.

Earnings analysis on interested earnings reports (often after a strong reaction in the stock price or unexpected fundamental developments).

Monthly ideas out of my investable universe.

Notified about all my transactions on the same or the next day via the premium chat.

My Inverse DCF template and other resources.

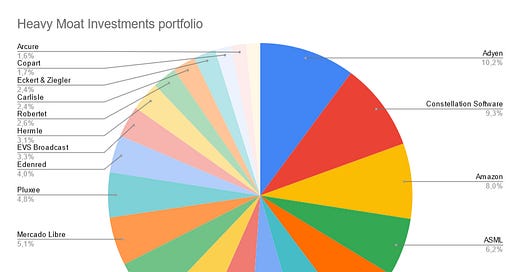

Portfolio Update

In January I started a position in EVS Broadcast, a European small cap focused on live entertainment. The company is shifting its revenue from hardware to software and services, making the businss more predictable and growing faster. You can my pitch here. I funded the purchase by selling Alimentation Couche-Tard. The company is still a great business, but it was my lowest conviction and I honestly wasn’t comfortable with the large merger they tried to do with Seven & I Holdings. I much prefer bolt on deals to large mega mergers like that. I did not buy any other shares in January.

After an underperformance in 2024, January started great: My portfolio gained 7.8% versus around 2-3% for the US Indizes. I’m very happy to see the great results that came out of Europe: Nemetschek (up 22% in the month) raised its full year guidance, Pluxee (22%) reported great results, Eckert und Ziegler (22%) with great results, Frosta AG (18%) with higher than expected margins, Sartorius Stedim (17% with good earnings and Lifco (14%) with good Q4 earnings. It’s great to see this rebound and let’s see if it continues into the rest of the year. My other companies performed well across the board, with the only losers Texas Instruments (-1%) and Danaher (-2%) after bad earnings and Hermle (-1%) who just can’t get any momentum in this downturn.

I hope to see you again next month. Investing is a journey, and I’m eager to learn and share my experience with you. If you haven’t already, consider subscribing, and let me know how your year went in the comments.

All the best,

Niklas from Heavy Moat Investments.

Exciting growth! Well deserved.

some lack of response is due to paid posts.