August was an average month with a lot of volatility in some positions. I published an analysis on Ashtead and Nemetschek. I also published my third Stock Spotlight under a new name, highlighting interesting investment ideas from my investable universe. The first idea is for all (Amazon), and the rest is for paid subscribers. I wasn’t happy with the name, and I think Quality Investment Ideas to Watch in August was more descriptive.

I posted updates and opinions on the crash at the start of the month, Atkore, Alimentation Couche Tard’s 7-Eleven offer and Napco. I also shared my thoughts and model to rank my portfolio to make quality between different business models comparable to an extent.

The publication accelerated again, adding 446 subscribers and almost 1,000 followers. We’ve reached the 5,000-subscriber milestone and are approaching the 10,000-follower milestone! Thank you for all the support.

Finchat.io partnership

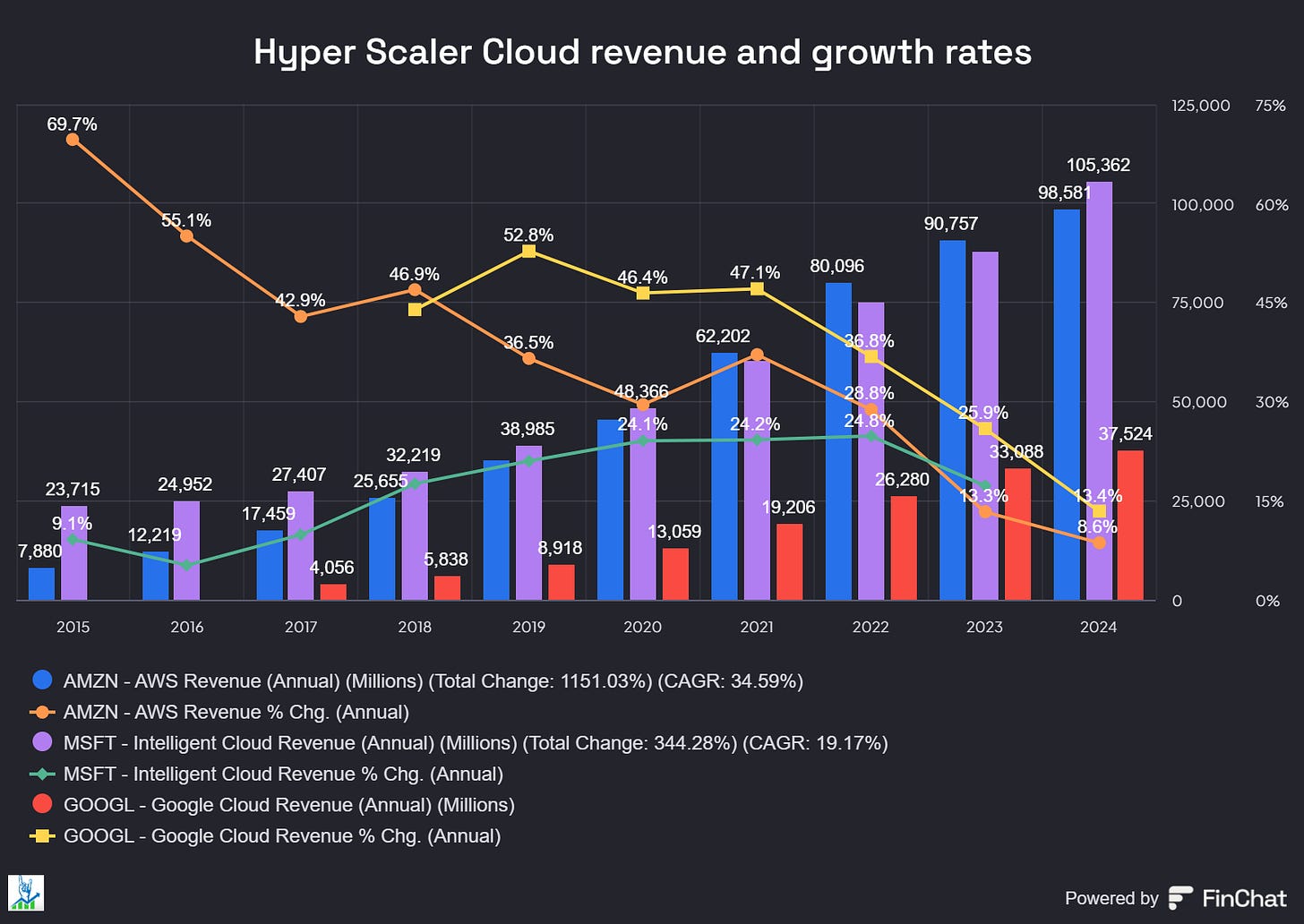

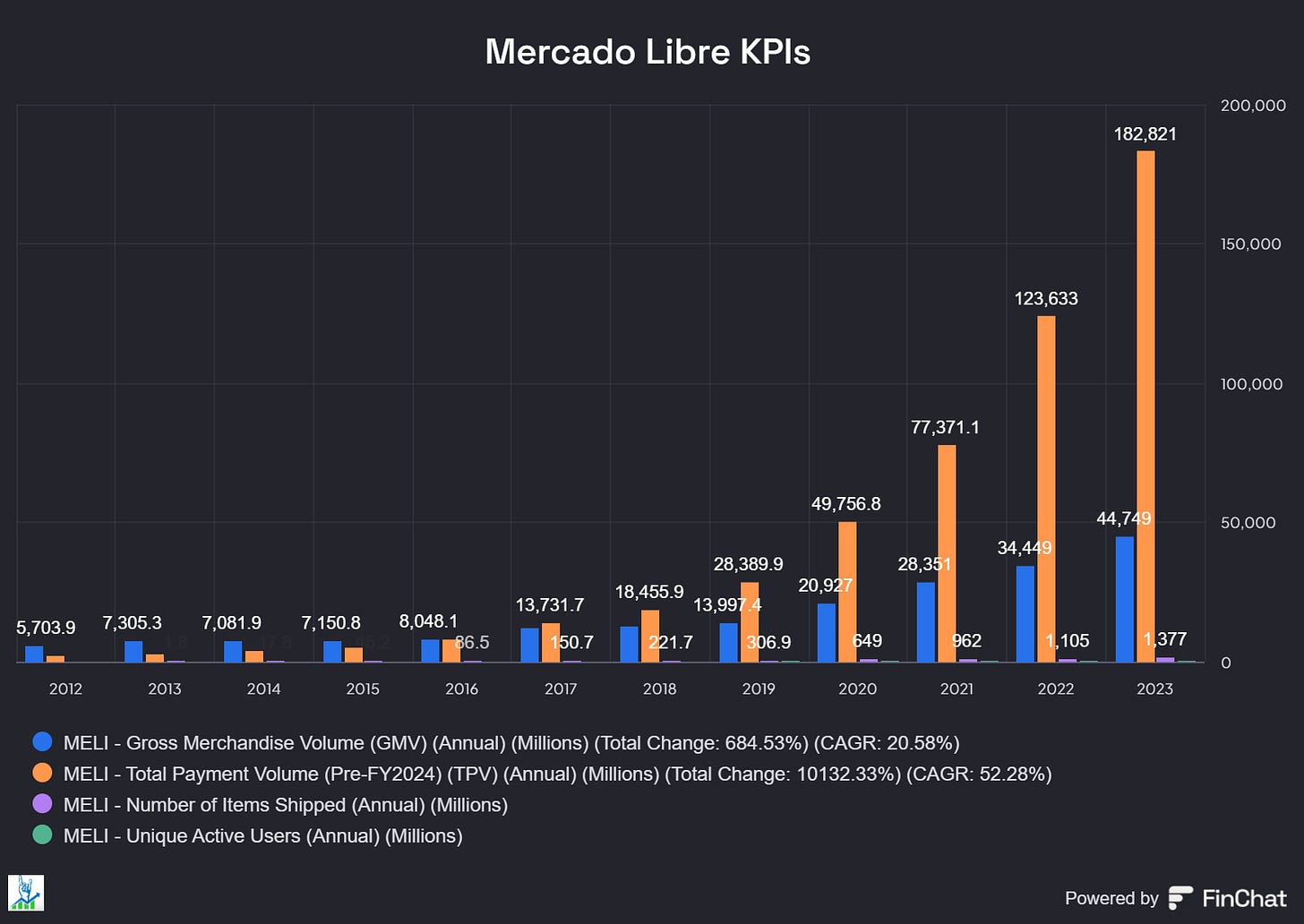

I’m excited to announce my partnership with Finchat.io, a fast-growing fundamental data aggregation and visualization platform. While many platforms offer aggregation and visualization of data from company filings(income statements, cash flow statements and balance sheets), Finchat goes one step further and supports segment info and specific KPIs for thousands of global companies. This is a game changer and I’m excited to enhance my content and research process with it. With my affiliate link you can secure a 15% discount on the paid subscription, they also have a free version and trial mode. Let me show you two examples of what Finchat can do: First an example of segment data for Hyper scaler cloud revenue and growth rates and second a visualization of Mercado Libre’s most important KPIs.

