Hello and welcome to the Heavy Moat Investments newsletter!

Performance

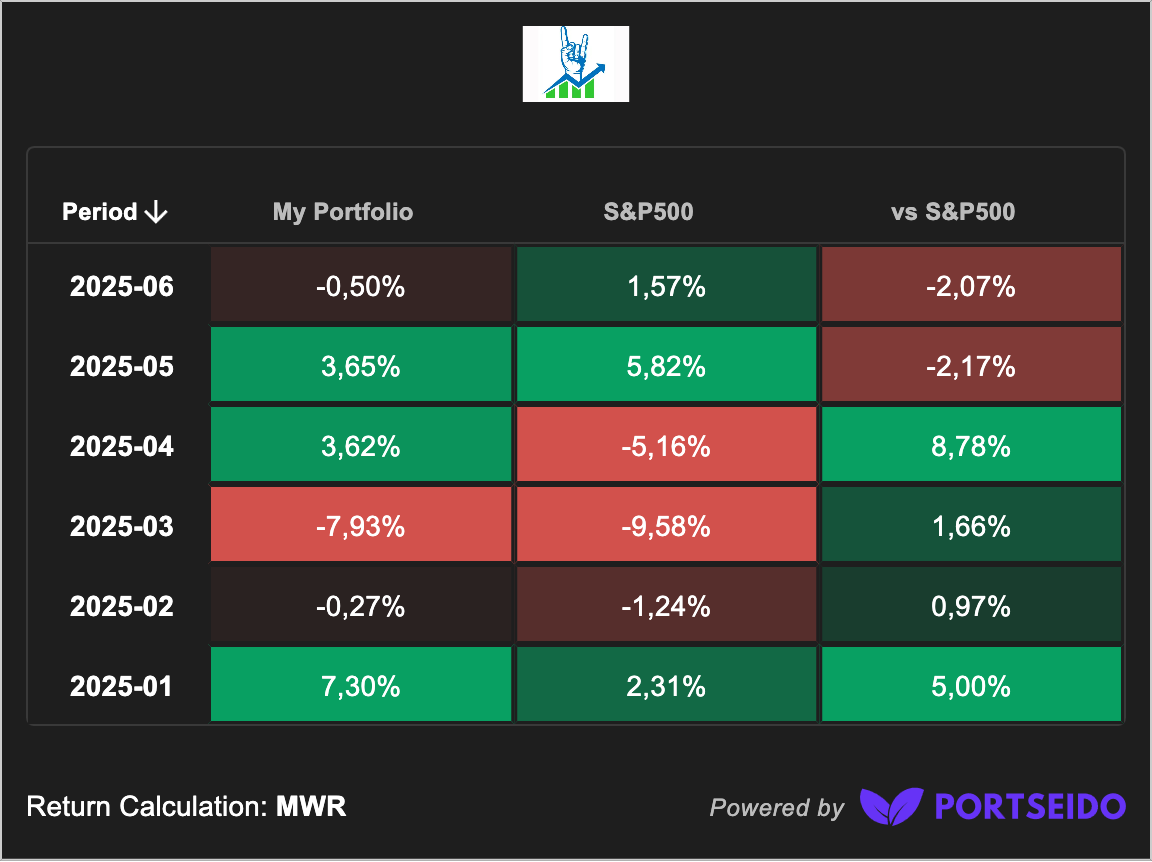

My portfolio declined by 0.5%, less than the 1,57% gain of the S&P 500. YTD my outperformance continues to be strong however at 12% alpha. With its great return last month, the Nasdaq extended its lead against me again. I’m satisfied, in beating 4/5 of my benchmarks over the long term.

Make sure to check out Portseido via my link. They have great free features, but if you decide to upgrade, you can get a 20% discount with my link, and I get a small commission.

