Outperforming all benchmarks: A more comprehensive performance update

Updating my performance since Inception of the Heavy Moat Investments Portfolio

As long-term investors we should strive to find an investment style that works for us. This doesn’t always align with getting the highest performance, it might also involve other factors like volatility or ethics. But at the end of the day, performance matters! If we can’t outperform over the long term then why bother putting all the time into researching (besides enjoying the hobby for the intellectual stimulation)?

In the past I used to track my performance like this, by tracking my portfolio performance and then look at the QQQ and SPY over the same time period. This was inaccurate and did not account for timing of purchases and was not truly comparable. Luckily I have found a good partner to help me track my portfolio in a more accurate way and with more comprehensive tools.

Portseido—An easy way to track performance

Portseido (affiliate link) is a great and easy way to track performance. They even offer importing your portfolio from European brokers like Trade Republic (which I use), something most international alternatives don’t offer! Let’s get right into it.

Portseido uses three metrics to track performance:

Simple Return (SR)—the simplest way to track, just total gain/total invested capital

Time-Weighted Return (TWR)—this adds timing of purchases into the mix to make it more accurate

Money-Weighted Return (MWR)—also accounts for size of purchases and holdings. It’s generally recognized as the most effective way to track personal performance.

In the past I only had access to SR. Now I will predominantly use MWR to calculate my returns. Portseido uses a hypothetical portfolio approach, where they simulate what would have happened if you invested the funds into the benchmark instead of your own purchases. Below we can see my performance against my primary benchmark, the S&P 500. It has been choppy, but right now I pulled ahead again.

2022 was a downturn and I’m happy how my portfolio performed.

2023 my portfolio recovered disproportionally by some larger bets like Adyen and Napco, which I bought in size during the lows.

2024 was disappointing as my continued switch towards European equities dragged on performance.

2025 so far has been a success with another large outperformance against the S&P 500 as European equities are holding up much better than US.

More benchmarks!

Portseido lets you use multiple benchmarks. I used:

S&P 500—Largest American index and the go-to benchmark

STOXX Europe 600 (EXSA.DE)—Largest European index, due to my large European exposure

MSCI World Quality Factor (IWQU.L)—A quality factor due to my quality bias

MSCI World (URTH)—A broader benchmark, with global diversification

Nasdaq 100 (QQQ)—The US tech index and best performer over the last decade

I am happy to outperform all of my indices since inception on a MWR, TWR and SR basis. We must remember however, that performance only matters over long periods. While 3 years and 4 months is a sizable comparison, it still is not a very long time. I’m excited to see how the future develops. Let’s look at one caveat however:

Currency impacts

I track all of my investments on a Euro basis, because I am living in Germany and that’s what matters to me (I still research and evaluate companies based on their native currency though). I don’t put too much thought into currencies and the chart below is a perfect indication of why: Over the long term it tends to even out.

In 2022 I had a large outperformance against the S&P 500 with my old tracking method, but now I just matched the index. That was due to the currency pressures then. Now in 2025 currency is positively impacting my performance. Overall, it usually evens out again.

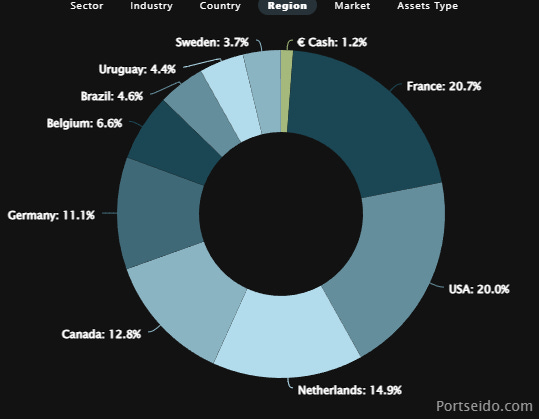

My portfolio is global now and the Euro is more important than the US Dollar for my holdings (I also have some exposure to the Canadian Dollar and Swedish Krona).

Excess returns calculations

Another feature I love is the excess returns calculation: This shows the performance against your primary benchmark and how much outperformance you generated in each period. My portfolio has a large variance to the S&P, as we can see: Most quarters have a difference > 3% and 5 out of the 14 quarters since inception had >5% of delta.

Upgrade your experience!

If you want to understand how I think, analyze companies and outperform the market, then you’re in the right place. Come and join the over 150 paid subscribers and elevate your investing experience!

As a premium subscriber, you’ll get:

Detailed Research on high-quality global compounders and European champions, with deep fundamental & valuation analysis.

Actionable Investment Pitches – Ideas with high upside potential and limited downside.

Earnings Breakdowns on key reports and market reactions.

Real-Time Trade Alerts on all my portfolio moves, plus access to the premium chat.

Exclusive Investing Tools, including my Inverse DCF template and more.

I recently made my deep dive into Ashtead Group free—so you can see exactly what to expect: Business model deep dive - Fundamentals and Valuation deep dive

Goal tracking

Another interesting tool is the goal tracking. We can track personal goals, I used a 12% IRR over 20 years. So far I’m tracking ahead of the target, let’s see where I’ll stand in 17 years!

The bottom line

While we should be aware of our performance, it should not lead us to action! Chasing trends and returns often is a recipe for disaster and underperformance. We must set a plan and stick to it (unless there are significant fundamental changes).

Investing never is a straight-forward game. If we micro-manage and track our performance every month and obsess about it then we can end up frustrated in (inevitable) bad periods and euphoric in great periods.

I am happy with my performance and outperformance over all my benchmarks and hope to continue this into the future. I hope to see you along for the journey, to learn and grow as an investor. I encourage you to join the chat and ask questions. So far the chat has been underutilized and I’d love to change that.

Thank you for sharing this.. I have been tracking mine in a spreadsheet (moved brokerage accounts a couple of times) and know some numbers were off, so I was looking for a website to do this. Portseido is amazing.