Hello and welcome to the Heavy Moat Investments newsletter! March was not as exciting as the start of the year, but my portfolio continued to outperform the US indices. The question arises, however, if the US indices are the best benchmark for my portfolio: only 22% of my portfolio is invested in US stocks. An MSCI World might be a better comparison.

Introducing Portseido

Portseido is a portfolio tracking software with a young and talented team of founders. I’ve been talking with the team for a while and you can now import portfolios even from my German broker Trade Republic, which made me finally try out their service. From now on, I’ll have a more accurate way to share my portfolio performance against a range of benchmarks with simple returns and the more accurate money-weighted return metric.

Previously I only compared my performance against the S&P 500 and Nasdaq 100, but without accounting for the timing of my purchases. Below, you can see my performance against a range of benchmarks. I have performed in line with most benchmarks but well behind the Nasdaq 100. I can’t say I am very sad about this outcome, but I’m also not excited about it. As I learn more about investing and my behavior, I strive to accelerate outperformance and more importantly, reach my personal goals! In the coming days, I’ll write a post diving into my past mistakes and trying to learn from them.

Portseido also has a great way to track your personal goals by setting parameters like time horizon (20 years in my case), expected annual return (12% like my hurdle rate), additional monthly/annual contributions and their growth rate. So far, I’m well ahead of my personal goals.

Make sure to check out Portseido via my link. They have great free features, but if you decide to upgrade, you can get a 20% discount with my link, and I get a small commission.

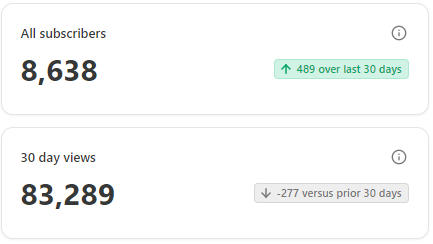

HMI continues to grow—this month, we welcomed 489 new subscribers, over 1,150 new followers and reached over 83,000 views. I’m excited to keep building this community with you. Maybe you remember my podcast with

about Robertet, we’ll be recording a new episode for our paid subscribers on my holding Pluxee next week, so stay tuned for that!New Content in March

Here’s what I covered this month:

Deep Dive: Sonova AG #2, IDEXX Laboratories #1, IDEXX Laboratories #2

Earnings update: Hermle’s brutal 2025 guidance

Strategy: How to survive and thrive in a market downturn & The hidden risk of historical valuation multiples

Portfolio Overview: Quick investment cases for all my holdings

New Investment Pitches: European SaaS company with 17% IRR, a German software company with 16% IRR & a cloned idea plus what is shameless cloning?

Quality Score: MSCI

Podcast: A deep dive into Robertet (now available for free subscribers!)

Portfolio Update

In March I sold my entire position in Hermle. I described my reasons in this post, but to summarize:

FY 24 results were in line, but FY25 guidance implies a further 8-23% revenue decline and EBIT collapsing 40-90%!

The business is much more cyclical than I expected and did not manage to retain margins as well as in the past.

I have not been good at valuing businesses in highly cyclical industries and this is not the first time I’ve made mistakes here; I’ll try to stay away from cyclicals in the future.

Hermle was not a big loss and I fortunately did not average down too much. I have not deployed the capital yet, but I’ll do so soon.

I might sell more Lifco in April. There is nothing wrong with the company, but the valuation ran up too much, and I don’t think Lifco can surprise too much on the upside with its business model. It remains a top position in my portfolio, but other opportunities are much more exciting from a valuation and quality mix.

I only bought a bit more of Danaher in March. April will see more capital deployment into the portfolio.

Want Better Investing Tools? Get Exclusive Discounts on What I Use!

I rely on fantastic tools to research and track investments—you can too, at a discount:

🔹 Koyfin – 20% off + 7-day free trial (my main research tool)

🔹 Finchat – 15% off (unique data visualization & KPIs)

🔹 Portseido – 20% off (portfolio tracking & return calculations)

🚀 Upgrade your toolkit today!

Let’s look at the top detractors and contributors to my -7.9% performance (still beating US indices, but nothing I’m happy about). There weren’t many interesting company-specific events last month, just multiple compression across the board.

📈 Top Contributors:

EVS Broadcast +3.16%

Robertet +0.12%

Lifco -0.5%

Frosta AG -1.3%

📉 Top Detractors:

Adyen -19.25%

Pluxee 13.3%

Texas Instruments -12%

Mercado Libre -11.8%

Constellation Software -11.5%

Napco Security -10%

What’s Next?

For paid subscribers, I’ll share my updated valuation matrix with this report—helping you see which stocks I currently find most compelling within my portfolio.

If you’re serious about identifying high-quality investments early, consider upgrading to premium and unlocking the full experience.