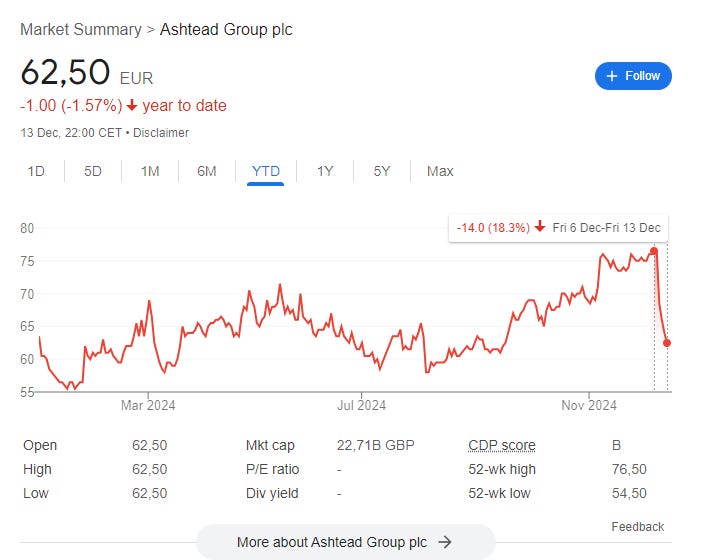

Today, I want to discuss a very heavy company: Ashtead. I sold the company a few months ago because it was too capital-intensive for me and I saw better opportunities. Since then, shares haven’t done much this year after plunging 18% in the last week. However, they’ve released an interesting update with the latest earnings. Let’s take a look.

Here is my deep dive into Ashtead from August:

Earnings

Ashtead reported earnings showing slight revenue growth and declining earnings. The local commercial construction market was exposed as a detractor to results because of the higher for longer interest rate policy, while the continued growth in mega project announcements and spending alongside hurricane response efforts have helped results. Mega projects are a large part of Ashtead's medium-term growth expectations, with $509 billion in value between FY22-24 over 414 projects ($1.23 billion on average), expected to almost double to $974 billion over 689 projects between FY25-27 ($1.41 billion on average).

There wasn’t much unexpected in the earnings, but the market probably got spooked by the guidance cut: US rental revenue growth was cut from 4-7% to 2-4%, reflecting the challenges in the local commercial construction market. The other end markets weren’t affected by the guidance cut. As a result of lower expected growth, Ashtead wants to use its ability to pull back on growth investments to drive higher Free cash flows. A reduction in CapEx of $500 million will result in $200 million of additional FCF. This is one of the advantages of the equipment rental business model: switching between investments and cash conversion.

An interesting point from the earnings call was that the employee count was down another 1% in the quarter, now down 7% year over year. While half of that is timing from some postponed projects, management also highlighted that part of Sunbelt 4.0 aims to leverage employees more efficiently to get more revenue per employee. The mega projects especially drive higher revenue per employee because of the much larger deal sizes.

Want to read the rest and much more?

By becoming a paying subscriber, you can read the rest of this article where I discuss the earnings and proposed US listing of Ashtead in more detail and all of my writing on businesses, valuations and investing. You can read more about the subscription benefits here. In 2025 my prices will increase, so make sure to lock in the current rates before new year! Don't miss out on the opportunity!