Hello and welcome to the Heavy Moat Investments newsletter on Substack. Join over 7,000 smart investors who already receive my in-depth analysis of high-quality businesses, timeless investment philosophy and actionable ideas straight to their inboxes. Click the button below to subscribe today and elevate your investment journey!

2024 comes to an end, and with it, my first year as an independent writer on Substack. While 2024 has not been a great year for me for many personal reasons, I am very glad that I took the plunge into the cold water and started this subscription service. It energizes me and fills me with pride to see people valuing my opinion and insights enough to pay for it. It’s a strong motivator and I’m looking to further improve this publication in 2025. My personal life is also looking up, and with fewer things to worry about, I’ll have a clearer mind to focus better on writing in my spare time.

Heavy Moat Investments gained over 5,000 subscribers and 12,000 followers in 2024. I’m especially happy to see the strong reacceleration in growth in December: after just 254 new subscribers in November, I managed to grow subscribers by around 600 this month. For 2025, I hope to continue and accelerate this growth to reach 15,000 subscribers by delivering high-quality analysis and valuable insights to my free and paid subscribers.

In December, I published some macro thoughts on the cheapness of Europe and Small caps, an update on the ATD takeover attempt of 7-Eleven and my thoughts on Ashtead’s H1 trading update. I also shared a deep dive into Watsco, a fantastic HVAC distribution business. Don’t worry, I have not forgot about the second part of the Carlisle deep dive, that’s coming early January. I started to reflect on 2024 by analyzing my sales (part 1 and part 2). I intend to share more reflections in January. Finally, I shared my IRR model template with paid subscribers.

Lock in the current rates today!

As a paying subscriber, you'll gain exclusive access to all my premium insights on businesses, valuations, and investing strategies. Don’t wait—prices are increasing in 2025, so subscribe now to lock in the current rate before the new year. Take advantage of this opportunity to elevate your investing game today!

As a premium subscriber, you get:

Investment research into global high-quality/compounder companies, primarily in the Small/Mid-cap range ($100 million to 20 billion), split into business model and fundamental & valuation analysis.

Earnings analysis on interested earnings reports (often after a strong reaction in the stock price or unexpected fundamental developments).

Monthly ideas out of my investable universe.

Notified about all my transactions on the same or the next day via the premium chat.

My Inverse DCF template and other resources.

