Goodbye 2022 and welcome to 2023! My portfolio has changed a lot throughout this last year, so let’s see what happened.

But first of all, I have a small announcement: I am now an affiliate partner with Seeking Alpha, so if you want to check out the service, here is a link to get your first year for $39 instead of $239!

Let’s start with my portfolio in January 2022: Back then, my portfolio had a lot of similar names, but also a lot of things I cut off since. In January, I sold two positions with Tencent $TCEHY and Meituan and throughout the year, my other Chinese positions (JD.com and Xiaomi) would also leave my portfolio. China certainly does offer opportunities, but I am not willing to invest in the politics happening there, where shareholders have no rights and the government takes as much as it wants. Many other stocks also left my portfolio throughout the year:

Medios AG, a small German specialty pharma, where I just didn’t know enough about the industry in retrospect.

Sartorius Vz, not really a sale, but I did purchase the Sartorius Stedim subsidiary instead.

Nintendo $NTDOY , too much nostalgia in the investment. Good quality but is too cyclical and does not have great management.

Sea Limited SE 0.00%↑ , very unprofitable and the path to profitability got a lot more uncertain. I rather own MELI 0.00%↑

Adobe ADBE 0.00%↑ , I hate the Figma acquisition for the way it got financed (reissuing shares at the lows to buy at 50x sales….crazy)

Blackrock BLK 0.00%↑ , this was mainly about management. I hate when they lie to you and Larry Fink is very hypocritical.

Teladoc TDOC 0.00%↑, lots of mistakes and my most expensive lesson yet. I wrote a detailed article about it.

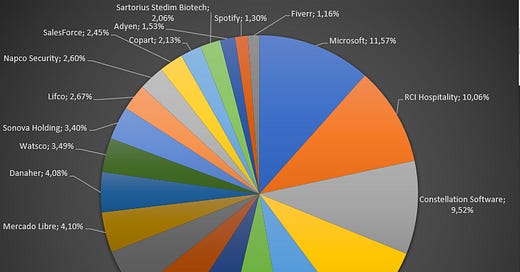

Let’s get back to the present with my portfolio at the end of 2022: I made some small changes in my portfolio last month. I cut my Salesforce CRM 0.00%↑ stake by 1/3 after noticing that 6 top execs left the company. Big red flag here, you can read more about it in my small blog about it. I put the money into VEEV 0.00%↑ .

Furthermore, I started two new positions in companies I researched over the last few months. The first is Napco Security NSSC 0.00%↑, a small-cap manufacturer of fire alert, access control and intrusion alert hardware with a growing recurring revenue component. You can read about it on my Seeking Alpha and my substack blog.

The second is Copart CPRT 0.00%↑ , the leading online auction site for totaled cars/wrecks with a large network of owned scrapyard real estate. After the company had come down a little since my initial analysis, I decided to take a small position in this extraordinary company. Read more here.

I also bought more Amazon AMZN 0.00%↑ , after selling some of my stake around $100 per share. I’ve read a bunch of times in the last weeks that Amazon seems to be taking cost-cutting more seriously, that coupled with the falling share price makes Amazon a strong buy again for me and I might increase the position further, potentially even at the expense of my GOOG 0.00%↑ position.

December was the first month in a long time where my portfolio did not concentrate and my Top 5 positions now “only” account for 47.26%, down from 50% last month. The top 10 is down to 73% from 77% last month. I plan to refocus my portfolio over the long term and would ideally want to get under 20 positions again. Unfortunately, there are too many great companies and I don’t have the discipline to only buy my highest conviction names, with new ideas coming up often. I’ll try to better myself in that aspect in 2023.

Lastly, as always, I’ll share my published Seeking Alpha articles of the month:

We both share $RICK in our portfolios! :)