Portfolio Update

In late August, I sold my position in AO Johansen, a leading Danish distributor of plumbing and industrial supplies. I shared my reasoning with paid subscribers here. To sum up, the AOJ investment thesis depends on managing to retain margins and grow cash flows. While the company invested to take market share, it failed to control its costs and saw margins halve from 8% to 4% of EBIT. Despite management constantly discussing a focus on margins, they failed to forward cost and wage inflation and are heavily impacted by the industry's weak macro and pricing pressures. ROIC is well below 10% currently, something I don’t like to see. While I believe AOJ is a good business, it did rank very badly in my quality score due to strong cyclical exposure, low growth, margin control and a worsening balance sheet. I sold the company at a pre-tax IRR of 35%, deciding it was a good point to get out and focus on better ideas. In the future I might move quicker in and out of cyclicals, I am not sure if they generally fit a buy and hold strategy compared to non-cyclical businesses with high recurring revenues.

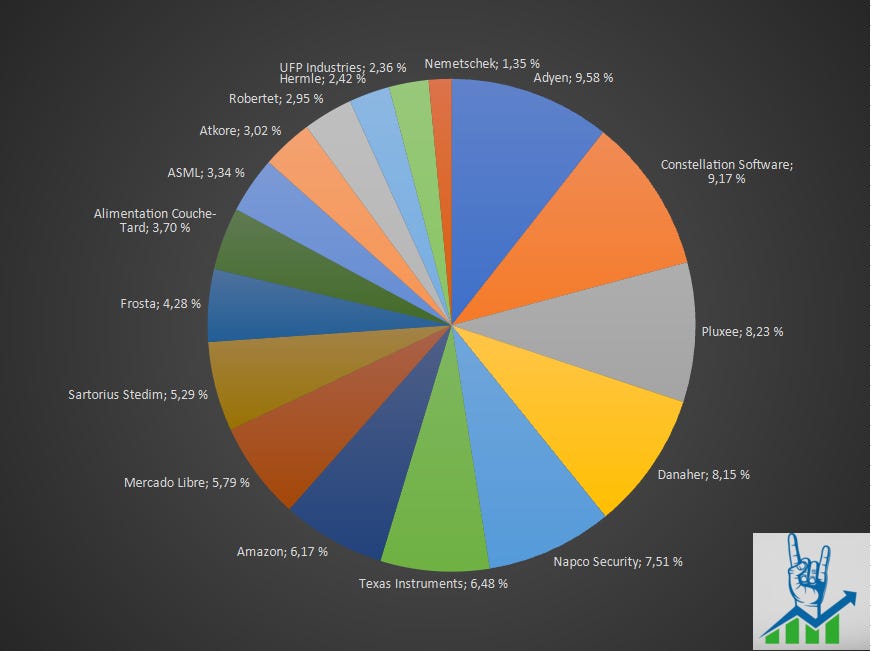

I have not allocated the proceeds yet because I need to move them to my main broker. However, I bought more shares of Frosta, Pluxee and Napco, using the weakness in share price to increase my portfolio allocation to businesses less impacted by cyclicality.

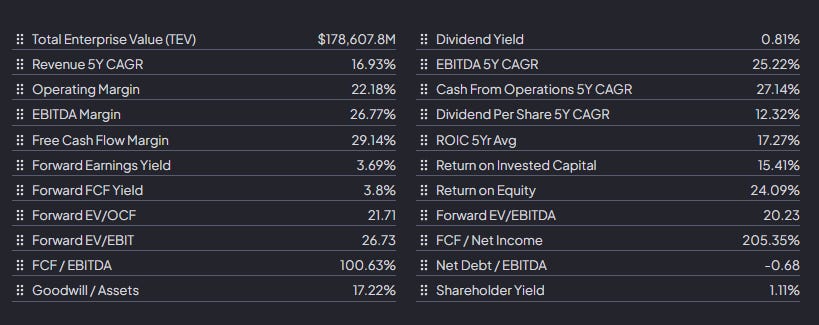

I also want to share another feature of finchat.io: weighted portfolio metrics. Here, you can see how the average company in my portfolio would look. I’m very happy with the strong past revenue growth, margins, ROIC >15% and high FCF conversion. The valuation is getting a bit high, but that’s okay as long as I buy cheap with incremental cash.

I had a large discrepancy between my top and flop performers in August. Top performers were Mercado Libre (+26%), Adyen (+18% on great earnings) and Lifco (+13%). Flop performers were Atkore (-32% on bad earnings and a short report and class action lawsuit emerging), Napco (-16% on great earnings; I covered it here and bought the dip) and Alimentation Couche-Tard (-7% slowly falling after the 7-Eleven offer came up). Overall, the portfolio went nowhere, but I got to buy more Napco at more reasonable valuations.

