Pluxee reported its Q3 results last night and shares plunged by up to 12% this morning. Right now, Pluxee is down 10% on the day. In this article, I want to discuss the results, possible reasons for the decline, enterprise value and valuation. Here are my previous analyses on the Business model and the fundamentals & valuation.

Clarifying something

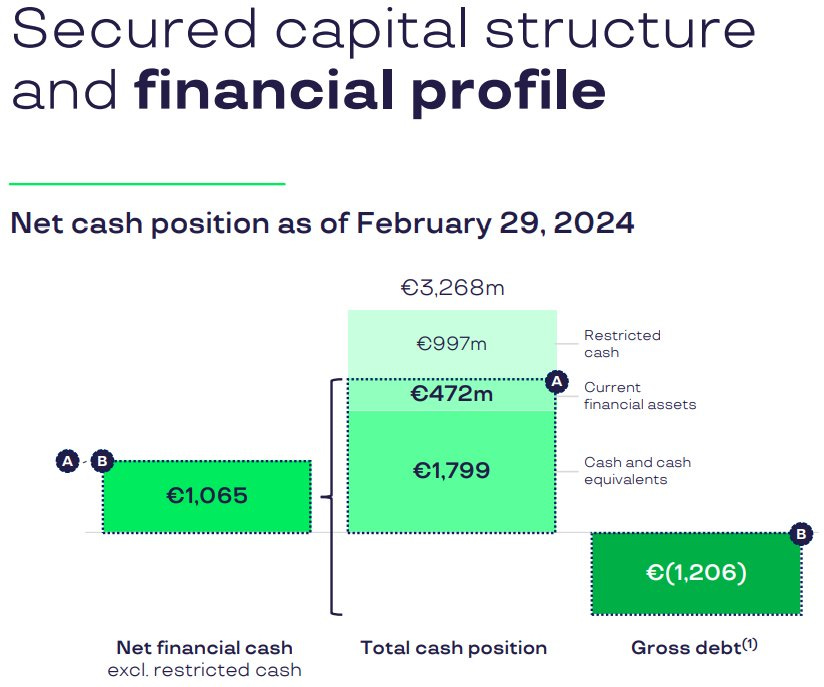

After a lengthy discussion on Twitter, I concluded that there are different ways to look at Pluxees' balance sheet. I want to address this and discuss some nuances before I get into the results. Pluxee shows the following slide for its balance sheet (these are H1 numbers; they didn’t update the balance sheet) with 1.065 billion euros net cash. However, a point must be made for a different calculation of net cash and, therefore, enterprise value.

Pluxee includes all but restricted cash in its net cash calculation. This means they include cash and receivables related to customer float, as seen below (thanks for the conversion to this Twitter user). While they earn interest on this float and can use it to invest it, it isn’t their cash. I’ll use just the non float-related cash portion for my enterprise value calculation. This makes a substantial difference and changes the net cash position of 1.065 billion to a net DEBT position of 719 million euros. One could add back leases of 66 million, but I prefer to be conservative. With this important nuance on the business model and balance sheet, let’s get to the results.

The results

Like many European stocks, Pluxee reports only revenues and limited data points in its Q1 and Q3 results, with more sophisticated reporting in H1/Q2 and H2/Q4 reports.

Pluxee delivered strong organic revenue growth of 17.9% (4.1% currency effects) and 21.8% YTD. This was driven by growth from all regions, with continental Europe being the weakest at 8% (however still strong). Organic growth consisted of 11% operating and 76% float revenue growth. Operating revenue is slowing down, as Pluxee expected in previous quarters against tough comparisons from regulatory changes in Brazil a year ago. Pluxee expects float revenue growth to slow down to around 30-50% or so due to lapping the hefty interest rate increases. The company continues investing in longer-duration investment vehicles to secure these high interest rates for longer. This should protect the current level of float revenue. Remember that Pluxee can actively increase float revenue by increasing its float dollars while the investment yield is largely out of their control.

Premium Offering

Consider subscribing to Heavy Moat Investments to get the full experience and improve your investment journey. As a premium subscriber, you get:

Investment research into global high-quality/compounder companies, primarily in the Small/Mid-cap range ($100 million to 20 billion), split into business model and fundamental & valuation analysis.

Earnings analysis on interested earnings reports (often after a strong reaction in the stock price or unexpected fundamental developments).

Notified about all my transactions on the same or next day and a premium chat.

My Inverse DCF template and other resources.