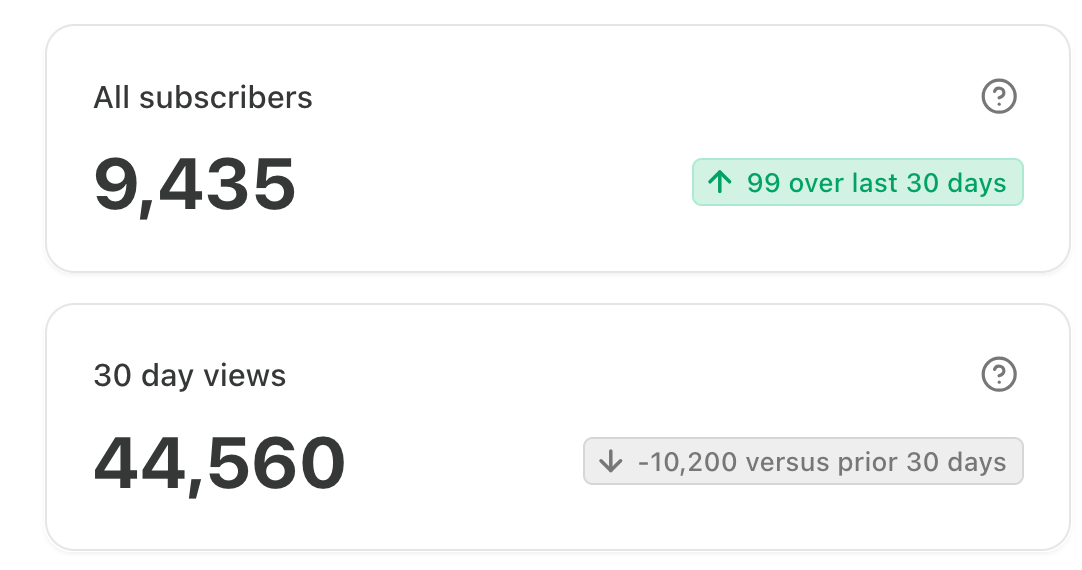

Growth has been very bad this month - we welcomed just 99 new subscribers, over 700 new followers and reached 44,560 views. Unfortunately, the month was very soft. The low views were partially by fewer posts in the month (however, 7 is still a lot of content). On the bright side, we welcomed a few new paid subscribers and continued to produce high-quality content.

New Content in May

Here’s what I covered this month:

Deep Dives: Eurofins Scientific #1, Eurofins Scientific #2

Strategy: Reflection on Brazil interest rates and investment implications, [FREE] The beauty of compounding: The life cycle of an investor

Portfolio changes: Nu Holdings sale details

Podcast: Quality Investing, moats and valuations with

Quality Score: Veeva Systems

Portfolio Update

In June I sold my relatively new position in Nu Holdings. While the thesis hasn’t changed and the company has a promising future, I had to be honest with myself and realized that it is outside my circle of competence. I detailed the decision here, but it boils down to not fully understanding the credit business and LATAM interest rates, something I deem necessary to build conviction in this investment in hindsight.

The presence of very attractive opportunities across my existing portfolio also helped me in hitting the sell button on Nu—I doubled down on Edenred, which continues to have horrible momentum and is getting to (in my opinion) ridiculous valuations. The company now is my largest on a cost basis and I’m considering adding more. If shares rebound I might trim them though, depending on how strong the rebound is. I do not expect a rebound until the regulatory clouds clear (which has started with specification on the French regulatory front last week). In the meanwhile, Edenred buys back shares and just paid me a 5% dividend a few weeks ago.

Want Better Investing Tools? Get Exclusive Discounts on What I Use!

I rely on fantastic tools to research and track investments—you can too, at a discount:

🔹 Koyfin – 20% off + 7-day free trial (my main research tool)

🔹 Finchat – 15% off (unique data visualization & KPIs)

🔹 Portseido – 20% off (portfolio tracking & return calculations)

🚀 Upgrade your toolkit today!

Let’s look at the top detractors and contributors to my 3% performance.

📈 Top Contributors:

Eckert & Ziegler +10,9%

Texas Instruments +8,95%

Sartorius Stedim +4,9%

📉 Top Detractors:

Robertet -9,8%

Copart -8,3%

Adyen -7,6%

Carlisle -7,6%

What’s Next?

For paid subscribers, I’ll share my updated valuation matrix with this report—helping you see which stocks I currently find most compelling within my portfolio.

If you’re serious about identifying high-quality investments early, consider upgrading to premium and unlocking the full experience.