Sonova AG: Positioned for a Comeback or Losing Its Edge? - Fundamentals and Valuation analysis

Analyzing Growth, Quality, Reinvestment, Risks and expected Long-Term Returns

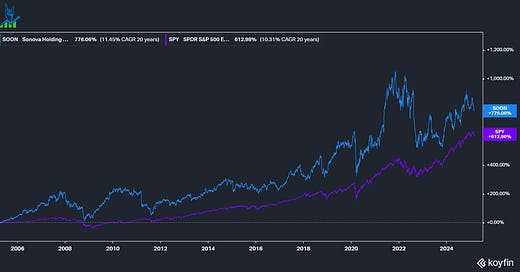

Sonova AG has outperformed the S&P 500 over the last 20 years, but its recent performance has lagged. With strong secular tailwinds and solid execution, can the company return to its past outperformance?

Here’s the first part of the deep dive.

Growth & Market Position

Over the last decade, Sonova has consistently grown its business (excluding COVID-related disruptions) at a 6% annual rate, translating to an 84% revenue increase. While this isn’t hyper-growth, it’s outpacing the overall hearing care market (4–6% p.a.), indicating that Sonova is gaining market share through superior execution and consolidation.

The hearing care industry

The global hearing aid market—excluding services—stands at $8.1 billion and is projected to grow at 6.6% annually, reaching $15.1 billion by 2033, according to allied market research. Sonova is the market leader with ~a 30% share and four players control around 80% of the market.

Audiological care services, a fragmented and capital-intensive retail segment, represent the largest part of the industry. Sonova is currently the #2 player, trailing only Italy’s Amplifon (13% market share). The sector breaks down as follows:

<50% - small independent players with few points of sale or tiny chains

>25% - specialty players, including OEMs like Sonova or Demant with global or national scale

>10% - non-specialty players like pharmacies, supermarkets and opticians

~3% - pure online retailers (in-house consulting plays a big part and is hard to digitalize fully)

Sonova has a long runway for growth in its audiological care business, organically through greenfield CapEx and inorganically through rolling up smaller competitors. Service represents around 65-80% of the value in the retail operations, with the remaining 20-35% being product sales. In the first part of the deep dive, I talked more in-depth about the competitive advantages Sonova has in this sector.

Cochlear instruments are the smallest but fastest growing segment with a lot of innovation, expected to grow by 5-10%. These devices are surgically implanted and provide life-long hearing assistance. Sonova should be the #2 player now. It was previously tied with Demant, who divested its Cochlear business to the undisputed market leader Cochlear Ltd.

A fascinating fact: While cochlear implant penetration in children with diagnosed severe hearing loss exceeds 80-95% in most developed nations, seniors only have a 1-10% penetration. This leaves a long runway of growth in this vertical in particular.

Lastly, Sonova also entered a new vertical with the Sennheiser acquisition, venturing into the consumer hearing industry. While adjacent to hearing aids, it is much more crowded with large players like Sony, Apple and Xiaomi. So far, the results from the acquisition haven’t been great, but they have the potential to be great as R&D investments continue to improve the product portfolio.

💡 Want Better Investing Tools? Get Exclusive Discounts on What I Use!

I rely on fantastic tools to research and track investments—you can too, at a discount:

🔹 Koyfin – 20% off + 7-day free trial (my main research tool)

🔹 Finchat – 15% off (unique data visualization & KPIs)

🔹 Portseido – 20% off (portfolio tracking & return calculations)

🚀 Upgrade your toolkit today! [Click the links above]

A highly profitable business

Sonova has maintained a strong margin profile, but in recent years, it has trailed Cochlear (a pure-play cochlear implant company) and Demant (its closest competitor). While its gross margin has expanded by 5 percentage points over the past decade, this hasn’t fully translated into bottom-line improvement.

Here’s how Sonova’s cost structure has evolved since FY17:

Gross margin: +5% (indicating strong pricing power and cost efficiency)

R&D investment: +1.1% to 6.5% (reflecting a focus on innovation)

Sales & Marketing (S&M) expenses: +1.6% to 35.5% (higher spending to drive market share growth)

General & Administrative (G&A) costs: -0.9% to 9.8% (improved operational efficiency)

While gross margin expansion hasn’t flowed directly to earnings, it’s encouraging that higher reinvestment in R&D and S&M—rather than G&A bloat—has been the primary driver.

The key question: Can Sonova regain its position as a margin leader? I’ll dive deeper into this in the full analysis, breaking down the factors that could drive future profitability.

What’s next?

Sonova’s growth story is only part of the equation. In the full deep dive, I cover:

✅ How efficiently Sonova reinvests its cash

✅ Key risks investors should consider

✅ The expected IRR from this stock

If you’re serious about identifying high-quality investments early, this analysis is for you. Consider subscribing to Heavy Moat Investments and take your investment research to the next level.

🔥 I recently made my deep dive into Ashtead Group free—so you can see exactly what to expect: Business model deep dive - Fundamentals and Valuation deep dive

As a premium subscriber, you’ll get:

✔ Detailed Research on high-quality global compounders and European champions, with deep fundamental & valuation analysis.

✔ Actionable Investment Pitches – Ideas with high upside potential and limited downside.

✔ Earnings Breakdowns on key reports and market reactions.

✔ Real-Time Trade Alerts on all my portfolio moves, plus access to the premium chat.

✔ Exclusive Investing Tools, including my Inverse DCF template and more.