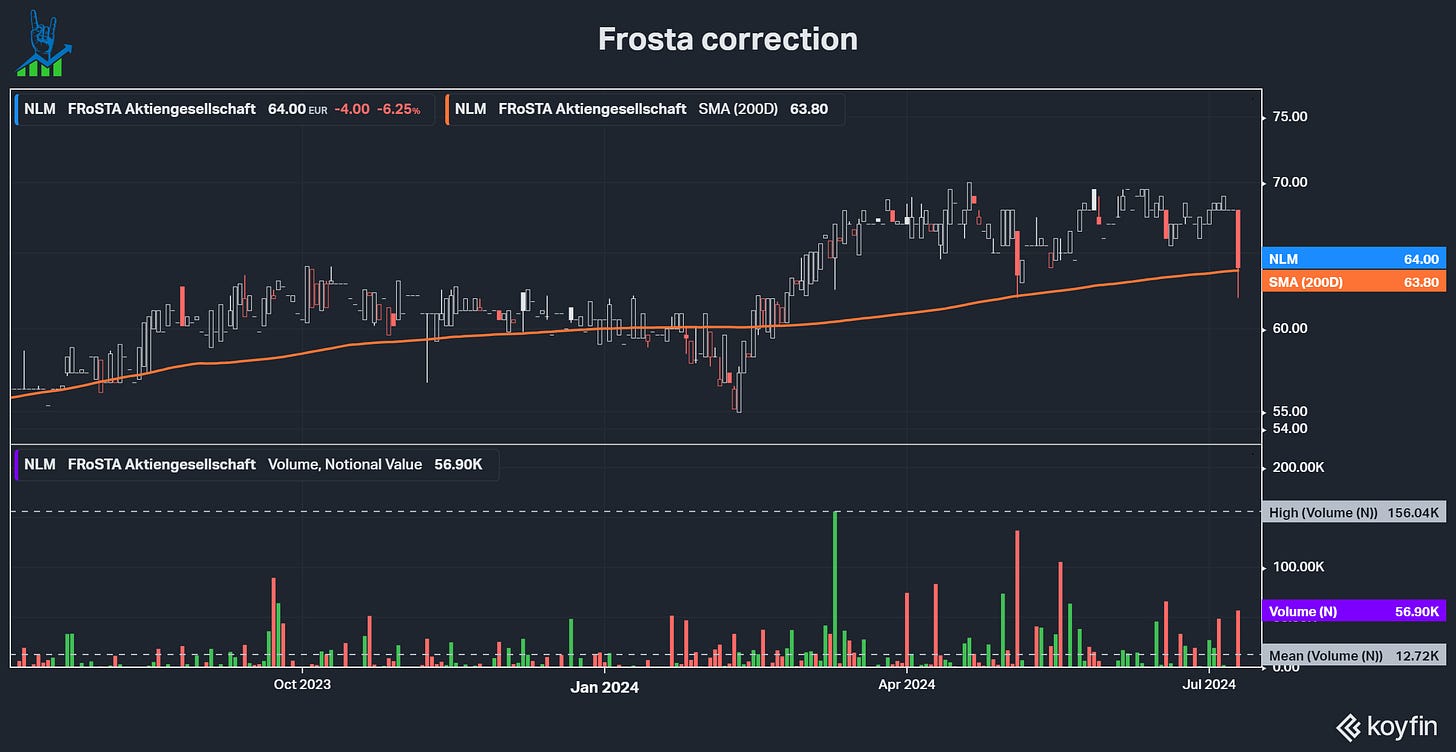

Frosta reported H1 earnings on Wednesday; however, shares already corrected around 7% on Tuesday to 64€, bouncing off the 200-day single moving average. You may wonder why I talk about technicals, and while I don’t usually care for this stuff, I find the 200d SMA to be a decent tool to see the overall trend of a stock. It is also often a resistance where traders buy up volume, however Frosta is a illiquid stock without much attention. The day with the highest volume in shares was under 500 thousand euros in the last 20 years. Interestingly, shares dropped the day before the results became public and haven’t reacted at all to the official release of the numbers. Let’s look at the results.

You can read my full deep dive on Frosta here.

H1 results

Frosta AG is a German small-cap and doesn’t report quarterly reports, just an H1 and FY report. The company does not do much investor relations work, which is the bare minimum they have to do. An investment in Frosta is a ticket to ride alongside a family without any influence on the business. That’s why we don’t get a nice presentation or a conference call. Frosta has two business segments: Frosta is their strong brand with the Frosta Reinheitsgebot (purity regulation) (manufacturing, marketing and distribution), while Copack manufactures frozen food products for customers. The investment case relies on Frosta, which will be again evident in the numbers.

The overall market for frozen food in Poland, Italy, and Germany (the main markets) saw volume declines of 0.2% and a total increase of 0.7% due to price increases from January through May 2024. Frosta continued its strong trend and matched its growth of 19% from 2023. The brand has shown strong above-market growth for a while now. On the other hand, Copack continued to underperform the market, seeing volumes decline 19% in H1, a strong deceleration from a 10% increase in 2023. While this might raise some alarms, this is totally fine and part of my investment case: Frosta is a melting ice cube, with its declining, break-even business Copack and the fast-growing Frosta brand. Copack continues to discontinue unprofitable contracts and declines, while the freed-up manufacturing capacity can be repurposed for Frosta products. Frosta now accounts for over 70% of total sales.

Overall revenue was stable, while Frosta reinvested more money into advertising to reach more customers. Given Frosta’s USP, it’s an excellent idea to spend marketing dollars because customers often stay with the brand once they try it. The profit margin was flat at 4.9%. Still, cash flows suffered from working capital changes related to increased safety stock to counteract possible bottlenecks due to uncertainties in the Suez Canal (accounts payable). This, however, is a seasonable issue.

Frosta continues to see macro challenges and thus wants to stay save with higher-than-needed inventories. The company expects flat revenues and margins of around 5%. Let’s take a look at the valuation next.

Premium Offering

Consider subscribing to Heavy Moat Investments to get the full experience and improve your investment journey. As a premium subscriber, you get:

Investment research into global high-quality/compounder companies, primarily in the Small/Mid-cap range ($100 million to 20 billion), split into business model and fundamental & valuation analysis.

Earnings analysis on interested earnings reports (often after a strong reaction in the stock price or unexpected fundamental developments).

Notified about all my transactions on the same or next day and a premium chat.

My Inverse DCF template and other resources.