Portfolio Update

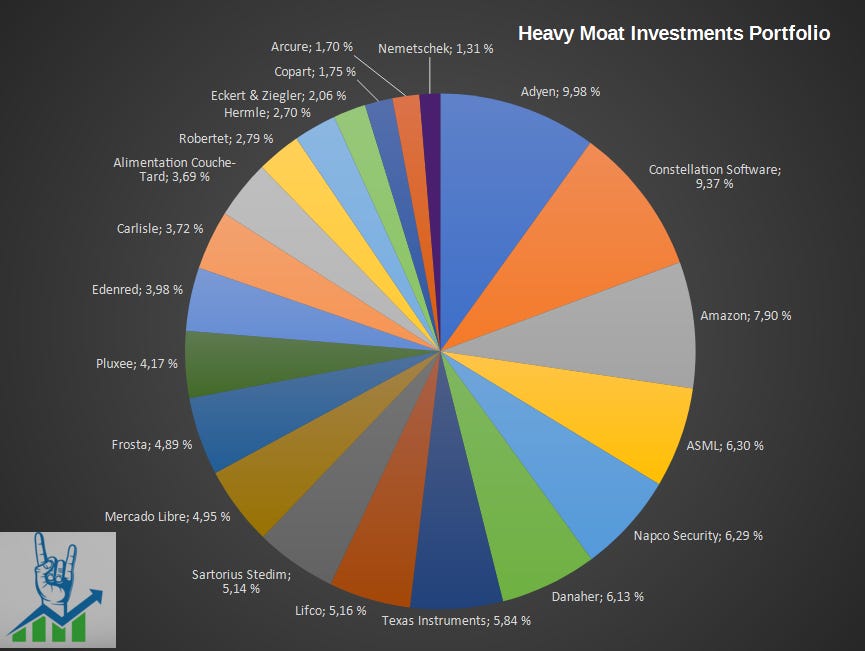

I did not buy or sell anything in December but continued to average into my two newest positions: Arcure and Eckert & Ziegler. Arcure saw its shares decline by 15% after pushing 1 million of revenue into 2025 with its updated guidance. This does not impact long-term targets and is a timing issue due to customers waiting to invest. I welcomed this drop because I wanted to add to the position anyway. Eckert & Ziegler did not move much, but I wanted to add to it.

I don’t plan on adding materially to both positions in the near future unless something drastic happens to the valuation. Eckert & Ziegler is a great business but not the highest IRR. I want to own a position and see how it feels to own the business before committing more cash. Arcure is my smallest holding by far under 50 million euros, so I’m careful not to weigh it too high in the portfolio. There are a lot of uncertainties in my life right now, so I’m not sure how much fresh capital I’ll be able to invest in my portfolio in 2025. So maybe I’ll be able to finally reduce my turnover….or I’ll have to sell positions to fund new purchases if it’s compelling enough. I’m actually considering a new position for January and will keep you updated.

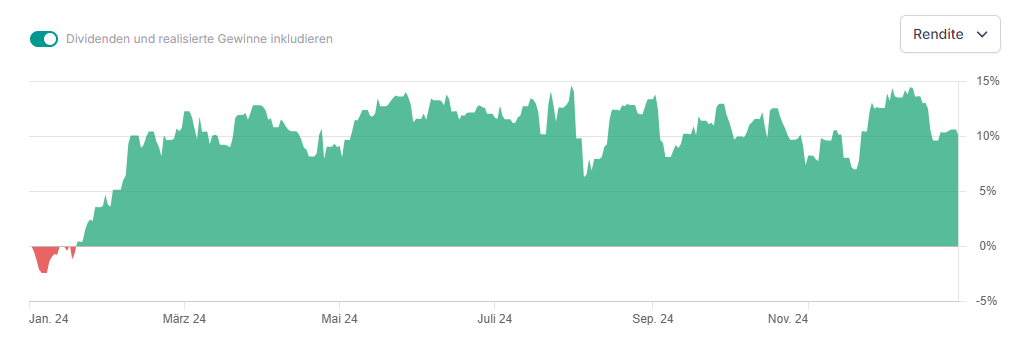

In hindsight, 2024 has not been a year of great performance for me. After outperforming the market in 2022 and 2023, I have to concede 2024: the portfolio returned 10% compared to ~25% for the S&P 500 and Nasdaq. I did outperform the Stoxx Europe 600 (9%) and other European indices, but I wouldn’t call this year a success…at least in my stock portfolio. My Bitcoin position has done phenomenally. I dislike talking about it because it does not align with my value investing principles. I played my cards right over the last 5 years and am currently just riding the profits in the crypto portfolio with a cost base of 0 after cashing out my cost base. We’ll see where it leads, and I’ll take some gains but don’t expect many updates on it, as it’s not the focus of this newsletter, and I’m not particularly knowledgeable about the topic.

I hope to see you again next year. Investing is a journey, and I’m eager to learn and share my experience with you. If you haven’t already, consider subscribing, and let me know how your year went in the comments.

All the best and a happy new year,

Niklas from Heavy Moat Investments.

I hope 2025 will bring you better returns Niklas. I underperformed this year also and many probably did if they have the same investing strategy as ours. One year returns are worthless metrics. Let’s see our average over 5-10 years sometime in the future. I’m sure the work we put in will pay dividends.

Niklas, wish you a great year in your personal and investment life! Things usually fall in place with time. No worries.

I will be sourcing some ideas from your newsletter as I want to diversify a little outside of the US and China.