Premium Offering

Consider subscribing to Heavy Moat Investments to get the full experience and improve your investment journey. As a premium subscriber, you get:

Investment research into global high-quality/compounder companies, primarily in the Small/Mid-cap range ($100 million to 20 billion), split into business model and fundamental & valuation analysis.

Earnings analysis on interested earnings reports (often after a strong reaction in the stock price or unexpected fundamental developments notified about all my transactions on the same or next day and a premium chat.

My Inverse DCF template and other resources.

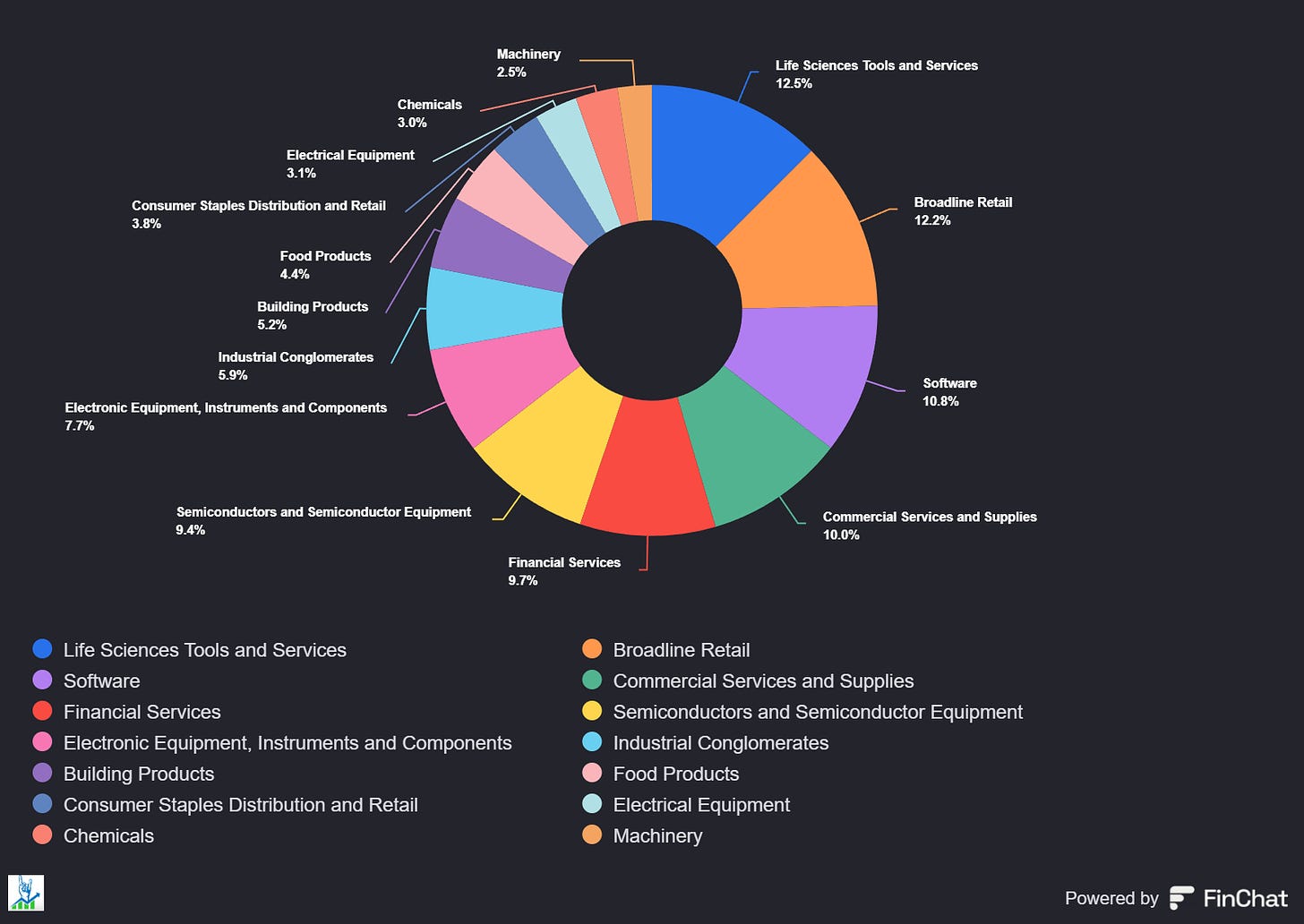

Below, you can see my exposure to different industries. After I bought Sartorius Stedim Live Sciences tools, this industry climbed to my highest weighted industry.

Congrats on 5000 subs!